When the Retailer is Your Competitor: Strategies to Face the Rise of Private Brands in 2026

TL;DR

Supermarket private brands are consolidating their market share in Europe and shifting the balance of power against manufacturers. The article explains why retailers are winning (data, point-of-sale control, quality, and pricing), the threats manufacturer brands face, and the strategic levers they must activate to remain relevant: brand value, innovation speed, alliances, first-party data, and omnichannel expansion.

2026, the Year the Retailer Becomes your Main Competitor

The growth of Private Brands (PB) has ceased to be a cyclical phenomenon linked to crisis periods and has consolidated as a structural preference of the European consumer. The data reflects an undeniable reality for the industry. In 2024, sales of these brands in Europe reached €352 billion, showing upward progress in 9 of the 17 countries analysed by NielsenIQ for the PLMA (Private Label Manufacturers Association). In 2025, in the United States alone, these brands grew by 3.3%, approaching $283 billion.

Spain is at the forefront of this trend. Our country stands out among the markets ceding the most market share to supermarkets’ own brands, with increases ranging between 1.1 and 1.2 percentage points annually according to pan-European measurements. Currently, the value share of private brands in the FMCG sector in Europe stands at around 39.1%.

However, the most relevant data for understanding the 2026 scenario is not economic, but behavioural. According to a study by McKinsey, 84% of consumers state they would stick with their decision to buy private brands even if their purchasing power improved. This indicates that the “perceived quality” barrier has been overcome. Consumers no longer buy supermarket products just because they are cheaper. They buy them because they believe they offer equivalent or superior value to leading brands.

This article covers the factors explaining the advance of private brands, the main challenges for manufacturers, and a set of strategies to reinforce their position without breaking the commercial relationship with retailers.

Why Are Retailers Gaining Ground?

The advance of distributors is not the result of chance. Retailers have managed to capitalise on their position of direct contact with the end customer to adapt their offering with an agility that many multinationals envy.

Key growth factors

Several pillars sustain this market dominance:

- Inflation as a permanent catalyst: Although inflationary pressure has moderated compared to 2022-2023, European consumers maintain more rational and value-oriented buying behaviours. Private brands initially benefited from this situation as an economic refuge, but many shoppers discovered that the difference in perceived quality had drastically narrowed.

- Full control over the shopping experience: The distributor owns the physical space and the digital environment. This allows them to place their products in the most visible locations (eye level on the shelf). They can also design promotions that systematically favour their own brands.

- Drastic improvement in quality: It has been decades since budget brands were synonymous with basic products and austere packaging. Today, retailers’ product development departments launch “gourmet”, organic, or functional lines that compete head-to-head in innovation with manufacturer brands.

- Advantage in data and consumer insight: Distributors possess privileged information on buying behaviour, price elasticities, promotional response, and substitution patterns between products. This intelligence allows them to position their own brands with surgical precision, replicating the most valued attributes of leading brands at more competitive prices.

- Efficient margin management: By eliminating intermediaries and reducing spending on large mass advertising campaigns, retailers offer more competitive prices while maintaining healthy profitability.

- Trust in the fascia: The modern consumer trusts the supermarket chain. If they trust the establishment for their weekly shop, they extend that trust to the products bearing its name or its exclusive brands.

Challenges for Manufacturers When the Channel Also Competes

For a manufacturer, the fact that their main customer is also their most direct competitor creates a series of conflicts of interest and operational challenges that require extremely careful management.

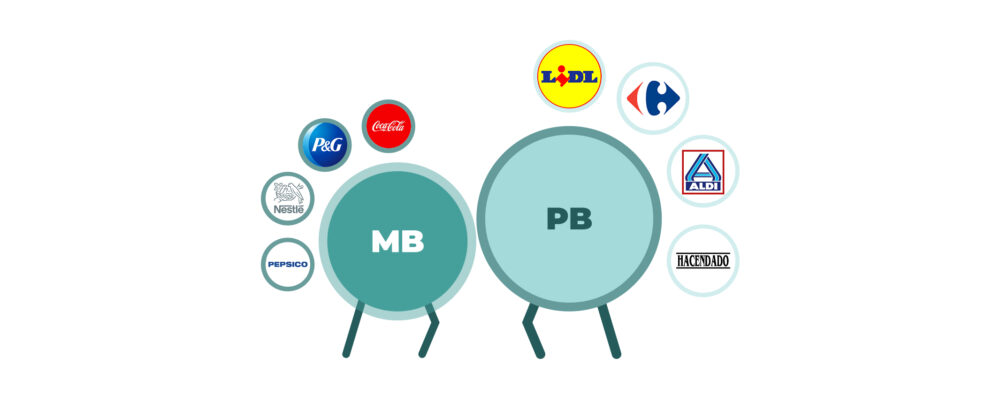

How bargaining power is changing

The scales have tipped in favour of distribution. The sustained gain in share by private brands gives retailers unprecedented influence over the available assortment, promotion design, and space allocated on the shelf.

Data from the PLMA is clear: in various European markets, while private brands grow steadily in units sold, manufacturer brands suffer setbacks. This reality reinforces the distributor’s position at the negotiating table. If a manufacturer brand decides to push for higher prices or better supply conditions, the retailer knows they can fill that gap with their own brand without the consumer leaving the store.

Risks for the manufacturer

This duality of the retailer generates specific risks that brands must identify:

- Progressive loss of physical and digital space: As private brands gain share, the retailers redistribute shelf space. Brands that are not clear leaders or do not provide sufficient differentiation find themselves increasingly sidelined. This dynamic accelerates in e-commerce, where search and recommendation algorithms are optimised by the retailer themselves and can systematically favour their own brands.

- Asymmetrical transparency in market data: Distributors have in-depth knowledge of the performance of all brands in their establishments, including margins, turnover, response to promotions, and substitution patterns. They use this information to design their own brands with specifications that replicate the most valued attributes of leading brands, often with minimal perceptible differences for the average consumer.

- Extreme vulnerability in low-differentiation categories: In segments like basic food (rice, pasta), household cleaning, or basic personal care, where functional differentiation is limited, private brands reach shares higher than 50% in many markets. For a manufacturer specialised in these categories, dependence on the channel becomes existential, with little room for manoeuvre to defend prices or invest in innovation.

- Erosion of advertising investment: When brands lose share and profitability, they cut marketing budgets. This creates a vicious cycle: lower visibility generates lower purchase consideration, which reinforces the preference for private brands that have guaranteed presence at the point of sale.

Strategies to Compete with Private Brands without Breaking the Relationship

For manufacturers, the goal is not to “beat” private brands, but to build a sustainable position that coexists with them and adds value to the retailer and the consumer. Below are concrete lines of action that help move in that direction.

1. Reinforce brand differentiation beyond functional benefit

The battle against private brands cannot be won exclusively on a functional level. If your product can be easily replicated in basic features, you will inevitably compete on price, and in that arena, the distributor has structural advantages.

The manufacturer must build a value proposition that the distributor cannot easily replicate. This includes working on brand purpose, real and certified sustainability, and an emotional connection with the user. Brands that manage to get consumers to actively seek them out by name are the only ones that retain bargaining power.

2. Accelerate innovation and time-to-market

The manufacturer must always stay one step ahead. While the retailer analyses data to copy a success, the manufacturer should already be launching the next evolution. Reducing the time from detecting a need to the product hitting the shelf is vital.

To adapt, many companies are implementing more agile innovation processes. They conduct limited-scope launches and pilot tests in one or two retailers. They use sales data intensively to decide which projects to scale. Furthermore, they reinforce early collaboration with distributors. They present concepts in initial stages to align category objectives. This helps identify spaces where their proposal complements, rather than overlaps, with the private brand.

3. Forge selective alliances with retailers

Although it may seem counterintuitive, sometimes the strategy consists of collaborating instead of just competing, as suggested in the previous paragraph. Not all distributors have the same strategy regarding their own brands, nor do all categories have the same importance for every chain.

Identifying distributors where your brand can play a strategic role (traffic driver, category benchmark, innovation pusher) and building joint category growth plans can create win-win situations.

On the other hand, some manufacturers also choose to manufacture certain private brand lines for the retailer, thus ensuring production volume and improving the commercial relationship. Another option is to develop exclusive products that are only sold in a specific chain, creating a differential value that benefits both parties and protects the brand from direct price comparison between establishments.

4. Leverage first-party data and loyalty

If distributors have an advantage in point-of-sale data, manufacturers can compensate by developing direct relationships with end consumers. Loyalty programmes, proprietary digital platforms, subscriptions, and brand communities allow for the capture of valuable information on preferences, consumption occasions, and willingness to pay.

This first-party data not only better informs product development and commercial strategy but also creates assets independent of the channel. A manufacturer with millions of registered and engaged consumers has greater bargaining power because they can demonstrate their own demand generation.

5. Build an omnichannel strategy and diversify channels

Relying on two or three large supermarket chains is an unacceptable operational risk in 2026. Developing a presence in alternative channels (pure e-commerce, specialists, direct distribution, HoReCa channel, export) reduces vulnerability and allows for experimentation with alternative business models.

The growth of pure e-commerce, especially platforms like Amazon, offers opportunities to build visibility without traditional distributor intermediation, although it presents its own competitive challenges. Direct-to-consumer subscription models, though still a minority in food FMCG, represent another avenue for diversification.

6 Trends to Watch in 2026

To stay ahead, it is necessary to pay attention to the movements that will mark the sector in 2026:

- Premium segmentation of private brands: Distributors are launching premium lines that compete directly with established brands in the high-end segment, not just the basic one. These lines incorporate attributes of sustainability, controlled provenance, or premium ingredients, challenging the traditional perception of private brands.

- Greater regulatory pressure and focus on sustainability: The transition towards more sustainable packaging, waste reduction, and EU climate targets will be a relevant axis for both private and traditional brands.

- Integration of artificial intelligence in product development. Some large retailers are beginning to use advanced algorithms to identify new product opportunities based on trend analysis, online searches, and gaps in assortment. This could further accelerate their responsiveness compared to manufacturer brands.

- Hyper-personalisation: Thanks to AI, retailers will be able to send personalised offers for their own brands directly to the customer’s mobile app while they walk down the aisle—a level of precision difficult for traditional manufacturers to achieve.

- Growth of private brand share in non-food categories: Recent data shows significant progress in general merchandise, home, DIY, and personal care categories, where the distributor sees margin to replicate the food strategy.

- International expansion of private brands: Chains like Lidl or Aldi are building recognition for their own brands beyond their original markets, generating economies of scale that reinforce their competitiveness.

Conclusion: From Suppliers to Indispensable Partners

The growth of private brands represents one of the most important strategic challenges for the FMCG industry. However, it can also be interpreted as a catalyst for brand manufacturers to evolve, professionalise their approach to the market, and reinforce what truly makes them unique.

The key lies in moving from a purely transactional relationship with retailers to a strategic collaboration where both parties recognise mutual value. Retailers still need leading brands to give credibility to their shelves and to attract consumers seeking novelty and status. The key is to occupy that cutting-edge space where private brands cannot or do not yet want to enter.

Checklist for your 2026 plan against private brands

To ensure your brand’s relevance in this competitive environment, review the following points:

- Differentiation: Does my product have at least one relevant benefit that the supermarket brand does not offer?

- Agility: Can we launch an innovation to market in less than six months?

- Data: Do we have our own consumer database to understand their habits without depending on the retailer?

- Profitability by channel: Have we diversified our sales so that no distribution chain accounts for more than 25% of our volume?

- Retail Media: Are we investing intelligently in the supermarkets’ internal advertising to maintain our digital visibility?

- Added value: Do we provide market studies or category data to the supermarket buyer that position us as experts and not just sellers?

The challenge is monumental, but brands that manage to combine a strong identity with agile execution will continue to be the owners of consumers’ hearts, regardless of who owns the shelf.