In AI Recommendations, What Matters Is Appearing Often, Not in Which Position

TL;DR

In AI product and brand recommendations, every response varies significantly in content and order. Chasing the top spot is of little use; the key is appearing frequently, as a repeated presence in these lists indicates relevance and authority.

In recent months, many brands have started asking themselves the same thing: if more and more users are asking ChatGPT, Gemini, or Perplexity to recommend products, does it make sense to “position” oneself in those answers as was previously done on Google?

A new study by SparkToro and Gumshoe.ai points to an uncomfortable answer: AI-generated recommendation lists are so volatile that chasing fixed rankings is, quite simply, a bad investment.

A Massive Experiment to Put AI to the Test

The work by SparkToro and Gumshoe starts from a very specific question: are AIs consistent enough to accurately measure a brand’s visibility in their recommendations? To answer it, they conducted 12 types of brand and product recommendation queries across the 3 most popular AI models in the United States (ChatGPT, Claude, and Google Search’s “AI-created view”). They then analysed the nearly 3,000 different responses received.

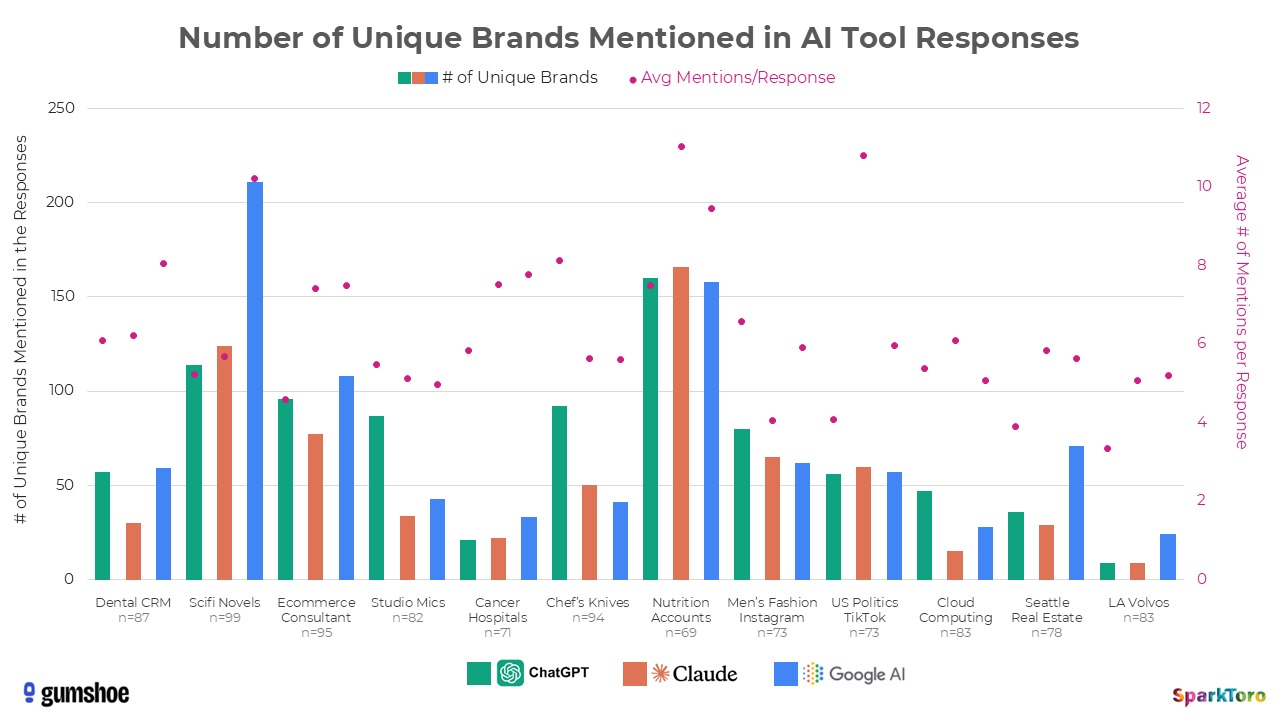

The questions spanned very broad requests, such as “science fiction novels”. They also included much more specific cases, such as “Volvo dealerships in Los Angeles” or “cloud computing providers for SaaS”. Each prompt was repeated dozens of times in each tool. Afterwards, the results were normalised into ordered lists of brands or products. This allowed them to measure which elements were repeated and which ones changed from one response to another.

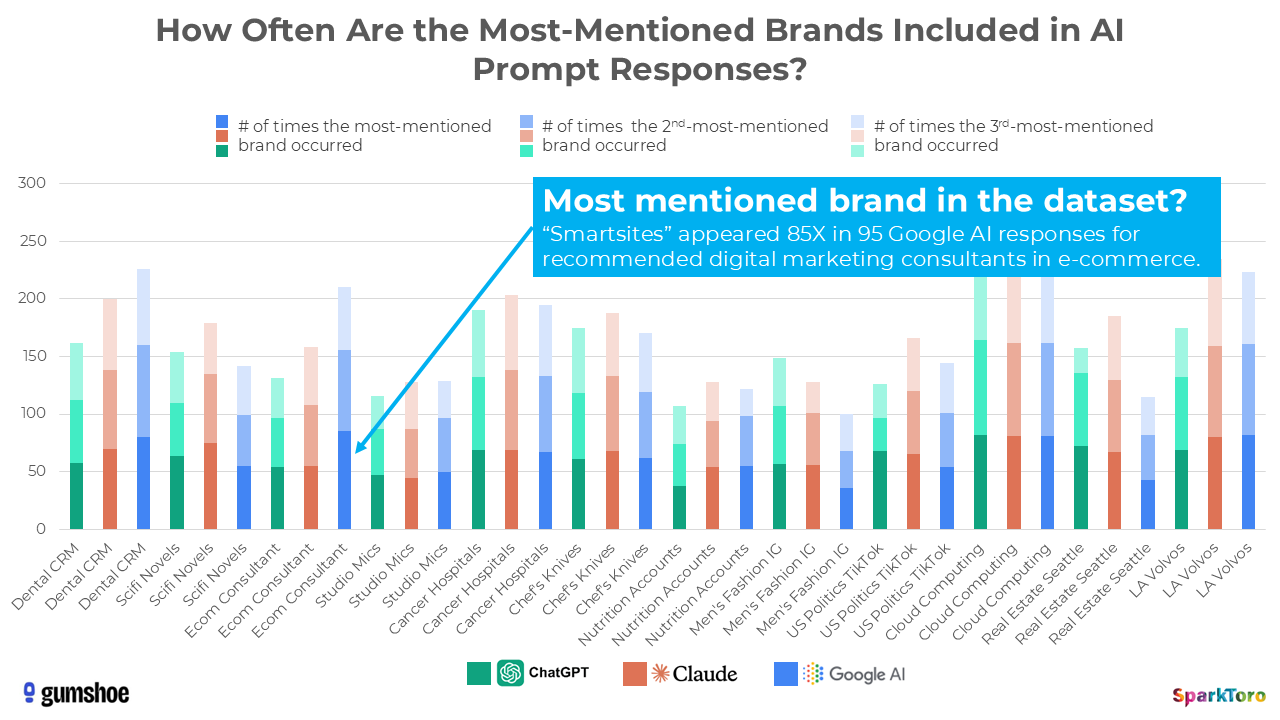

The following image shows a visualisation of the huge variety of product/brand combinations generated by the 12 different prompts, executed between 60 and 100 times each:

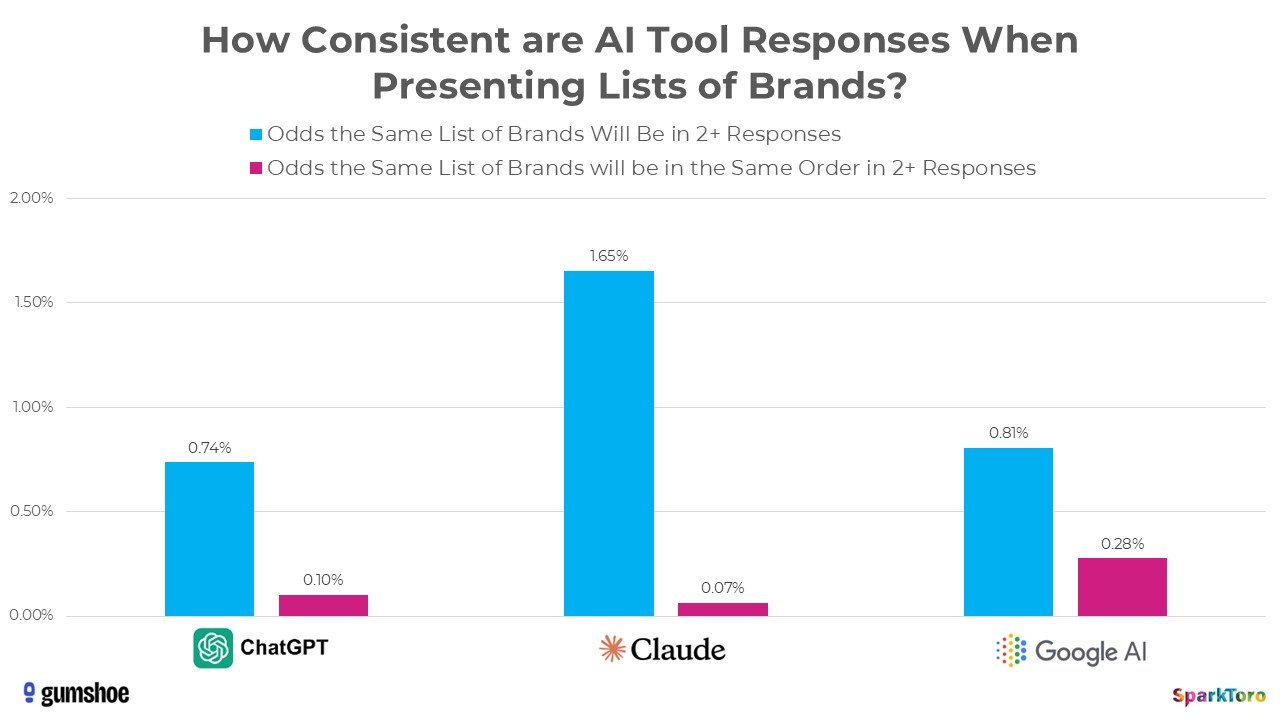

The statistical conclusion is definitive: less than 1% of responses repeat the exact same list of brands when the same request is made to the same model. And the probability of the list being ordered in the same way falls below 0.1–0.3%, even in categories with few possible options.

Three Types of Variation in Each Response

Volatility is not limited to the “top 3”. AIs modify three variables at once almost every time:

- The list of brands or products.

- The order in which those recommendations appear also changes.

- And the total number of items included in the list changes, ranging from 2–3 items to more than 10.

The breadth of the “universe of options” also influences this. In queries with thousands of possible answers, such as science fiction novels, the diversity of lists is enormous, while in cases like Volvo dealerships in a specific city, the variation is reduced because there are simply fewer possible candidates.

But even in these narrower scenarios, the data shows that the models do not behave like a classic search engine ranking: the order shifts from response to response and the composition of the list never fully settles.

In the words of Rand Fishkin, co-founder and CEO of SparkToro:

Probabilistic Engines, Not Search Rankings

The study forces us to abandon a widespread assumption: thinking of AI as a Google SERP with a different design. Generative models function as probabilistic text engines that, based on a context, choose from many possible answers; they do not consult a static table of positions.

SparkToro summarises it clearly. If you ask an AI to recommend brands or products a hundred times, almost all the responses will be unique in those three dimensions (list, order, and length). This happens while users formulate prompts that are very different from each other, even when they share the same purchase intent, which further multiplies the diversity of the result. The SparkToro and Gumshoe.ai study goes much deeper into this semantic part. It explores the different ways people express the same request to the AI. If you are interested, you can read more about this part of the article by clicking on this link.

The consequence is that concepts like “always being first” in AI responses have little empirical support. At most, a brand can aspire to be part of the set of candidates that appear frequently when the model tries to solve a specific need: choosing a digital bank, e-commerce software, headphones, or an online supermarket.

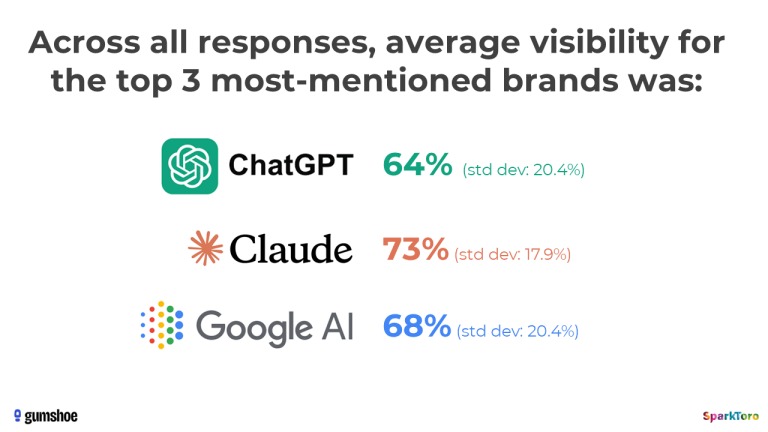

When Presence Carries More Weight than Position

Amidst such volatility, SparkToro’s own study identifies a much more stable data point: the frequency with which a brand appears in responses. This is what several analysts are already starting to call “AI visibility”. It is not so much about what position you appear in, but in how many responses you are present when a family of related queries is formulated.

This phenomenon can be illustrated with a specific example from the report. In one of the analysed queries, related to “e-commerce consultants”, the agency Smartsites appeared in 85 of the 95 responses returned by Google’s AI, although it did not always occupy the same position. In other words, its position fluctuated, but its presence was almost constant—a clear sign of leadership in that category.

The message is direct for the retail sector and brands. In recommendation lists created by AIs, appearing repeatedly matters more than topping the ranking occasionally. The metric is starting to look more like an AI “Share of Voice” than a traditional top 10.

What Brands and Retailers Can Do From Now On

The first practical implication involves expectations. No retailer or manufacturer can guarantee “always being first” in an AI response for a specific category, no matter how much budget they dedicate to content or campaigns. The reasonable goal is to aim to be part of the set of brands that the AI considers relevant and mentions frequently for a given intent.

Beyond that, experts point to three lines of work:

- Build authority in the sources that feed the models: authoritative media, own documentation, in-depth content, and verified reviews, both on marketplaces and specialised sites.

- Clarify the brand’s category and value proposition, so the AI can easily associate it with specific needs (“local online supermarket”, “mid-range electronics store”, “eco-friendly household brand”, etc.).

- Continuously monitor how AIs describe the company and which products they choose as examples. This will help detect both positioning opportunities and potential reputation crises.

For retail, there is also a specific nuance: many AI queries mix product, service, and logistics information. The models value everything from availability and price to return policies, shopping experience, or perceptions of sustainability, according to recent analysis on how AI constructs its recommendations in e-commerce. This requires thinking of “AI visibility” as a global reflection of the brand, not just an extension of product page SEO.

A Shift in Mindset for the Sector

The SparkToro research arrives at a moment marked by economic pressure, consumer volatility, and the rise of AI. These factors are reshaping the path to purchase. For retail, this involves accepting that visibility is no longer played out only in physical shop windows or Google search results. It is also contested in synthetic, personalised, and largely unpredictable conversations.

In this new scenario, the temptation to search for “the new magic metric” is understandable. But the data reminds us that there is no direct equivalent of Google’s “top spot” in AI responses, and basing investment decisions on unstable rankings can prove expensive.

What does seem clear is that repeated presence in AI recommendations will increasingly be an indicator of relevance and authority for brands. Achieving this requires combining a good product, a good experience, and a good reputation, translated into signals that models can read and reuse. And measuring it correctly will require less obsession with exact position and more of a culture of probabilistic data, experimentation, and methodological transparency.