Supermarket Q-commerce in Spain to Grow by Nearly 40% in Five Years: Redefining the Online Shopping Basket

TL;DR

Supermarket q-commerce in Spain is set to grow by nearly 40% in five years, driven by convenience, delivery speed, and the habitual use of delivery services. This model is transforming how consumers plan their shopping and forcing retailers to strengthen their logistics, data, and omnichannel strategy.

Supermarket q-commerce is preparing to take a qualitative leap in Spain, driven by the search for convenience, time-saving, and the expansion of delivery to new categories beyond restaurants.

More than a passing trend, this is a profound transformation in the way daily shopping is done and in how retailers design their digital value proposition and logistics.

Introduction: Why Talk About Supermarket Q-commerce Now

Quick commerce, or q-commerce, defines an evolution of e-commerce towards fast deliveries of relatively small orders, usually in a matter of minutes or hours, supported by local logistics and specialised digital platforms. In the case of supermarkets, this model sits halfway between traditional in-store shopping and “large basket” e-commerce. In this way, it fits consumers who want to handle daily replenishment without travel or waiting.

Spain has established itself as one of the markets most receptive to these types of services. It has a growing penetration of delivery platforms and a user base that perceives the channel as a “smart” way to organise their time. The Just Eat 2025 Gastrometer and various industry reports suggest that quick commerce will be one of the drivers of digital growth in FMCG during this decade, especially in food and large-scale distribution.

In this regard, Pablo de La Rica, Retail & Foodservice Manager at AECOC, stated:

Therefore, supermarket q-commerce has become a strategic priority for retailers who want to keep pace with an increasingly omnichannel consumer.

Market Overview: Figures and Forecasts until 2030

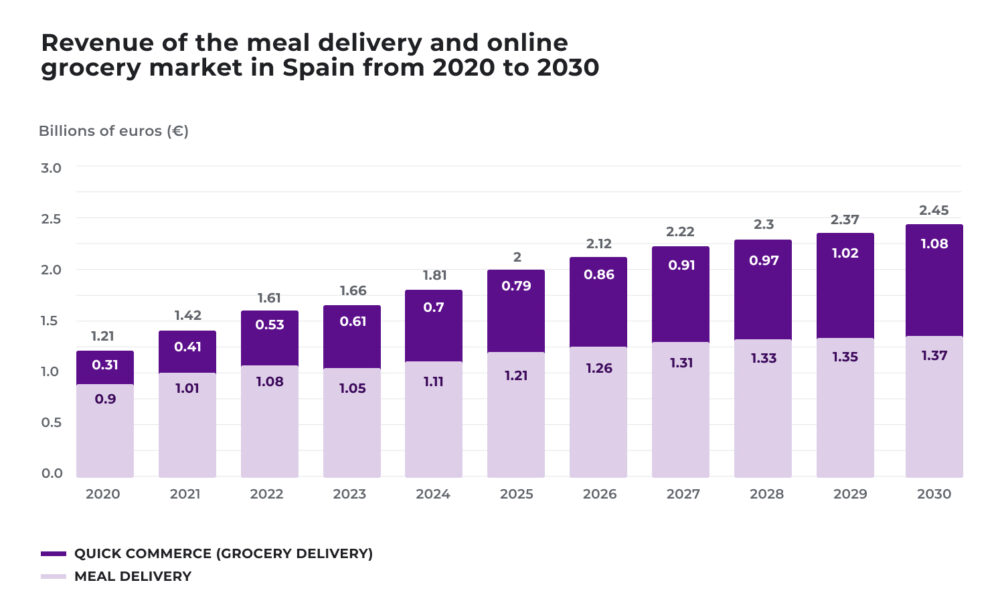

The food distribution q-commerce sector in Spain closed 2025 with a turnover of 790 million euros, according to the Just Eat 2025 Gastrometer based on Statista data. The same forecasts point to sustained growth that will lead the sector to exceed 1.08 billion euros in 2030, an increase of 36.7% in five years. By 2026, it is expected to reach 860 million, and it will be around 2029 when this modality crosses the 1 billion barrier.

Source: Gastrometer 2025 – Report on delivery trends and consumption data – Just Eat, January 2026

In parallel, Just Eat places the combined value of home delivery food and the online shopping basket at 2.45 billion euros in 2030. This means that supermarket q-commerce will gain weight within the delivery mix. And it will provide a significant portion of the channel’s additional growth in the coming years. Internationally, some reports anticipate strong global development of this market until 2032, reinforcing the idea of a structural rather than a temporary trend.

From Restaurant Delivery to a Comprehensive Convenience Ecosystem

The first major leap for delivery was restaurant food. The second is the extension to new retail categories, with quick commerce as the axis. Just Eat, for example, emphasises that its goal is to be “the logistical engine that brings everything home from exclusive electronics launches to wellness products or the weekly shop”. This goal will help it expand its restaurant core into a broader convenience ecosystem.

Users no longer open the app just to order dinner, but to manage a “smart basket”. Their order may include supermarket products, pharmacy items, pet supplies, gifts, or last-minute treats. The quick commerce vertical has consolidated itself as one of the segments with the greatest projection within the delivery sector in Spain. This has been achieved by relying on the capillarity of the associated merchant network and the continuous improvement of the digital experience.

The Spanish Consumer: Planning, Time-Saving and Omnichannel Habits

Data from the 2025 Gastrometer shows that Spanish consumers have integrated delivery and q-commerce into their weekly planning. Supermarket baskets through these platforms already exceed an average of ten items per order and reach an average transaction value of over 30 euros. It is no longer just about emergency purchases, but a regular way of shopping.

Furthermore, the report “The Rapid Evolution”, prepared by Just Eat alongside PA Consulting, highlights that Spanish users are 1.4 times more likely than other European consumers to consider delivery as a smart and planned purchase, saving them around 30 minutes of free time per order. This perception places convenience and time management at the heart of the q-commerce value proposition. At the same time, 77% of users state that delivery is an addition to their routine, not a substitute for physical shopping, reinforcing the logic of an integrated omnichannel experience.

From the supermarket’s perspective, this implies that the customer no longer distinguishes so much between “online” and “offline”. They expect to find the same assortment, prices, and promotions regardless of the channel they use. As the general director of Plaza Supermercados, Pascual Campos, explains:

Challenges and Opportunities of Q-commerce for Supermarkets and Retailers

For supermarkets and retailers, q-commerce opens up a huge field for growth. However, it also poses significant challenges in terms of operations, profitability, and brand consistency. One of the most visible challenges is reconciling expectations for fast delivery with a sustainable cost structure in the last mile. This is especially evident during high-demand periods like 7:00 PM, when a large portion of supermarket orders are concentrated. It is also key to manage store capacity and that of couriers, and move towards more efficient and digital-first logistics models.

Added to this are omnichannel challenges: keeping assortment, prices, and promotions aligned between the app, web, and physical store, and guaranteeing a consistent experience for the customer regardless of the channel. In parallel, the integration of data from all these channels becomes essential to understanding the different shopping missions (replenishment, large baskets, emergencies) and optimising decisions regarding assortment, dynamic pricing and promotions.

On the opportunity side, the picture is very attractive. Beyond adding a new sales channel, this model allows for additional business by capturing orders that might otherwise not be made or would be diverted to other operators. It leverages the digital maturity of the consumer and their preference for convenient solutions. At the same time, it reinforces the role of the store as a key operational node. It becomes a hub from which orders are prepared, collection is offered, and fast deliveries are coordinated in the local area.

Furthermore, new formulas for collaboration between supermarkets and platforms are opening up: shared catalogues, joint campaigns, and exclusive launches, all supported by an increasingly mature technological and data base.

Conclusion: Q-commerce as a Key Piece of the New Shopping Basket

Everything indicates that q-commerce is becoming integrated into the daily life of consumers with the same naturalness as other major digital changes that once seemed incidental. Shopping no longer follows a single pattern or a single time of day. It adapts to people’s real rhythm, their schedules, their unforeseen events, and their way of understanding time. And with this, the way retailers must understand their own business also changes.

In this context, those who know how to connect all the pieces well will gain relevance: stores, data, logistics, technology, and customer experience. As if they were parts of the same gear. Because consumers move with total freedom between channels, moments, and shopping missions, and they expect everything to work with the same fluidity.

Ultimately, q-commerce draws a scenario where proximity is no longer measured only in metres, but in minutes. And there, in that ability to be present exactly when the need arises, is where much of the growth of the digita