Analysis of Private Brands in Europe 2025: A Sector at Record Highs

TL;DR

In 2025, Private Brands in Europe reached an average market share of 42% and record sales. Spain and the Netherlands lead, while Italy grows with potential. Private brands are established as the engine of European retail, driven by quality, innovation, and premium ranges.

During 2025, private brands (PB) have consolidated their position as one of the most dynamic pillars of European FMCG retail. According to recent data from Circana presented at the 22nd edition of Marca by BolognaFiere & ADM, private brands closed the year with record figures in both total sales and market share across the continent’s major countries.

In addition to a solid sales volume, two key facts stand out: Spain and the Netherlands lead private brand penetration with particularly high figures, while markets such as Italy show a notable growth path that could translate into substantial progress in the coming years.

Key Private Brand Data in Europe in 2025

Volume and market share

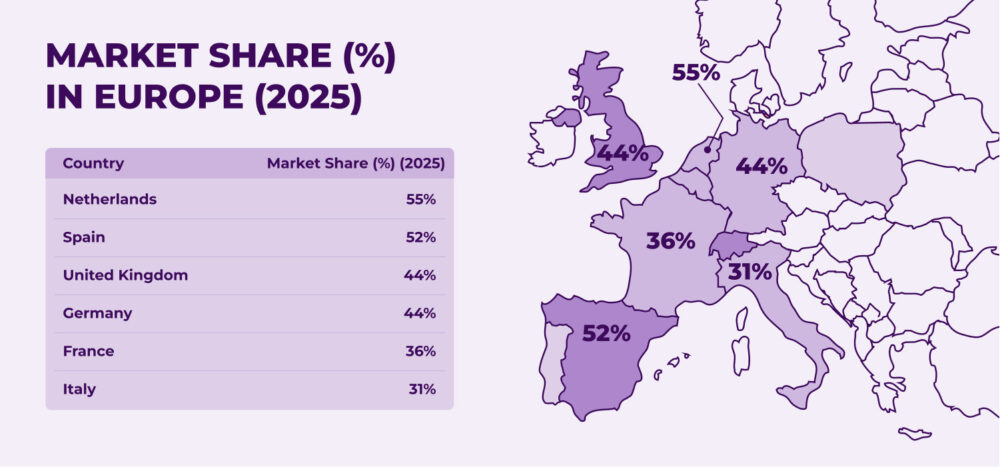

In the 6 major European FMCG markets (Spain, the Netherlands, Germany, the UK, France, and Italy), private brands have reached approximately 324 billion euros in total sales in 2025, consolidating an average market share of 42% in value terms.

This growth represents an increase of 4.4% compared to 2024, when sales volume was close to 310 billion euros. At the same time, market share increased by approximately 0.5 percentage points, evidencing that private brands are not only selling more but gaining relative presence against manufacturer brands.

In unit volume, private brands represent around 50% of FMCG sales, indicating a strong foothold in the shopping baskets of European consumers.

Year-on-year evolution: value vs. volume

The growth of private brands in value consistently exceeds growth by volume, a phenomenon reflecting both the price effect (higher revenue per product despite pressures on the consumer) and a mix effect where higher-value categories gain ground. This combination suggests that private brands are not only selling more units but are scaling towards segments with higher prices and better margins.

How Major Private Brand Markets are Evolving in Europe: Leadership and Potential

Spain and Italy: maturity versus potential

Within the European private brand map, Spain and Italy represent two very different stages of the development cycle and help to understand where the market is headed.

Spain has consolidated its position as one of the most advanced countries in Europe, with a share close to 52% in value. In practice, this means that more than half of FMCG spending already corresponds to own brands. Furthermore, it was the market that grew the most in 2025, with a gain of approximately 1.5 percentage points, reinforcing its leadership.

This weight is not solely due to a price strategy. Spanish private brands have evolved towards higher quality, innovation, and premium range offerings, competing directly with manufacturer brands in key categories. The result is structural integration into the shopping basket. The own brand is now the standard choice rather than the budget alternative.

Italy shows the opposite situation. With a share close to 31%, it is the major European market with the lowest private brand penetration, but also the one with the greatest room for growth. As Rossano Bozzi, Business Unit Director of BolognaFiere and head of Marca, predicted at the Italian event:

The contrast is clear: Spain represents the maturity of the model, while Italy concentrates the main expansion potential, becoming a strategic opportunity for both retailers and manufacturers.

The rest of Europe: high adoption and more stable growth

Beyond these two cases, the rest of the major European markets are in intermediate positions. They show already consolidated adoption, albeit with more moderate increases.

The Netherlands leads the continental ranking with shares exceeding 55%, while Germany and the UK are around 44% and France stands at around 36%. These are markets where private brands are fully integrated, but with less room for sharp jumps in penetration.

This context confirms a structural trend: private brands have become a pillar of European retail, with countries already operating at peak levels and others still offering additional growth potential.

Factors Driving the Advancement of Private Brands

Economic context and behavioural change

Persistent pressure on purchasing power and inflationary dynamics have led consumers to adjust shopping habits, seeking to optimise spending without sacrificing quality. According to recent data from Nielsen IQ, more than 50% of European consumers claim to buy more private brand products than before.

This shift has transformed the traditional perception of private brands: from being seen as a budget option to being considered a quality and value alternative, with growing recognition across all consumer segments.

Innovation and premiumisation

Private brands are evolving beyond basic products. Innovation and premiumisation are growth drivers, with launches incorporating attributes such as health, sustainability, and gastronomic quality, which attracts consumers with higher expectations.

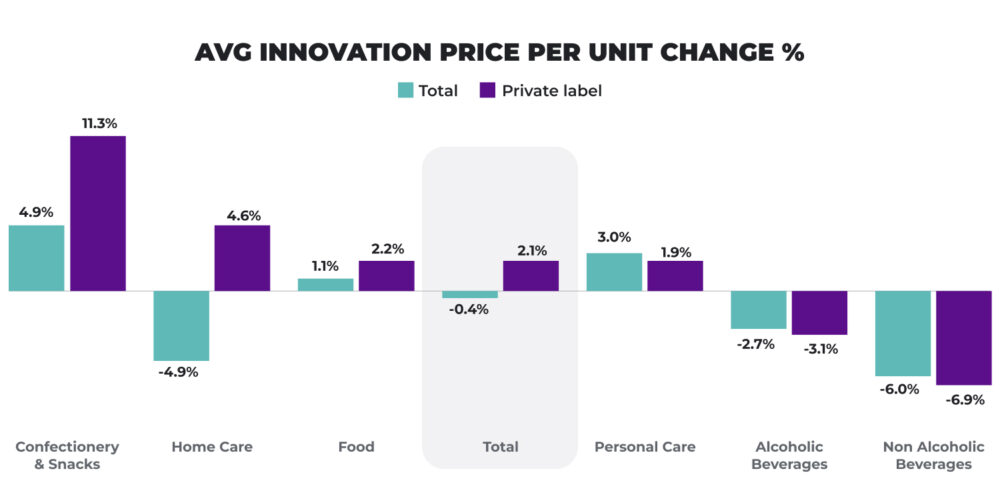

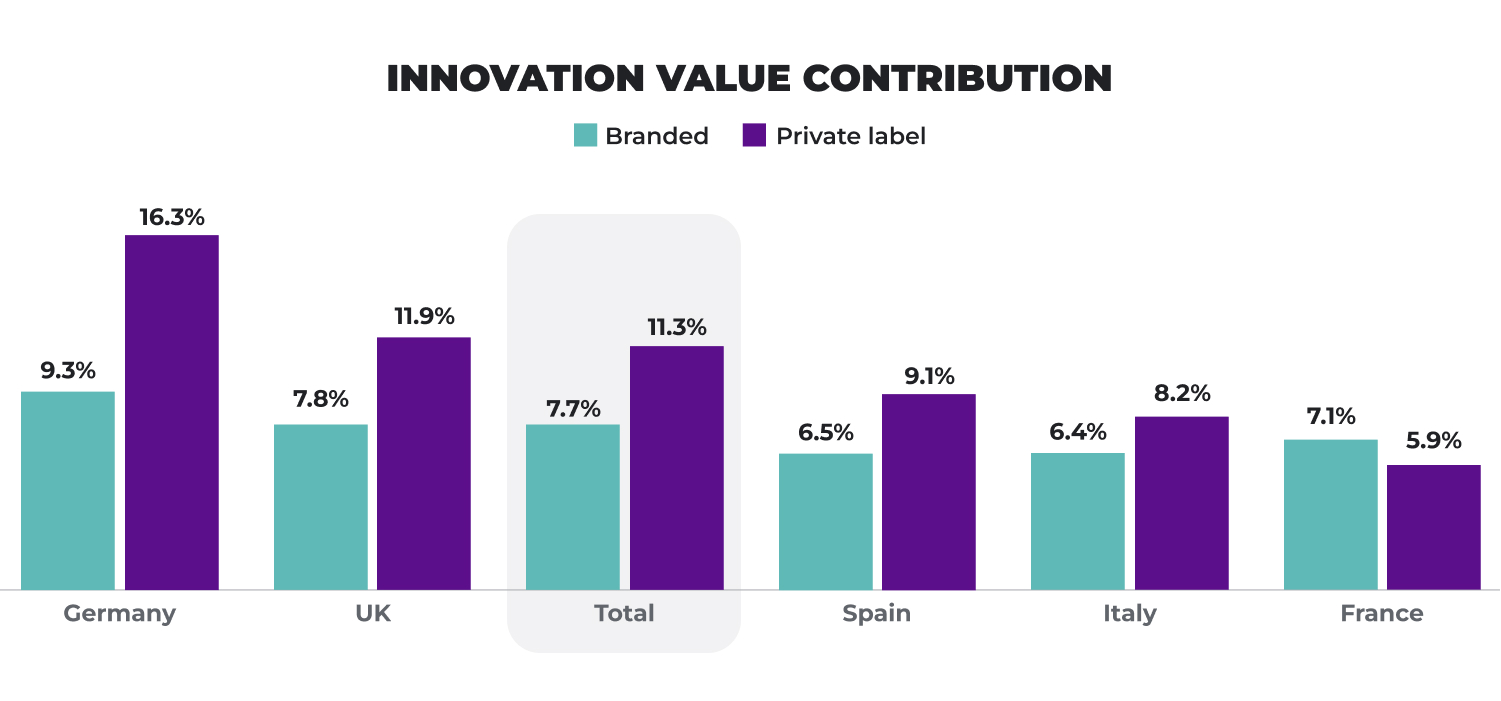

In 2025, private brands represented 44% of all new products launched in Western Europe. Furthermore, in the food category, it reached nearly 70%.

The contribution to innovation from private brands is outpacing that of branded products in most categories.

Source: Private Label Power in Western Europe – Nielsen IQ – October 2025

On the other hand, in many markets, new private brand references are exceeding the average price of traditional private brand products, reflecting the trust generated by these products and their competitive position against manufacturer brands.

Source: Private Label Power in Western Europe – Nielsen IQ – October 2025

Additionally, discounters and leading supermarket chains have played a crucial role by expanding private brand portfolios, perfecting quality, and reinforcing visibility in physical and digital stores.

Outlook for European Private Brands in 2026–2027

Growth expectations

Projections for 2026 and 2027 maintain a positive trend for private brands. Retailers and manufacturers anticipate that share will continue to expand, albeit at more moderate rates, driven by perceived value, innovation, and portfolio diversification.

Markets with high current shares such as Spain and the Netherlands might stabilise, while markets with lower penetration (such as Italy or France) could record more significant share gains in the coming years.

Risks and challenges

However, there are risks that could moderate private brand growth, including:

- Aggressive response from manufacturer brands with reinforced value propositions.

- Competitive saturation in key categories.

- Regulatory or policy changes affecting labelling or pricing structures.

Careful evolution of commercial and innovation strategies will be key to sustaining the segment’s momentum.

Conclusion

In summary, 2025 has been a record year for private brands in Europe, with an average value share of 42%, led by Spain and the Netherlands, and with countries like Italy showing ample growth potential.

Consumer transformation and the commitment to value, quality, and innovation have consolidated private brands as a fundamental axis of European retail, and their evolution will continue to be a key indicator for understanding FMCG dynamics in the coming years.