Key dynamics on the shelf and prices in the Mexican meat market in 2025

Mexico is one of the largest producers and consumers of meat in Latin America. According to the Mexican Meat Council, national meat consumption (beef, pork and chicken) is around 10 million tonnes per year. Per capita consumption is 82 kilograms, positioning Mexico as one of the countries with the highest meat consumption worldwide, only behind the United States, Argentina and Brazil.

According to a report by IMARC Group, the meat market reached a size of 21,500 million dollars in 2024 and is projected to reach 25,500 million by 2033, with a compound annual growth rate (CAGR) of 1.92% between 2025 and 2033. This growth is driven by factors such as increased production, diversification of the offering, and a shift in consumer habits towards healthier, higher-quality products.

On the other hand, the modern channel and e-commerce are reinforcing their role in the distribution of packaged foods. The AMVO’s 2024 Online Sales Study reports that e-commerce in Mexico reached a value of 658 billion pesos in 2023, with 24.6% annual growth and with food and groceries among the most frequent purchasing categories. The digital expansion, combined with the coverage of large retail chains, has intensified shelf competition and has made the management of prices and promotions more visible.

Consumers, for their part, remain highly price sensitive. Kantar and NielsenIQ have documented that Mexican families have increased their search for promotions and are comparing more between brands and formats. This is driving the share of own brands in several supermarkets. In this scenario, building value by format, brand strategy and precision in commercial execution make the difference when it comes to gaining visibility and turnover on the shelf.

A contested shelf and a price-sensitive consumer

Between January and April 2025, we analysed three key categories in this market—Turkey Ham, Pork Leg Ham and Turkey Breast—in the country’s main chains (Bodega Aurrera, Chedraui, H‑E‑B, La Comer, Sam’s, Soriana and Walmart). The data comes from the continuous monitoring with our tool of prices and assortment in these chains’ online channels and shows two initial conclusions:

- The shelf is highly fragmented, especially in Turkey Ham.

- Price and promotions decisively influence choice, with almost half of the products on promotion throughout the period studied.

In this first article, we focus on two key areas of the report: who gets the shelf visibility (Share of Shelf) and how prices evolve by format and by chain. This is a useful read for commercial directors, trade marketing managers and category teams operating in the Mexican meat market.

Share of Shelf: the real picture of shelf space

Share of Shelf is the percentage of visibility that each brand achieves in the listings of the analysed chains. To carry out this analysis, we count the active products per brand within each category, thus obtaining the relative weight of each participant.

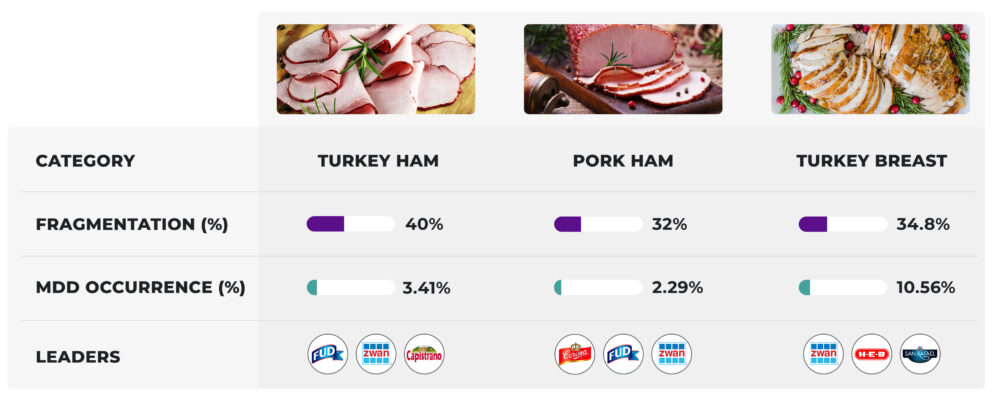

Turkey Ham: the most fragmented category

Of the 3 categories analysed, this is the most fragmented, i.e., the most competitive. The Top 5 brands listed account for 60.1% of the digital shelf, leaving 40% for another 10 brands. It is the category in which the offering is most dispersed.

The Top 5 is balanced and is rounded out by brands with significant coverage such as Fud (which leads with a 14.68% share) and Capistrano (12.29% share). On the other hand, in this category, the Own Brand (MDD) has a limited impact. Despite having 3 own brands present (Bodega Aurrera, H-E-B and Great Value), their combined share barely reaches 3.41%.

From this data, we can draw the following operational conclusion: The coexistence of several medium-sized brands with a good share suggests very competitive assortment decisions by the chains. It also indicates a consumer who is open to trying new products. The challenge for each manufacturer is to build a unique value proposition and ensure perfect in-store execution so as not to dilute their presence within the “long tail” of brands.

Pork Leg Ham: the largest category, with concentrated leadership

This is the category with the largest number of products, 437 in the analysed period. However, leadership is concentrated in just 3 brands, which occupy half the space: La Corona, which accounts for 24.03%, Fud (13.73%) and Zwan (12.13%).

With regard to private brands, they have a minimal presence in this product family. Its incidence in this category is only 2.29%.

It can be concluded that in this category, La Corona, Fud and Zwan dominate visibility. For smaller brands, the way to gain space is through differentiation in formats, attributes or chain-specific alliances. For the chains, the challenge is to balance leadership with sufficient variety to avoid internal cannibalisation.

Turkey Breast: fewer products and an own brand with a leading role

The Turkey Breast category is the smallest category in terms of number of SKUs (161), but it maintains a medium-high concentration. The Top 5 brands on the digital shelf account for 65.2% of the Share of Shelf.

In this category, the surprise comes from a Private Brand: H-E-B enters the Top 5 with a 9.32% share. The total share of private brands in the category reaches 10.56%, well above that observed in turkey ham and pork leg ham.

In short, Turkey Breast has become a testing ground for private labels, with good consumer acceptance. For manufacturer brands, this requires fine-tuning price-positioning and strengthening arguments related to quality, traceability or health.

Price evolution: what changed between January and April 2025

Observing the price by format and by chain offers a tactical reading of the market: it helps to define portfolio architecture, packaging policies and negotiation decisions with retailers.

Comparison by format

Between January and April, Turkey Ham in the 250g format showed stability with a slight upward trend of 5.6%. The 1kg format registered a sharp jump in February (+56.6%), followed by moderate increases in the following months. In April, buying a kilo was 29% cheaper than buying the same amount in small packs. This reinforces a clear message for volume pricing strategies.

In the case of Pork Leg Ham, the 250g format grew by 12.4% over the four-month period, with a peak in March. The 1kg format showed a more stable rise of 6.5%. Furthermore, the price advantage per kilo remains: 15% cheaper than four small trays.

Turkey Breast, on the other hand, followed a different pattern: the 250g format rose by 10.7% and reached its peak in April. Meanwhile, the kilo format showed a slight initial rise but corrected in April with a 9.11% fall compared to March, ending up 23% more expensive than the small packs. This implies that, unlike with ham, where the large format rewards the consumer, with turkey breast it is better to opt for the 250-gram trays.

For brands, these behaviours open up the possibility of tailoring prices, promotions and displays according to the elasticity of each category. On the other hand, for the chains, there is an opportunity to clearly communicate the value per kilo and design mechanics that incentivise the most profitable format in each case.

Comparison by retailer

In the comparison by chain, Turkey Ham shows a wide dispersion of prices. Sam’s and La Comer are in the high range, while Chedraui leads in low prices. Between January and April, the rises at Sam’s (+17.5%) and Bodega Aurrera (+22.3% with a sharp jump in April) stand out, followed by increases at Chedraui (+10.9%), Soriana (+8.8%) and H-E-B (+6.3%). Walmart’s prices barely rose (+1.8%) and La Comer was the only one to reduce its average price (-9.7%).

Pork Leg Ham shows three price tiers. In the low tier, Chedraui and Soriana remain stable, while Bodega Aurrera shows a U-shaped curve with a drop in March and a rebound in April. The mid-level is marked by a continuous decrease at Walmart (-5.7%), while H-E-B remains stable. Finally, in the high segment, Sam’s registers a slight increase (+3.7%) and La Comer adjusts sharply downwards, converging towards the club’s price level.

In Turkey Breast, Bodega Aurrera is positioned with extraordinarily low prices, although it raises its prices from a very low base (+19.2%). La Comer applies a significant downward correction, and Walmart and Soriana show increases. Chedraui and Sam’s move with slight decreases or stability, and H-E-B remains practically unchanged.

The result is a broad and heterogeneous price spectrum, which opens up space for differentiated tactics per retailer, especially in contexts where own brands have high penetration.

What this analysis means for manufacturers and retailers

The Turkey Ham category demands a focus on execution and differentiation. With 40% of the shelf space distributed among many brands, the risk of invisibility is real. Some recommended actions are to segment the assortment by use (daily lunch, premium, healthy), carefully manage the price architecture, and ensure the portfolio covers both 250g and 1kg formats, prioritising the kilo format as a value offer.

In Pork Leg Ham, the game is about scale. La Corona, Fud and Zwan concentrate half of the visibility. To compete, it is advisable to focus on clear attributes (artisanal quality, low sodium, no additives) and work on displays that gain impact against the leading bloc.

Turkey Breast poses a different challenge: a greater presence of private brands and a value relationship that favours the small format. Here, the key is to justify the difference with perceived quality propositions and health messages; also, to review the costs of the kilo format, which currently offers no advantage to the buyer.

The strategy by chain also matters. Chedraui is consolidating its position as a benchmark for low prices in several categories; Sam’s and La Comer function as the ceiling of the range; Bodega Aurrera makes profound adjustments and is also one of the chains with the most aggressive discounts. Adjusting net prices and mechanics to the reality of each retailer will improve margins and turnover.

Conclusion

Between January and April 2025, the Mexican meat market confirmed three trends: an intensely fragmented Turkey Ham shelf, concentrated leadership in Pork Leg Ham, and a Turkey Breast category where the own brand is visibly gaining ground. The price evolution reinforces the need for a fine-tuned strategy by format and by chain.

For brands, the challenge is to build a clear and consistent proposition, with an assortment and prices adjusted to the reality of each retailer. For chains, the opportunity lies in balancing variety with an architecture that maximises turnover and margin, taking advantage of elasticity by format and the role of private brands in categories where the consumer is more accepting of them.

If you want to delve deeper into the tables, charts and findings by chain and brand, download the full report here. It will help you decide where to invest in space, how to adjust your portfolio and what messages to bring to your next negotiation.