The Retail Media Dilemma in 2026: How to Allocate your Budget between Amazon Ads, Walmart Connect and the New Players?

Until recently, the decision of where to invest in Retail Media was relatively simple: allocate the budget to Amazon and, perhaps, experiment with another small and novel player. Heading into 2026, the scenario is radically different. The expansion of the sector has meant that practically any retailer with web traffic and customer data has launched its own Retail Media Network. From quick delivery apps to DIY stores, everyone is competing for the same budget.

This new landscape poses a crucial strategic dilemma: Where should you invest your advertising budget to get the best return on investment? Should you concentrate your resources on the established giants or explore the opportunities offered by the new players?

In this article, we will explore what the Retail Media ecosystem will look like in 2026 and provide you with a practical framework to decide how to allocate your budget intelligently between established platforms and emerging challengers.

Retail Media Landscape in 2025–2026

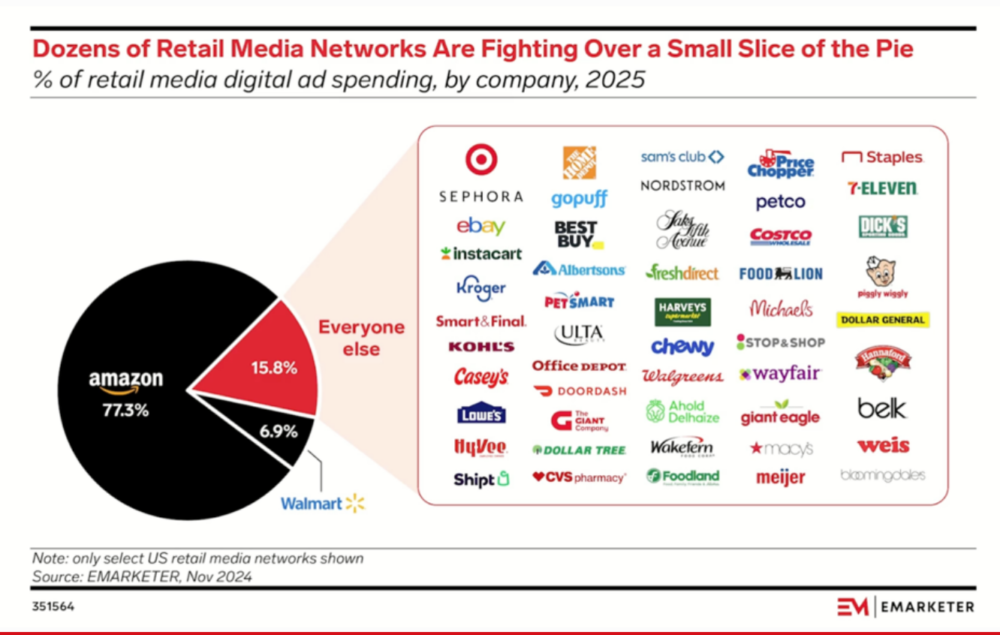

The Retail Media Networks (RMNs) ecosystem is undergoing a phase of accelerated expansion. Currently, there are almost 300 active retail advertising networks. This proliferation responds to an undeniable economic reality: retailers have discovered in digital advertising a high-margin source of revenue that complements their traditional trading activity.

Amazon continues to lead the sector with a significant market share. According to data from RMIQ, in 2024 Amazon Ads accounted for approximately 75% of total Retail Media spend in the United States. However, this dominance is beginning to erode gradually. Walmart Connect has gained ground steadily, leveraging its extensive network of physical stores and its growing presence in e-commerce.

Source: The 2025 State of Budget Allocation in Retail Media – Kenshoo Skai, March 2025

For brands, this fragmentation of the ecosystem presents both opportunities and challenges. The main advantage lies in access to high-quality first-party data. Unlike traditional digital advertising channels, RMNs offer direct information on real buying behaviours, allowing for precise segmentation and attributable measurement of the advertising impact on sales.

Operational complexity, however, has increased considerably. Managing and monitoring simultaneous campaigns across multiple RMNs requires specialised resources and data consolidation tools to obtain a unified view of performance. The flipflow Retail Media solution serves precisely this purpose. It helps you control the entire flow of your campaigns, centralising your performance data in our platform to have a unified view.

Amazon Ads vs Walmart Connect: Advantages, Limitations and Use Cases

To make sound budgetary decisions, it is fundamental to understand the structural differences between the two giants of the sector. They are not interchangeable tools; each fulfils distinct functions within a comprehensive marketing strategy.

Amazon Ads: The conversion and entertainment machine

Amazon has transcended its function as a shop to consolidate itself as a complete advertising giant. Its ecosystem ranges from sponsored ads in search results to premium video formats on Prime Video.

Key advantages:

- Massive scale: No other player offers the volume of traffic with purchase intent that Amazon has.

- Innovative formats: By 2026, Amazon will have perfected formats like Shoppable Carousels on Prime Video, which allow users to buy products they see on screen without interrupting viewing, and Interactive Pause Ads, which show contextual advertising when the user pauses content.

- Full funnel: Allows working from awareness with Amazon DSP and Prime Video, through to final conversion with Sponsored Products.

Ideal use case:

Brands looking for direct conversion and rapid sales volume. It is essential for categories with high search frequency on the platform, such as electronics, home and beauty. The ability to measure direct sales attributable to advertising campaigns provides a clarity of ROI difficult to find in other channels.

Walmart Connect: The king of omnichannel

Walmart plays with a strength that Amazon can hardly replicate: its network of physical stores. It has managed to integrate in-store purchase data with the digital behaviour of consumers.

Key advantages:

- Unique demographic reach: Reaches a massive audience that includes population segments that shop frequently in physical stores and may be less active on Amazon.

- In-store innovation: Walmart is digitising its physical spaces with digital labels, screens in fresh food sections (deli screens) and ads at self-checkouts, allowing the consumer to be impacted just before the physical transaction.

- Strategic alliances in CTV: Its collaborations with partners like Disney, NBC Universal and integration with Vizio (TV manufacturer) allow it to offer real purchase data to segment connected TV campaigns.

Ideal use case:

Hybrid strategies where the brand needs to drive both online sales and product rotation on physical shelves. It is especially powerful for consumer packaged goods (CPG) and food brands.

Common limitations

Both platforms share challenges that advertisers must watch out for:

- Rising costs: Cost per click and cost per sale tend to rise as more brands saturate the auctions.

- Incrementality measurement: It is often difficult to distinguish whether an ad generated a new sale or if it simply claimed attribution for a sale that would have occurred anyway (organic cannibalisation).

- Complexity: They require specialised teams or agencies with specific technology to manage the complexity of bids and formats.

- Visibility in niche markets: The capacity for scale in niche categories can be limited. Specialised products or emerging brands may find it difficult to compete for visibility against established competitors with larger budgets.

The “New Players” and When to Consider Them

Beyond the Amazon-Walmart duopoly, there is a universe of “challenger retailers” that can offer surprising efficiencies if used tactically.

Categories of new players

- Supermarkets and delivery (Instacart, Kroger): They possess extremely high frequency purchase data. Instacart, for example, captures the user at the exact moment of weekly menu planning or immediate replenishment purchase.

- Specialised verticals (Home Depot, Best Buy, Ulta): These marketplaces offer a context that generalists cannot match. A consumer browsing Best Buy is actively looking for electronics, which represents an exceptional targeting opportunity for tech brands.

- Owned media and streaming (Roku, Vizio): Although born as TV hardware or software, they now possess viewing data which, crossed with retail data, is very valuable for brand campaigns.

When does it make sense to invest in these new players?

There are several scenarios where diversifying towards emerging RMNs can be strategically valuable. If your target audience is concentrated in a specific retailer, investing in its advertising platform can offer superior efficiency. A professional tools brand might find better performance at The Home Depot than at Amazon.

A/B tests to identify cost-effective channels are another valid reason. Some emerging RMNs offer lower CPMs than established giants, allowing for better results with limited budgets.

For upper-funnel campaigns focused on awareness, new platforms with CTV inventory can effectively complement conversion strategies on Amazon or Walmart.

Risks to consider

Smaller scale represents the main risk. Many emerging Retail Media networks have limited audiences that may not justify the effort of configuration and campaign management.

Platform stability varies considerably. Some advertising networks lack the technological maturity of the big players, resulting in inconsistent user experiences or technical issues.

Reporting fragmentation complicates consolidated measurement. Managing campaigns across 10 or 15 different RMNs requires specialised tools to aggregate data and evaluate global performance.

5-Step Framework for Allocating your Budget in 2026

Given this complex landscape, we propose a framework for making rational decisions on resource allocation.

Step 1: Define your business objectives

The first fundamental step consists of clarifying what you seek to achieve with your investment in Retail Media. Different platforms serve distinct objectives more effectively.

- If your priority is to build brand awareness and reach, platforms with CTV inventory or off-site display are more appropriate. Walmart Connect with its streaming offer or Kroger with its omnichannel reach can generate massive impressions.

- For consumer consideration and education objectives, video formats and sponsored content on diverse RMNs allow you to convey more complex messages than traditional search advertising.

- When the goal is direct conversion and immediate ROAS, sponsored search formats on Amazon and Walmart offer the most measurable and predictable results.

- Defending market share and Share of Voice requires strategic presence where your competitors are investing. Analysing competitive activity on each platform informs defensive budget decisions.

Step 2: Follow your customer, not the platform

The second critical principle is to base your decisions on real buying behaviours of your target audience. Avoid falling into the trend of trying the latest advertising network just because it is a novelty.

Use market research, consumer surveys and sales data analysis to understand where your target audience really shops. A premium electronics buyer may prefer Best Buy over Amazon for specialised service. An organic product buyer may frequent Whole Foods or Instacart more than Walmart.

The customer journey varies significantly by category. High-consideration products, like major appliances, involve extensive research that may start on Google, pass through YouTube, continue on specialised sites, and conclude at a specific retailer. Mapping this journey helps identify where to invest at each phase.

Step 3: Analyse margin and profitability by channel

Sales volume does not automatically equate to profitability. Sales volume is vanity; profit is sanity. It is fundamental to calculate the real ROAS of each channel after considering all commissions, advertising costs and margin structure.

Amazon may generate the highest absolute volume of sales, but marketplace commissions, fulfilment costs and competitive CPCs can erode margins. Compare this scenario with the rest of the networks and you may discover that a smaller network with less volume offers you a superior net margin, thus justifying a higher proportional budget allocation.

Establish minimum profitability thresholds by channel. If a specific channel cannot reach your target ROAS even with optimisation, reconsider the budget allocation towards more efficient platforms.

Step 4: Adopt a “Test & Learn” approach

Innovation requires disciplined experimentation. Dedicate a defined percentage of your budget, typically between 10-15%, to testing new RMNs and formats.

Structure these tests rigorously. Define clear hypotheses, establish specific success metrics, and determine decision criteria before launching campaigns. What ROAS would justify scaling the investment? What level of CPM or CPC would be acceptable?

Measure results with the same rigour you apply to main campaigns. Many brands test new platforms but do not analyse results adequately, losing opportunities to identify high-performance channels.

Be prepared to scale quickly what works. If an emerging network demonstrates superior performance, reallocate budget from lower-efficiency channels.

Step 5: Invest in unified measurement

The biggest barrier for 2026 will be comparing apples with apples. The fragmentation of the ecosystem makes it essential to use tools that consolidate data from multiple RMNs into a single view of performance.

Evaluate specialised management platforms in Retail Media that aggregate reports from different networks. These tools eliminate data silos and facilitate direct comparisons between platforms.

Implement consistent attribution models that allow for evaluating the real incremental impact of each channel. Multi-touch attribution provides a more complete perspective than the last-click attribution dominant in Retail Media.

Consider investing in incrementality studies to validate that your campaigns generate additional sales rather than simply capturing existing demand.

Conclusion: From Tactical Spending to Strategic Retail Media Management

Retail Media in 2026 will cease to be a tactical exercise to become a true portfolio management model. Betting everything on a single player, however dominant, no longer guarantees competitive advantage. Sustainable growth will come from the ability of brands to build an orchestrated presence, combining the scale and depth of the big leaders with the agility and tactical efficiency of the new players.

In this context, flexibility consolidates itself as the main strategic asset. Rigid annual plans lose relevance against quarterly or even monthly review cycles, where investment is reallocated based on real performance, the maturity of each channel and the speed of ecosystem innovation. Brands that invest in monitoring technology like flipflow, adopt dynamic decision models and maintain a culture of constant experimentation will be better positioned to capture value incrementally and sustainably.

There is no universal formula to solve the Retail Media dilemma in 2026. Optimal allocation will depend on your business objectives, your category, your audience and your operational capacity. However, with a clear framework and a continuous testing mindset, it is possible to transform complexity into a competitive advantage.

In 2026, Retail Media will reward brands capable of reading the market in real time, adjusting course without friction and turning every euro invested into a conscious decision, not an inherited inertia.