Rethinking the Digital Catalogue: Strategies for D2C and Distributors Seeking to Stand Out in Saturated Marketplaces

Digital commerce is undergoing a phase of accelerated maturity. In most cases, both in direct-to-consumer (D2C) models and in generalist and vertical marketplaces, supply has multiplied faster than demand. The result is a clearly saturated environment: more brands competing for the same visibility, increasingly tight margins, customer acquisition costs at historic highs, and a growing difficulty in achieving sustained differentiation.

Context: Why the Catalogue Is No Longer Neutral

Entering any major marketplace reveals the magnitude of the problem: Amazon has more than 9 million registered sellers worldwide, of which nearly 2 million are active. Miravia added thousands of sellers in Spain in just two years. This saturation has direct and measurable costs.

The customer acquisition cost (CAC) has grown to the point of making many business models unsustainable. D2C brands that relied on Facebook or Google Ads are seeing the profitability of each sale evaporate. Distributors are not escaping this pressure either: according to industry data, sellers on marketplaces like Amazon operate with net margins between 5-15%, well below what traditional channels used to allow.

When dozens of sellers offer identical products, price becomes the only visible variable, pushing margins downwards. Standing out has become a matter of survival. This is where the digital catalogue takes centre stage. For years, it has been seen as a basic operational element: a list of products with references, prices, and generic descriptions. This vision is obsolete.

The catalogue now determines your ability to capture attention, generate trust, and convert visits into sales. That is why it can no longer be considered neutral. Marketplaces work with algorithms that reward information completeness, image quality, customer reviews, and dozens of other factors. A mediocre catalogue condemns you to invisibility, regardless of your advertising investment.

What Does “Rethinking the Digital Catalogue” Mean?

Rethinking the digital catalogue involves moving beyond the traditional view of the catalogue as an ordered inventory of references. Instead, it is about conceiving it as a combination of three elements: a solid information architecture, a consistent brand narrative, and an engine for personalisation and adaptation to the context of the channel and the user.

From a functional point of view, the catalogue continues to fulfil its basic role: describing what is being sold. But, from a strategic perspective, it also answers other key questions: how each product is presented, who it is relevant to, in what context it should appear, and with what arguments it should compete against similar alternatives.

This change in focus requires paying attention to several critical components:

- Product data quality: clear titles, complete descriptions, standardised attributes, and an absence of errors.

- Content enrichment: benefit-orientated copy, high-quality images, videos, and resources that aid the purchase decision.

- Category and attribute structure: a taxonomy designed for the user and for internal search algorithms.

- Omnichannel automation and orchestration: the ability to adapt the catalogue to different marketplaces, countries, and formats without losing consistency, supported by product information management systems and integrations with other systems.

Rethinking the catalogue is not a purely technical exercise. It is a strategic decision that connects marketing, operations, sales, and technology.

Critical Components of the Catalogue to Stand Out in Marketplaces

To excel on a platform where you share space with thousands of sellers, the catalogue must meet standards of technical and visual excellence.

1. Content quality and consistency

Trust is built on the consistency and quality of information. In practice, when a customer finds different descriptions for the same product on Amazon and on the brand’s official website, doubts arise that directly affect the purchase decision. For this reason, content quality also involves exhaustiveness: taking advantage of all the fields offered by the marketplace, providing clear and useful information. In this way, the more complete the product sheet, the less friction is generated, which in turn translates into fewer customer service enquiries and lower return rates.

On the other hand, descriptions must find a balance between technical data and concrete benefits. In many cases, distributors resort to generic manufacturer texts that provide little value and do not connect with the buyer. Conversely, some D2C brands lean towards highly elaborate brand storytelling but with deficiencies in key specifications that the user needs to confirm before buying.

Maintaining that consistency across all channels is fundamental. Otherwise, discrepancies, however small, erode trust and weaken the perception of professionalism.

2. Differentiating formats & rich media

Text is no longer enough. Enriched content includes:

- High-resolution lifestyle images: With the ability to zoom in and see texture details. Multiple viewing angles and usage context should also be included.

- Product videos: These show the item in use and resolve doubts about size or operation.

- Infographics: These allow key benefits to be summarised at a glance, which is vital for users browsing on mobile devices.

- A+ Content or enhanced descriptions: These modules allow for the inclusion of graphics and comparisons that elevate the brand’s perceived quality.

Rich Media is fundamental for retaining attention and has a demonstrable impact on conversion.

Marketplace internal SEO

Every marketplace functions as its own search engine. Therefore, understanding how it indexes and prioritises products is fundamental. In this context, the correct use of keywords in titles, bullet points, and descriptions, along with an attribute structure aligned with available filters, improves organic visibility within the platform. Furthermore, hidden keywords (backend keywords) allow for the addition of synonyms, alternative terms, or common errors that customers might use in their searches.

However, this internal SEO is not static. For this reason, it requires continuous analysis of search behaviour, as well as the terms that convert and changes in each marketplace’s algorithms.

Differentiation Strategies in Saturated Markets

Depending on whether you are a D2C brand or a distributor, the priorities when managing your catalogue will vary.

Specific strategies for D2C

Brands that sell directly have the advantage of total control, but the challenge of scale and profitability.

- Brand control and narrative: The catalogue is your shop window. You must ensure that your brand voice and values are consistent and distinctive, permeating every product sheet. This involves defining clear content guidelines, tone, and message hierarchy, and adapting them to the limitations of each platform without losing identity. Do not delegate content creation to machine translators or generic templates.

- Personalisation and offer segmentation: Direct access to behavioural data should translate into personalised catalogue strategies. Analysing how different customer profiles browse and buy allows for the structuring of specific collections and the design of packs or product combinations exclusive to the direct channel. This reinforces differentiation from marketplaces. Although these platforms limit individual personalisation, they do offer room to decide which assortment to prioritise, when to do so, and with what arguments to present each product.

- Smart pricing and competitiveness: Pricing in marketplaces is dynamic and competitive. Define tactics that balance various objectives: protecting margins, maintaining consistency with your own channel, or being competitive against authorised distributors. A well-structured catalogue will allow for more sophisticated strategies, supported by clear comparisons, differentiated value propositions, and active promotion management.

Specific strategies for distributors

Distributors usually handle third-party catalogues, which presents the challenge of not having “exclusive content” from the source.

- Catalogue adapted by marketplace and country: Not all markets work the same way. A successful distributor adapts descriptions and attributes to local customs and the specific rules of each platform (for example, adapting sizes or units of measurement).

- Real-time inventory and availability management: In a marketplace, running out of stock severely penalises positioning. Integrating real-time stock information and reflecting it correctly in the catalogue avoids frustration and algorithmic penalties.

- Relationship with brands and consistency control: Authorised distributors are responsible for correctly representing brands to the final consumer. When managing multi-brand catalogues, it is key to guarantee a homogeneous level of quality and consistency in information. To do this, it is necessary to establish common data standards and clear governance processes that ensure a consistent presentation across all products.

Technology at the Service of the Catalogue

Professional management in multi-channel environments requires an appropriate technology stack. The central component is the PIM (Product Information Management) system, which acts as the single source of truth.

A modern PIM allows for the centralisation of data from multiple sources, enriching information collaboratively, validating its quality through automated rules, and distributing it to multiple destinations while maintaining consistency. This ensures that, both on marketplaces and on your own website, products are presented consistently and accurately.

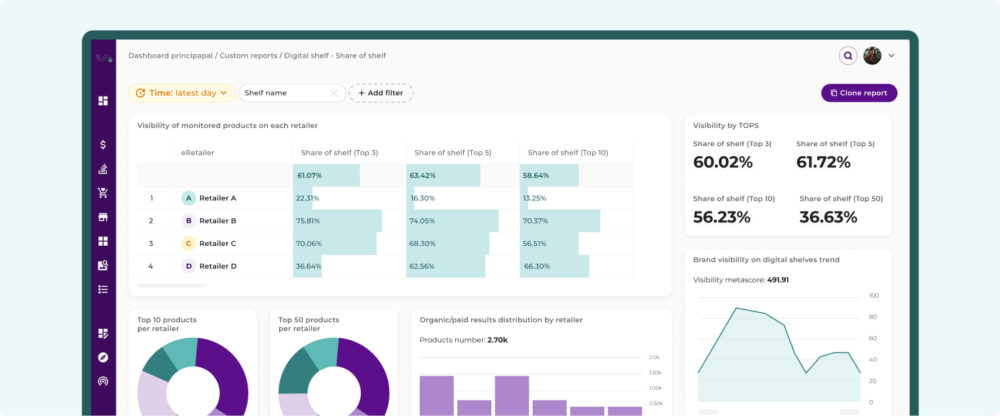

Catalogue analytics provide visibility into product health: identifying which references have incomplete information, which generate views but do not convert, and which attributes relate to higher conversion rates. Complementarily, Digital Shelf analytics allow for the evaluation of product performance on marketplaces from the consumer’s perspective: visibility, ranking against the competition, compliance with content standards, and performance compared to other brands or categories. Together, these analytics offer a comprehensive overview for making strategic catalogue optimisation decisions.

Click here to discover flipflow’s Digital Shelf Analytics tool

Artificial intelligence is starting to transform catalogue management: automatic generation of descriptions adapted to each channel, image enrichment, automatic categorisation, and detection of bundling opportunities. Furthermore, automation facilitates key tasks such as:

- Localised translations: adapting content to different languages while preserving the correct technical terminology.

- Assisted description generation: creating drafts based on technical attributes that the team can polish to maintain brand consistency and tone.

- Data validation: automatic alerts when mandatory information is missing or a title does not comply with marketplace rules.

Beyond the specific tool, the relevant thing is the approach: having a single source of truth, clear processes, and the ability to adapt to the changing requirements of marketplaces.

Actionable Checklist for D2C and Distributors

To move from theory to practice, evaluate your current situation with the following points:

For D2C brands:

- Does your catalogue clearly reflect your value proposition and storytelling on each channel? Don’t just copy and paste; adapt the message without losing the essence.

- Are you using first-party data (CRM, analytics) to decide which products to push? Identify which products have the best margins and highest customer satisfaction to give them priority in your catalogue.

- Do you offer product sets (bundles) that provide a complete solution to the customer? This helps increase average order value and differentiates you from sellers of individual products.

- Have you defined key messages and priority benefits by product and category? Ensure that each sheet clearly communicates why that product is relevant and how it solves specific customer needs.

- Do you periodically review the performance of your listings and adjust content and prices accordingly? Evaluate conversion and visibility metrics to make informed decisions that continuously optimise the catalogue.

For distributors:

- Do you have a single source of truth for product data and an attribute model common to all brands? Avoid having information scattered across multiple Excel files.

- Is your browsing experience (categories, filters, comparison tools) superior to that of other sellers? If you sell the same as others, your advantage lies in helping the customer find it faster and with better data.

- Do you synchronise your stock in real-time with all marketplaces? Reliability is your best asset for maintaining a good seller reputation.

- Do you have clear processes for validating and enriching content received from manufacturers? This ensures that all published information meets quality and consistency standards, avoiding errors and improving the shopping experience.

Conclusion: Beyond the Catalogue, a Competitive Strategy

While many companies continue to treat the catalogue as an operational checklist, others have turned it into their primary asset for differentiation. As a result, the gap between the two widens every day.

In this context, improving the catalogue is a cumulative process where each improvement generates a measurable return: better content drives conversion; in turn, higher conversion improves positioning in algorithms; subsequently, a better ranking generates more organic visibility and, finally, that visibility reduces dependence on advertising investment. Thus, this virtuous circle rewards those who invest consistently.

However, implementing it requires budget, technology, and coordination between teams that have traditionally worked in silos. Therefore, waiting for margins to stabilise or for competition to decrease only delays the inevitable. Every quarter that passes without action, your catalogue loses ground to competitors who have already started. You can continue competing only on price, or you can start competing on information. Only one of the two options has a path forward.