From Multichannel to Signal Ecosystems: How The Way We Understand Retail Is Changing

Introduction: Why Thinking in “Channels” Is No Longer Enough

For years, retail has organised its strategy around channels. Efforts were divided according to where the transaction took place. Physical shops, e-commerce, marketplaces, social media, or customer service were treated as distinct spaces, each with its own objectives, metrics, and managers. This approach allowed the initial complexity of digitalisation to be managed and facilitated growth on multiple fronts.

However, the current context has changed. Consumer behaviour is more fragmented, less predictable, and much more dynamic. In fact, 73% of shoppers interact with multiple channels and integrate an average of 6 touchpoints before completing a transaction.

Purchase decisions are built from micro-interactions that happen at different times and places. Where does each channel begin and end? This question is starting to fall short of explaining what is really happening and, above all, of making decisions with speed and consistency.

The limits of the classic “multichannel” approach

The multichannel model was designed so that companies could sell in physical shops, on their websites, and later, on social media. Although it represented progress, this system carries a structural problem: fragmentation. Each channel usually operates with its own budgets, its own sales targets and, more seriously, its own databases.

This separation creates an incomplete view of the customer. According to Plivo (2025), only 13% of companies manage to transfer the customer context between channels, which means 56% of consumers have to repeat information when they switch touchpoints. If a person researches a product on the web but buys it in the physical shop, the digital team interprets that the online campaign failed, while the shop team claims a success without knowing the origin of that visit.

This lack of communication between departments prevents resources from being optimised and causes decisions to be made based on a partial reality. The channel-based approach measures where the money ends up, but ignores the previous journey and the ‘why’ behind consumer behaviour.

From channels to signal ecosystems

The emerging alternative consists of moving away from thinking in separate channels and starting to build an ecosystem where every user interaction (a product saved to favourites, time spent in front of a shop window, or a customer service enquiry) generates a signal. These signals are captured, interpreted, and shared in real-time across all areas of the business. It is not just about technology, although data infrastructure is essential. It is about a change in mindset: moving from managing points of sale to orchestrating information flows that continuously improve the entire operation.

In this model, a customer who compares products on the web for several days does not simply generate traffic. They generate signals of intent that can inform the recommendation system, adjust inventory in the nearest shop, or trigger personalised communication. Every action tells a story that feeds the decisions of the rest of the organisation.

What is a “Signal Ecosystem”?

A signal ecosystem is defined as a management model where every touchpoint is treated as a valuable data source that feeds the entire corporate system. From this perspective, a shop return, a click in an email, or a comment on social media cease to be isolated events and instead become part of a common information flow.

The fundamental difference compared to the traditional model lies in the circulation of information. In the channel scheme, data is stored in watertight compartments or silos. The logistics department knows what is being returned, marketing knows who is clicking, and sales knows what is being sold, but they rarely cross-reference this information in an agile way.

In a signal ecosystem, information flows seamlessly to improve three critical areas simultaneously:

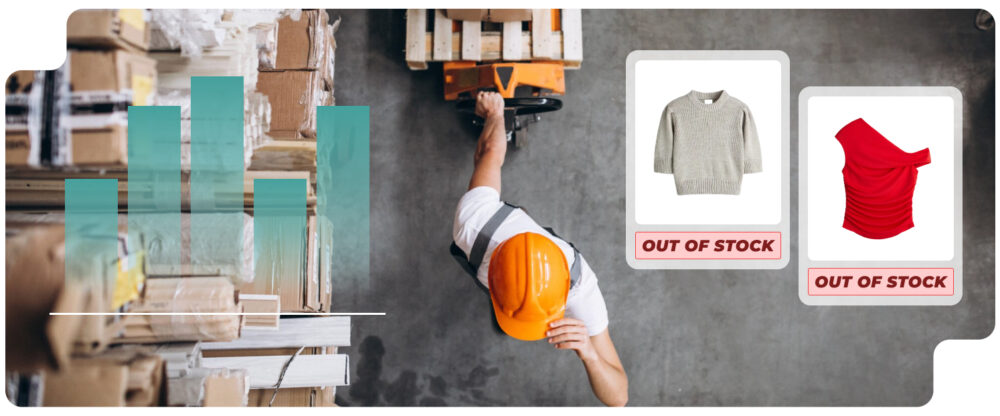

- The supply chain: Demand signals on the web can trigger replenishment orders before physical shops run out of stock.

- Marketing: Real-time behaviour data allows for the delivery of personalised messages that match the user’s current interest.

- The in-shop experience: Sales staff have access to information about customer preferences, allowing them to offer much more precise and useful advice.

Everything works as an integrated organism that constantly learns and adapts.

The 5 Types of Signals That Matter

Not all signals carry the same weight or have the same purpose. To make the ecosystem actionable, it is useful to group them into clear categories that help with interpretation and prioritisation.

Intent Signals

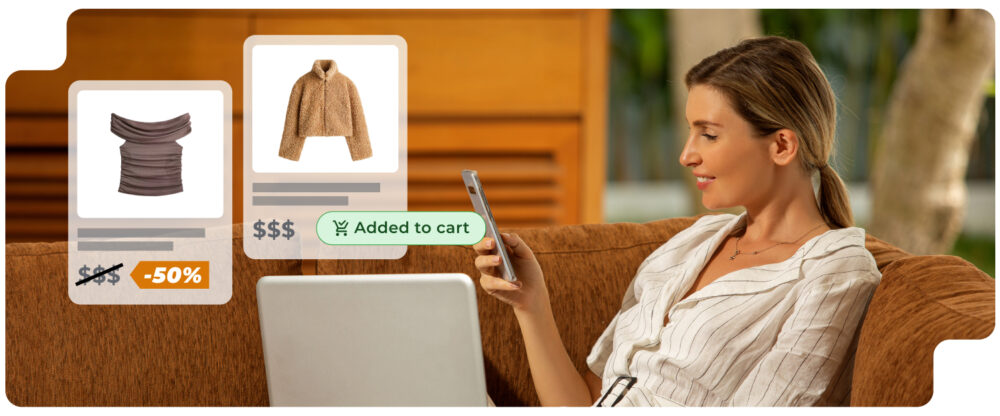

These signals reveal what the customer is looking for and how close they are to making a decision. In the digital world, they are easy to track through website searches, products added to wishlists, or time spent reading the specifications of a specific item.

In the physical environment, intent is manifested through the journey through the aisles or the use of changing rooms. If a customer enters the shop with their mobile phone and scans a QR code to see if other sizes are available, they are emitting a clear signal of intent. Capturing this data allows the company to know which products are generating real interest, even if the sale is not closed at that precise moment.

Signals of intent are especially valuable because they allow companies to stay ahead. They also help in understanding emerging trends. When searches for a specific term spike, the system can alert the buying and marketing teams long before that change is reflected in sales. This time advantage allows for an agile reaction to market shifts.

Value and Sensitivity Signals

These signals help us understand the customer’s relationship with price and exclusivity. Observing how a segment of users reacts to a specific discount or whether they prefer to buy products from the new collection without waiting for the sales provides data on their price sensitivity.

If a group of regular customers only buys when there is an active promotion, the ecosystem receives a signal about the need to adjust the margin strategy for that profile. Conversely, if signals indicate that additional services, such as fast delivery or premium packaging, are valued, the company can enhance those aspects to increase the average transaction value.

Friction and Trust Signals

These signals identify where the customer encounters obstacles or doubts. Abandoned checkout forms at the same step, FAQs about return policies, calls to customer service after starting a purchase, products repeatedly added to and removed from the basket. Each of these behaviours indicates a point of friction that is costing sales.

They also capture positive signals of trust: customers who complete purchases without checking reviews, who choose quick payment options, or who enable product notifications. Understanding what builds trust and what erodes it allows for the design of experiences that remove barriers and reinforce the elements that work.

Operational Signals

Unlike the previous ones, operational signals come from the company’s internal processes but directly impact the customer. Products that frequently run out of stock, lengthening replenishment times, returns concentrated on specific items, or incidents in the delivery process. These signals alert to problems in the supply chain, errors in product descriptions, or failures in quality control.

Operational signals allow for action before problems affect customers on a massive scale. If a batch of products shows an abnormal return rate, it can be withdrawn from circulation and reviewed before complaints multiply. If a shop records recurring stockouts in certain categories, the system can redistribute inventory from other locations or adjust orders.

Context Signals

Context provides essential nuances for interpreting the rest of the signals. Customer behaviour changes according to multiple external variables: season, weather, local events, social trends, or the economic situation. Context signals capture these factors and relate them to purchase patterns. A day of heavy rain can trigger sales of certain products in specific areas. A viral conversation on social media can generate sudden interest in something that had seen no movement for months.

These signals help differentiate between structural changes and temporary fluctuations. They allow for dynamic strategy adjustments and the seizing of opportunities that would otherwise go unnoticed until it was too late.

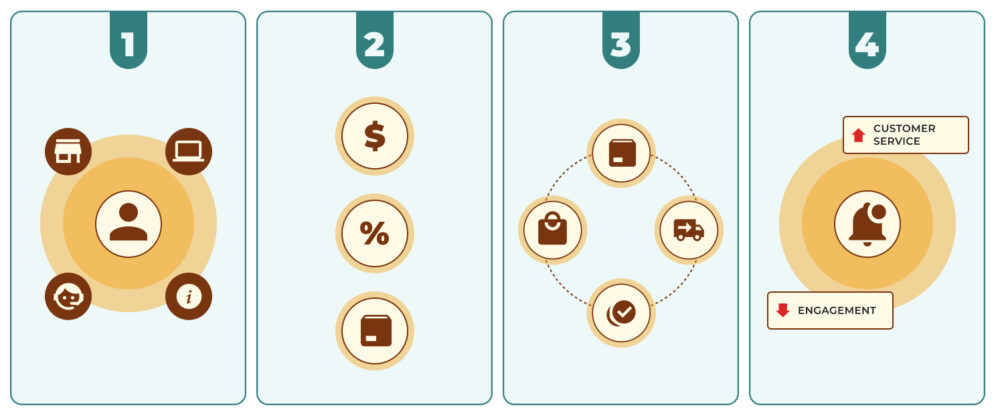

From the “Channel Map” to the “Decision Map”

The fundamental change proposed by the signal ecosystem affects how organisations make decisions. Instead of planning strategies by channel, they are planned around four types of decisions that need integrated information to function well.

1. Experience Decisions

Experience decisions include shop design, digital navigation, product information, or customer service. Friction, intent, and context signals help identify which elements cause confusion, abandonment, or dissatisfaction.

Instead of redesigning the entire experience, specific adjustments with real impact can be prioritised.

2. Commercial Decisions

Commercial decisions cover assortment, prices, promotions, and activations. These decisions improve drastically when they incorporate signals of intent, value, and context. They are also nourished by operational signals. A decision map based on signals allows these variables to be adjusted according to real behaviours rather than just sales history.

This is especially relevant in categories with high turnover or strong competition.

3. Operational Decisions

How much inventory to keep, where to locate it, when to replenish, and how to organise logistics. These decisions, traditionally based on history and forecasts, become much more precise with real-time signals.

The signal ecosystem allows for a shift from reactive inventory management to predictive management. Instead of waiting for stockouts to occur, the system anticipates demand and redistributes resources proactively.

4. Relationship Decisions

Relationship decisions especially benefit retention and long-term value. The ecosystem allows for the identification of early signals of disengagement (reduction in purchase frequency, increase in technical service enquiries, less interaction with communications) and action before losing the customer definitively.

Furthermore, having more relevant communications, better segmentation, and more contextualised service reinforces the perception of brand consistency.

What Changes When We Connect Information Better

Understanding retail as a signal ecosystem requires a change in mindset at all levels of the organisation. It means accepting that the value of an interaction does not always translate into an immediate sale, but into a piece of information that can improve global business performance.

The good news is that a complete transformation is not required overnight. Many organisations start by connecting two or three signal sources, demonstrating value, and building capabilities gradually. The important thing is to understand that each isolated signal counts for little, but every connection between signals multiplies the system’s value exponentially. The more integrated the ecosystem, the smarter and faster the decisions will be.

This approach prepares companies to be much more agile in an environment where change is the only constant. By integrating data and allowing it to flow between departments, decisions are no longer based on intuition or past sales reports. The company starts to operate in the present, responding to the real stimuli of its customers and optimising every available resource. Ultimately, the transition towards a signal-based model allows retail to reclaim its original essence: listening to the customer to offer them exactly what they need, at the right time and place.