The Dominance of Private Brands in Cleaning Wipes: An Analysis of the Spanish Market 2025

The Spanish household cleaning products market is undergoing a profound transformation, driven by new consumer habits and an increasingly dynamic competitive environment. In this context, Private Brands (PB) have consolidated their leadership: they account for nearly 50% of total spend in the shopping basket and exceed 60% of sales value in categories like toiletries and cleaning. For specific products, such as bleach, this share can reach as high as 75%, reflecting their dominant influence in Spanish households.

Within this evolution, cleaning wipes stand out as a strategic segment in the Home Care world. Not only do they have a high concentration of Private Brands, but they also show clear signs of innovation, changes in format, and significant competitive shifts. This article analyses, using data from September 2024 to April 2025, how the Share of Shelf has evolved in the main wipe sub-categories and which product innovations are shaping the future of the sector.

The Digital Shelf in Home Care: A Landscape Dominated by Private Brands

The analysis of the Share of Shelf for cleaning wipes reveals a stark reality. Private Brands maintain a dominant position in all the sub-categories analysed. This hegemony is no accident, but rather reflects a consolidated strategy on the part of Spanish retailers.

Anti-Decoloration Wipes: Minor Shifts in a Stable Market

In the anti-decoloration wipes segment, PB hold a 64.3% market share in the first quarter of 2025. This figure represents a slight decrease from the 66.7% recorded in the last quarter of 2024. The loss of 2.4 percentage points indicates that Manufacturer Brands are gradually gaining ground.

Manufacturer Brands have managed to increase their presence from 33.3% to 35.7%. Although this growth may seem modest, it represents a significant trend in a market traditionally dominated by Private Brands. The increase in the total product range, which went from 12 to 14 products, suggests there is room for greater diversification and competition.

Glass Cleaner Wipes: Consolidation of PB Leadership

The glass cleaner wipes sector presents the most favourable scenario for Private Brands. Their market share increased from 76.5% to 78.9% between the fourth quarter of 2024 and the first quarter of 2025. This growth of 2.4 percentage points shows that PB are not only maintaining their position but actively strengthening it.

Manufacturer Brands have seen a decline in this sub-category, falling from 23.5% to 21.1%. This decrease coincides with an increase in the total product range, which grew from 17 to 19 products. This data suggests that new additions to the shelf mainly favour private label brands.

Furniture Wipes: Consistent Dominance

Furniture wipes represent the sub-category where Private Brands exert the most control. With a 77.8% share in the first quarter of 2025, compared to 80% in the previous quarter, PB maintain a virtually hegemonic position. The slight decrease of 2.2 percentage points does not fundamentally alter the competitive landscape.

Manufacturer Brands have made a modest gain, from 20% to 22.2%. However, the gap remains considerable. A notable aspect of this sub-category is that it is the only one where the total range has decreased, going from 10 to 9 products. This contraction could indicate market consolidation or shelf optimisation by distributors.

Multi-Purpose Wipes: Stability is the Norm

In multi-purpose wipes, the Share of Shelf distribution remains virtually unchanged. PB retain a 71.4% share, barely changing from 72% in the previous quarter. Manufacturer Brands hold their 28.6%, with minimal variation from the previous 28%.

This stability, accompanied by a growth in the range from 25 to 28 products, suggests a mature market where competitive shifts are gradual. The absence of significant changes could be interpreted as a sign of a temporary balance in the strategies of both brand types.

The Innovation Revolution: Parity Between Private Brands and Manufacturer Brands

A particularly revealing fact emerges when comparing overall innovation in the FMCG sector with what is happening specifically in the Home Care category. Although Manufacturer Brands (MB) are responsible for nearly 90% of innovations across the entire Spanish FMCG market, the picture changes completely in the home care segment. According to our 2025 analysis, this category has reached absolute parity in the number of launches between Manufacturer Brands and Private Brands. This balance is striking and suggests that, in Home Care, PB are not just competing on price and shelf presence, but are also decisively backing innovation as a strategic tool.

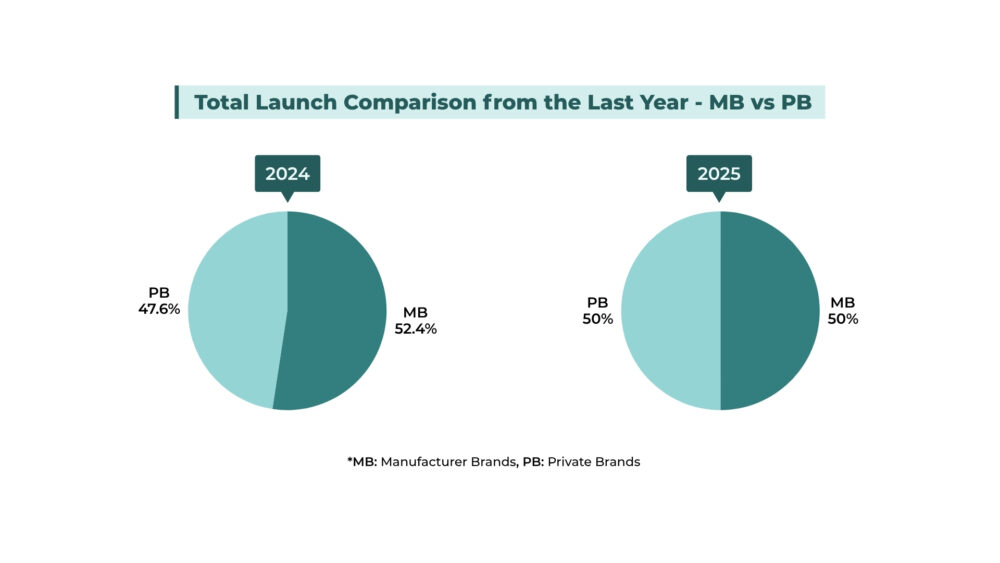

The Perfect Balance in Product Launches

In 2025, Private and Manufacturer Brands have achieved perfect parity in launching new products. Each brand type accounts for exactly 50% of the new products introduced to the market. This balance contrasts sharply with the picture in 2024, when Manufacturer Brands dominated launches with 52.4% compared to 47.6% for Private Brands.

This evolution towards parity indicates that Spanish distributors have intensified their commitment to own-brand innovation. The balance in launches suggests that PB are not content with simply maintaining their market share, but are actively seeking to compete on innovation and differentiation.

Distribution of New Products by Sub-Category

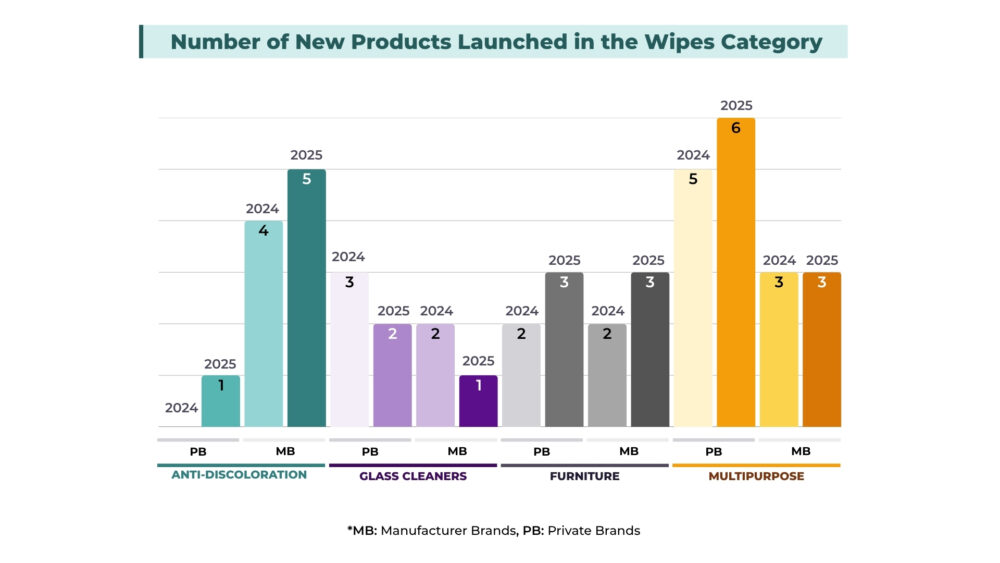

A detailed analysis by sub-category reveals interesting patterns in innovation strategy:

- In anti-decoloration wipes, there were five launches from Manufacturer Brands compared to one from Private Brands. This greater innovative activity from Manufacturer Brands correlates with the general trend in the Spanish FMCG sector.

- In furniture cleaning wipes, the distribution of new products was more balanced, with three launches for each brand type. This parity in innovation coincides with the consolidation of PB leadership in this sub-category.

- Multi-purpose wipes showed the highest level of innovative activity, with three new products from Manufacturer Brands and six from Private Brands. This intense activity could be related to the segment’s versatility and the differentiation opportunities it offers.

- Glass cleaner wipes had the fewest new products launched, with both PB (down from 3 to 2) and MB (down from 2 to 1) losing one launch each.

The Key Players in Innovation

Among the most active Manufacturer Brands in terms of launches are Sanytol, Iberia, Don Limpio and Ace. These brands have committed to maintaining their innovative presence in an increasingly competitive market. Their strategy focuses on technical differentiation and functional specialisation.

On the Private Brands side, Carrefour, Lanta and Bosque Verde are leading the innovation. The presence of multiple own-brands from different retailer chains (Lanta belongs to Ahorramas and Bosque Verde to Mercadona) indicates that PB innovation is not concentrated in a single retailer but is a widespread trend across the sector.

Retailers as Drivers of Innovation

An analysis of the retailers with the most innovative activity reveals that Alcampo, Carrefour and Ahorramas lead in the number of new products launched. This distribution suggests that innovation in the sector is not centralised, but rather that different chains are actively investing in renewing their product lines, as we mentioned in the previous paragraph.

Mercadona and Eroski complete the top five most innovative retailers. The presence of chains of different sizes and commercial approaches indicates that innovation in cleaning wipes is a cross-cutting strategic priority throughout the Spanish retail sector.

Strategic Implications of the Current Market

The dominance of Private Brands on the digital shelf for cleaning wipes, combined with their growing innovation, poses significant challenges for Manufacturer Brands. The latter must rethink their strategies to compete effectively in an environment where distributors not only control the space but also actively innovate.

For Manufacturer Brands, the key could lie in technological differentiation and functional specialisation. The small gains seen in some sub-categories show that opportunities exist, but they require specific and sustained long-term strategies.

Distributors, for their part, have shown that own-brands can be both a tool for margin control and a platform for innovation. The parity achieved in new product launches during 2025 confirms that Private Brands have evolved from generic products to differentiated and specialised offerings.

Conclusions: A Market in Transformation

The Spanish cleaning wipes market presents a landscape where Private Brands exert dominant but not absolute control. Their hegemony in Share of Shelf is now complemented by innovative activity comparable to that of Manufacturer Brands.

What is most surprising is that, although Manufacturer Brands generate around 90% of innovations in the entire Spanish FMCG market, Home Care has reached total parity in the number of launches between PB and MB during 2025. This equality in innovation capacity reflects a strategic evolution of Private Brands, which no longer compete on price or visibility alone, but also on innovation and added value.

In the coming quarters, it will be crucial to see whether this parity in innovation translates into more significant changes in the Share of Shelf distribution. The minor shifts recorded in some sub-categories could be a prelude to more profound transformations in the market’s competitive structure.

The growing sophistication of Private Brands, evident both in their control of shelf space and their innovative capacity, is redefining the rules of the game in the household cleaning products sector. This new paradigm will demand more elaborate and differentiated strategies from all market players.

Want to know more? Download the full report by clicking this link.

And if you found this analysis useful, don’t miss our next article, where we will explain the evolution in prices, promotions and formats that are changing the Home Care sector across four different categories: detergents, floor cleaners, dishwasher products and wipes.