The End of an Advertising Era: The Keys to why Amazon has Abandoned Google Shopping

The world of e-commerce has in recent weeks experienced an earthquake of a magnitude similar to that which hit the Kamchatka Peninsula on 30 July 2025. Amazon, the online retail giant, has made a decision that has shaken the foundations of digital advertising: abandoning Google Shopping.

This decision represents much more than a simple change in advertising strategy. We are witnessing the end of an era where the e-commerce giants depended on Google to reach their customers. Amazon has decided to cut the umbilical cord that tied it to the world’s most powerful search engine.

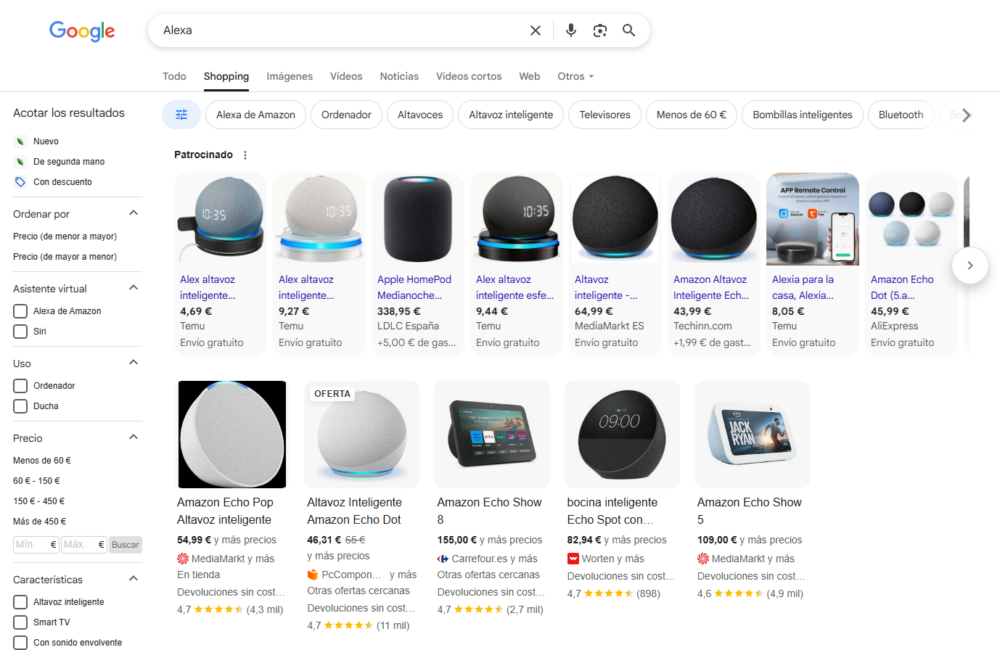

Note: As can be seen in the screenshot, when searching for the product ‘ebook’ on Google Shopping, not a single product advertised by Amazon appears. The Amazon Kindle appears, but it is not sold by Amazon; it is sold by other e-commerce sites such as MediaMarkt or Temu.

The magnitude of this decision is comparable to a declaration of digital independence. After years of investing millions of dollars in Google Shopping, Amazon has said enough is enough. The question on the minds of all industry experts is clear: why now?

This break-up not only affects these two tech companies. The shockwaves are spreading throughout the entire digital ecosystem. Advertisers, marketing agencies and competitors are watching the movements of these two titans with keen interest.

What Exactly has Happened?

Context

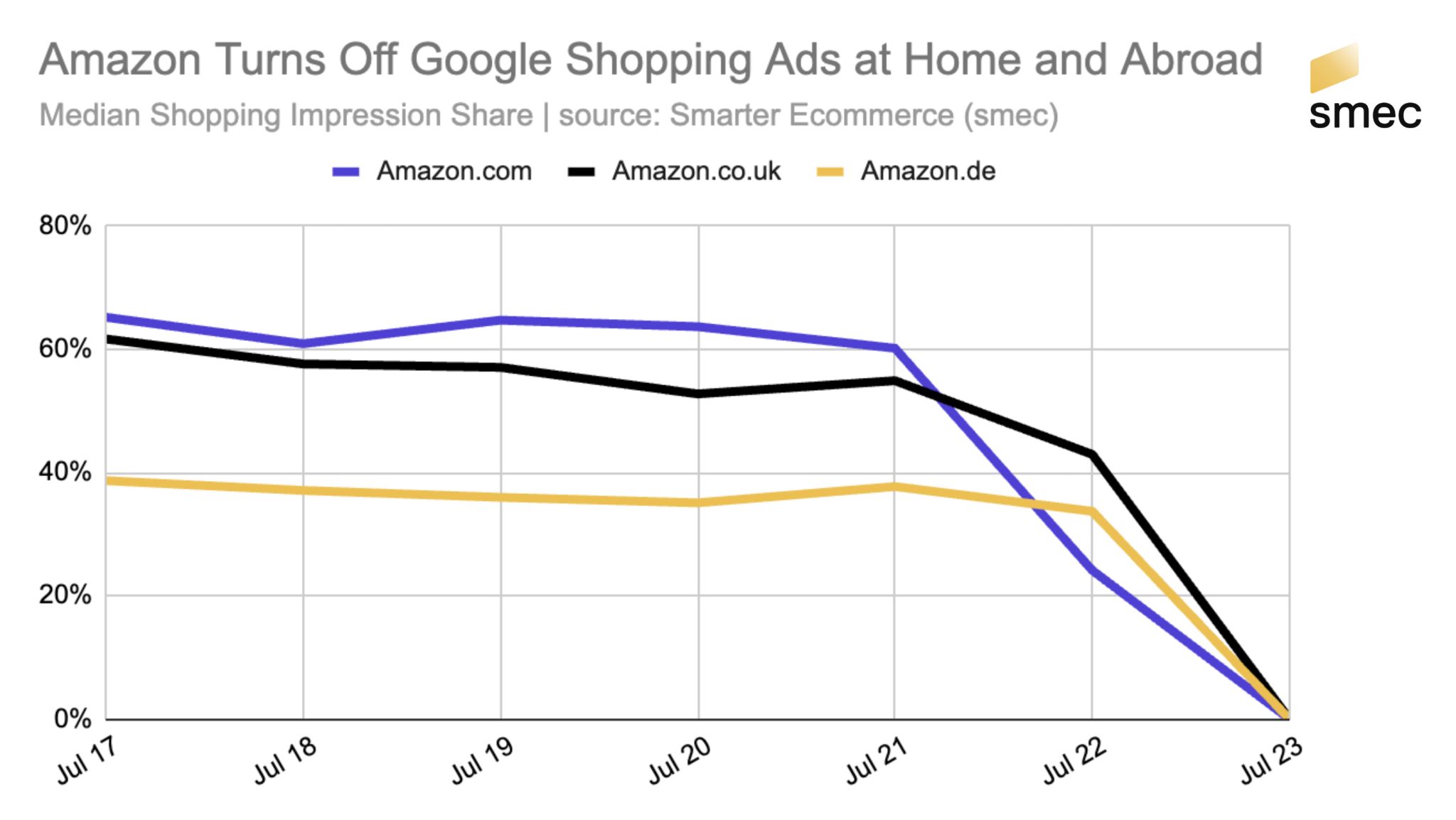

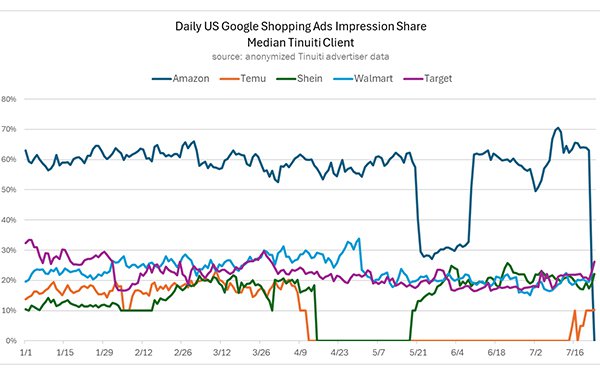

To understand the scale of this decision, one must be aware of the weight Amazon carried on Google Shopping. Until July 2025, Amazon completely dominated this advertising channel, with a 60% impression share in the United States.

For years, Google Shopping had become a fundamental platform for Amazon. Through this channel, the company achieved massive visibility, making it the dominant player in the ecosystem. Users could see Amazon’s offers directly in Google’s search results. Amazon’s presence on Google Shopping was so massive that it overshadowed any other competitor. Its dominance of advertising impressions practically turned the platform into its personal channel.

However, this mutual dependence began to create strategic tensions. Amazon was indirectly funding its direct competitor in the realm of commercial searches. The strategic contradiction became increasingly apparent to the company’s executives.

Timeline of events

The first signs of change appeared in May 2025. Amazon reduced its spending on Google Shopping by 50% in the United States during May 2025, suggesting that the July withdrawal followed months of strategic planning, not an impulsive decision.

The reduction was gradual during May and June 2025. Industry analysts detected a steady decline in Amazon’s advertising presence. This trend continued for several weeks before the final blow.

The turning point did, however, arrive abruptly. Between 21 and 23 July 2025, Amazon withdrew its entire advertising presence from Google Shopping, going from a dominant visibility to zero. The figures speak for themselves:

- United States: impression share from 60% → 0%

- United Kingdom: from 55% → 0%

- Germany: from 38% → 0%

- Japan: complete exit also confirmed

Source: Mike Ryan – x.com, July 2025

According to Mike Ryan, Head of E-commerce Insights at Smarter Ecommerce (smec):

I have not seen an ad stop this dramatic from Amazon since the acute phase of the pandemic lockdowns.

Official confirmations and expert reactions

The industry’s reaction was immediate and one of surprise. Digital marketing experts did not expect such a radical and sudden move. The speed of the withdrawal – in just 48 hours – caught the entire advertising ecosystem off guard.

Josh Duggan, founder of the agency Vervaunt, explained in a LinkedIn post that:

Across ~13 million impressions we track daily, we’ve seen Amazon completely disappear from the auction since Tuesday afternoon.

On average, Amazon appears in ~30% of Shopping auctions across our client base – so this is a big shift

Source: Amazon Turns Off Google Shopping Ads – Media Daily News, July 2025

Analysts at Tinuiti, an independent marketing agency, suggest that this could be a turf war in the field of Artificial Intelligence search. With the strong launch of Rufus and generative responses, Amazon wants full control of the funnel before Google Performance Max takes over.

Google has so far remained officially silent on this decision. The company has not issued any public statements about the loss of one of its most important advertisers on Google Shopping. This lack of official comment is generating even more speculation in the sector.

The “Why” Behind the Decision: Analysis of the Possible Reasons

Mikael Brakker, Director of E-commerce and Amazon at L’Oréal Luxe – Europe Zone, explained it very graphically in less than ten words:

Cause the richest click is the one you don’t buy.

But we are going to try to analyse the possible reasons in a little more depth:

a) The battle for product search

Amazon has been developing its own product search engine for years. Millions of users start their shopping searches directly on Amazon. This trend directly threatens Google’s dominance in commercial searches. Users no longer need to go through Google to find what they are looking for.

Amazon’s strategy is clear: to become the primary destination for commercial searches. Every dollar invested in Google Shopping represented a vote of confidence in its direct competitor. Business logic dictated a change of course.

b) Boosting its own advertising platform

Amazon Advertising has experienced exponential growth in recent years. Amazon’s internal advertising platform generates billions of dollars annually. Retail Media revenue has become a crucial source of profit for the company.

The decision to leave Google Shopping frees up resources to invest in its own platform. Amazon can allocate those millions of dollars to improving its internal advertising tools. Advertising self-sufficiency strengthens its market position. And the profits stay within the company’s ecosystem.

As Mikael Brakker also aptly put it in his LinkedIn post:

Why rent shoppers from Google when your own Retail Media cash machine pays twice?

c) The cost vs. benefit (ROI) factor

Advertising costs on Google Shopping have increased considerably in recent years. Competition to appear in the top results has driven up prices. Amazon was facing rising costs to maintain its visibility.

The profitability of campaigns on Google Shopping had begun to decline. Margins were shrinking while cost-per-click was increasing. This trend made long-term investment unsustainable.

The company has demonstrated its ability to generate qualified traffic without relying on Google. Its own direct marketing channels offer higher conversion rates. Advertising efficiency improves when you control the entire value chain. Furthermore, nothing creates more bargaining power to achieve a reduction in rates than withdrawing a multi-million dollar advertising investment overnight.

d) Total control of data and the customer

Customer data is the most valuable asset in today’s digital commerce. Amazon was losing valuable information when users arrived via Google Shopping. This loss of data limited the possibilities for personalisation and optimisation.

Control of the customer relationship allows for more sophisticated marketing strategies. Amazon can develop more complete user profiles when it controls all points of contact. This information translates into better recommendations and greater customer satisfaction.

Immediate Impact on Advertisers and the Market

Amazon’s decision has sent shockwaves throughout the digital advertising ecosystem. Advertisers who competed with Amazon on Google Shopping have experienced immediate changes in their campaigns. The reduction in competition has significantly altered pricing dynamics.

Initial data indicates that cost-per-click rates have fallen by between 7% and 12% following Amazon’s exit, although these drops are still considered normal within the usual market volatility. Since 23 July, competitors such as Walmart, Target and Home Depot have managed to increase their impression share by up to 20%, as indicated by Heidi Sturrock, a consultant at OMG Commerce. The space left by Amazon represents a golden opportunity to gain market share.

However, smaller retailers may not see the same benefits. Industry analysis suggests that large chains, with larger advertising budgets, are better positioned to occupy the space left by Amazon, which could continue to put pressure on small businesses.

Digital marketing agencies, on the other hand, have had to quickly readapt their strategies. Google Shopping specialists have lost one of their most important clients. The industry has been forced to diversify its services and approaches.

Amazon Sets the Course: the Future of Digital Advertising

Amazon’s departure from Google Shopping represents a key moment in the evolution of digital advertising, marking the end of a period of strong reliance on external platforms and the beginning of an era of advertising self-sufficiency. Although Amazon has not completely abandoned Google—as evidenced by its presence in sponsored results for certain key searches—the decision to withdraw from Google Shopping auctions reveals a profound shift in focus: prioritising investment in its own advertising ecosystem.

Amazon Advertising will now receive a larger allocation of resources, with special attention on the development of targeting, measurement and analysis tools. This commitment to strengthening its internal infrastructure responds to a clear objective: to build a closed, controlled and efficient environment, in which users do not need to leave its platform to discover, compare and buy products. This vertical integration not only improves the customer experience, but also allows Amazon to control the entire user journey, maximise the value of its data and capture advertising revenue in its entirety.

Amazon’s move could motivate other e-commerce giants—such as Alibaba, Shopify or MercadoLibre—to rethink their advertising strategies, accelerating a trend towards closed and self-sufficient ecosystems that will reshape the market. In this new scenario, where Google will have to adapt to retain advertisers, control of data, ownership of the channel and the building of own audiences are emerging as keys to success in an increasingly fragmented and specialised digital advertising landscape.

Amazon’s decision, in short, could be remembered as the moment when one digital commerce leader cut ties with another tech giant to chart its own course, ushering in a new era in the history of online advertising.