Free report

Digital Shelf & Retail Media in European Beauty 2025

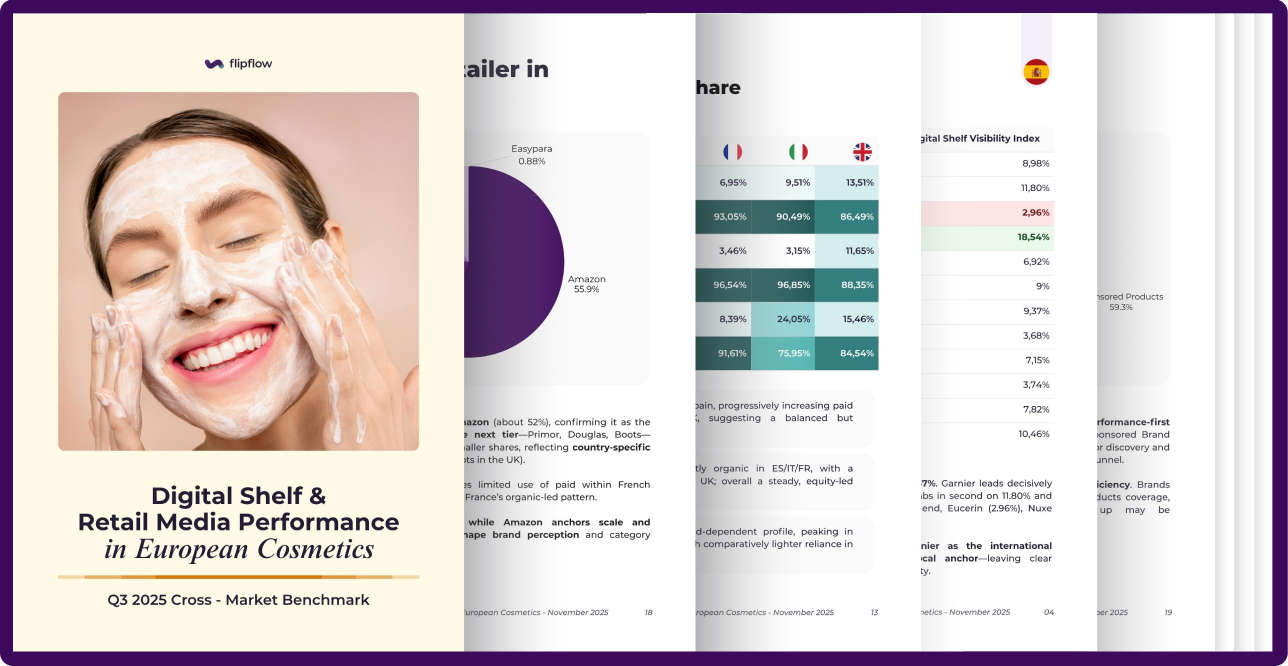

5 key insights you’ll get from the report

- Top 12 anti-aging brand rankings in Spain, France, Italy, and the UK.

- Which markets are paid‑media heavy vs. more organic‑led.

- The balance of paid vs. organic share by brand and country; high paid dependency = poor efficiency.

- Amazon’s Retail Media dominance and local specialist retailer influence.

- High-leverage paid play examples and zero-presence blind spots.