Anatomy of the UK Chocolate Market: Pricing, Visibility, and Brand Awareness in the Sharing Pouches Segment

TL;DR

Chocolate pouches are solidifying their position in the UK as a small treat that consumers continue to buy even during inflation. In-store space is dominated by a few brands, and regulation is increasingly limiting physical exposure. In this context, growth depends on fine-tuning pricing and assortment by retailer and taking advantage of the Retail Media opportunity.

The British assorted chocolate bags segment is part of a key category for FMCG: confectionery. It maintains a significant weight in value, despite an environment marked by inflation, changing shopping habits, and stricter regulation.

In 2025, chocolate and confectionery production in the UK reached a value of nearly £4.2 billion, within an industry that already exceeded £6.18 billion in 2023 and is expected to maintain a positive trend in the coming years.

The UK Chocolate Market: Formats, Consumer Context, and Regulatory Framework

Chocolate accounts for around 75% of the total value of British confectionery, in a category worth around £5.5 billion that has returned to growth driven by new formats.

Formats for home consumption

In this context, the chocolate pouches segment has established itself as one of the most dynamic. The so-called “pouch sector” was already valued in 2021 at almost £580 million, representing nearly 13% of the total chocolate market in the UK. This growing weight reflects the shift from on‑the‑go consumption towards moments of indulgence at home, with formats designed to be opened, shared, and enjoyed throughout the week.

Following the pandemic, the reduction in impulse purchases of individual bars has been offset by an increase in multipacks, sharing packs, and pouches, allowing the chocolate category to maintain stable growth of around 1.5% annually in recent years.

The consumer context

This shift is closely linked to the rise of Big Night In occasions. These are gatherings at home to watch streaming content or play games, which have made assorted bags the standard format for the segment. In parallel, the “less but better” trend has gained strength. Premium offerings are growing, featuring higher cocoa percentages or complex textures, as consumers accept paying more for an indulgent experience they perceive as an affordable little luxury.

Furthermore, British consumers are showing increasing sensitivity towards the origin of cocoa and packaging sustainability. This is a trend that is also being seen strongly in Spanish-speaking markets.

Changes in the British regulatory framework

The regulatory environment adds complexity. HFSS regulations (High Fat, Salt or Sugar) have limited the presence of products high in fat, sugar, and salt in “hot zones” of the store, such as checkouts, entrances, or aisle ends. This has reduced the visibility of many pouches at the physical point of sale.

Despite this, both the products most associated with indulgence and the confectionery category as a whole have shown remarkable resilience. Since the new rules came into effect, some varieties of chocolate and sweets have recorded sales increases of up to 27%, confirming that British consumers continue to demand these types of products even in a context of high inflation.

All this makes the UK chocolate pouches market a particularly relevant laboratory for manufacturers operating in modern retail and e-commerce. The UK brings together a mature market valued at over £6 billion, a pouches segment that already accounts for nearly a seventh of the category, and regulation that is pushing brands to rebalance price, assortment, promotions, and digital visibility.

Anatomy of the Sector during Q4 2025

During the last quarter of 2025, the sector showed notable volatility and adaptability. Factors such as raw material inflation, the introduction of new health regulations, and the digitalisation of shopping are redrawing the category map.

Using data obtained from our market analysis platform, we break down in this article how prices are evolving, who truly dominates in-store visibility, and how digital advertising is beginning to compensate for physical restrictions.

Price Evolution: Rise, Peak, and Stabilisation

Between September and December 2025, the average price of the chocolate pouches category in the UK (in the 100g to 200g format) rose sharply until November and then stabilised. In September, the average price stood at £3.05; in November, it reached £3.57 (a 17% increase); and in December, it barely changed, staying at £3.58, which points to a pre-Christmas peak followed by a normalisation in prices.

This dynamic reflects inflationary pressure, but also the category’s ability to sustain higher prices by leaning on higher perceived value propositions. For a manufacturer operating in several markets, this behaviour is a clear signal that the assorted bag is solidifying its position as a “micro-luxury” that consumers choose to maintain, even if they must adjust their consumption of other impulse products.

Price differences by retailer

When breaking down the average price evolution by chain, strategies differ greatly between supermarkets:

- Waitrose acts as a clear outlier: jumping from £2.79 in September to £5.53 in November, revealing a markedly premium mix in Q4.

- Tesco shows restraint after October: rising from £2.34 in September to £2.58 in December, remaining the most accessible option.

- Sainsbury’s increased prices until November and then dropped sharply in December, consistent with more aggressive promotional activity at the end of the period.

- Morrisons accelerated until November and consolidated the new level, while Ocado remained the most stable chain regarding pricing throughout the quarter.

This dispersion highlights that the category’s price architecture is not homogeneous and that each retailer is using the pouch to position themselves differently: from Tesco’s accessibility to Waitrose’s premium focus. For a multi-channel manufacturer, this requires precisely defining the role of each chain in their value strategy and segmenting assortment and promotions accordingly.

Price evolution by manufacturer brands

Among manufacturer brands, different profiles are also observed. Cadbury maintains stable prices, Aero rises gradually (+12.5%), and Galaxy shows some volatility with rises and corrections. Brands with strong seasonality, such as Maltesers (+68.6%) or M&M’s (+42.6%), concentrated their increases in November and then stabilised prices, while Hershey’s significantly reduced its price, suggesting promotions or a mix of more economical references.

These patterns show that there is room for varied strategies: from price stability to defend volume, to premiumisation and seasonality to drive the average transaction value.

Pricing in Private Labels

In Private Labels (or Own Brands), Tesco maintains the most economical range with moderate increases (+14.6%). Morrisons reduced prices (-11.2%), while Sainsbury’s became the most expensive Private Label with a 57.9% increase. Marks & Spencer reinforced its stable premium positioning.

On the other hand, Waitrose keeps its own brand at low and stable levels, even though the retailer’s overall average skyrocketed, indicating that the global price increase is driven by the mix of manufacturer brands rather than its Private Label.

This demonstrates that Private Labels do not form a homogeneous block and forces manufacturers to carefully calibrate their strategies against each retailer.

Share of Shelf: Shelf Space Concentration

The concept of Share of Shelf is decisive in understanding a brand’s power. In the UK, the chocolate assorted bag shelf is extremely concentrated. Data from our analysis reveal that just two brands, Maltesers (28.05%) and Cadbury (24.75%), control more than half of the space available on the shelves of major supermarkets.

The challenge for independent brands

This concentration represents a very high barrier to entry for new competitors. With over 52% of the shelf occupied by two giants, remaining brands must play a “long tail” strategy or seek very specific niches.

In this context, innovation in flavours or formats is one of the few ways to gain centimetres of exposure.

The role of Private Labels

Private Labels hold a very relevant weight on the shelf, accounting for 21.3% of the products analysed. However, their presence is not uniform. Sainsbury’s and Marks & Spencer are the ones most pushing their own brands, using them as a tool to influence the price architecture of the entire category. In contrast, supermarkets like Tesco or Morrisons maintain a much more residual Private Label presence in this specific segment, letting manufacturer brands carry the weight of the shelf.

For a manufacturer in Spain, where Private Label penetration is extremely high, these data suggest that the UK pouches market still offers opportunities for manufacturer brands that know how to differentiate themselves, as Private Labels have not cannibalised the sector in the same way as in other countries.

Share of Voice: High Organic Visibility and a Clear Window for Retail Media

The Share of Voice reflects a brand’s visibility in retailer media (primarily digital), distinguishing between organic and paid presence. In chocolate pouches, the report shows a landscape that is still not very saturated in terms of paid investment.

A mostly organic environment

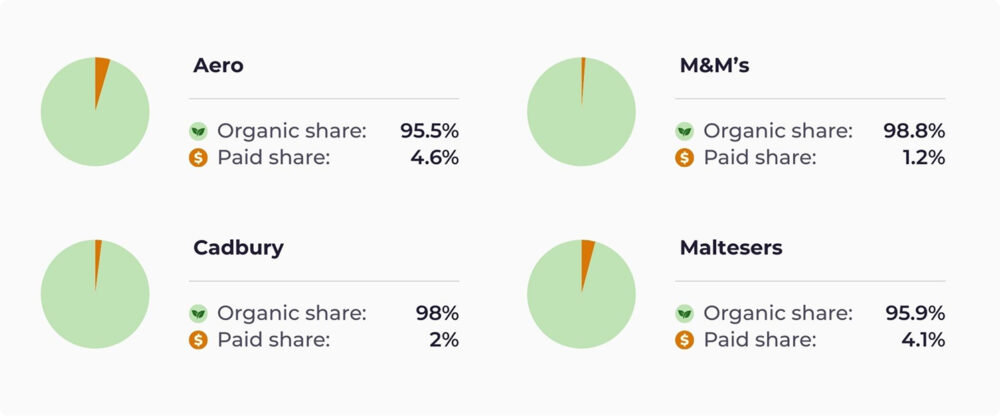

Visibility in Retail Media in this category is low and concentrated in a few brands. For brands that do have paid investment, the weight remains small:

- Aero: 95.5% organic / 4.6% paid

- Cadbury: 98% organic / 2% paid

- M&M’s: 98.8% organic / 1.2% paid

- Maltesers: 95.9% organic / 4.1% paid

Many brands appear with a 100% organic share (no paid investment in the analysed period), including Munchies, Reese’s, or Galaxy, and all Private Labels.

Why does this matter now?

This information is relevant for two main reasons. Firstly, a slight uptick in Retail Media investment was observed at the end of the fourth quarter. This indicates that the channel is starting to activate and gain traction within brands’ commercial strategies. Secondly, HFSS regulations have substantially changed the rules in physical stores. There are now location restrictions and limitations on volume-based promotions. As “natural” exposure in hotspots such as entrances, checkouts, or aisle ends is reduced, digital visibility takes on a much more strategic role.

In this context, for chocolate brands, there is a clear opportunity to gain presence through incremental investment in Retail Media. Competitive pressure in paid formats remains limited. This allows small budget increases to have a disproportionate impact on discovery and consideration, especially during key seasonal moments.

HFSS Regulation and its Impact on Promotions

Due to the introduction of HFSS regulations, since October 2025, volume offers such as “3 for 2” or “Buy one get one free” are prohibited for products like chocolate pouches in the UK. Additionally, chocolate bags can no longer be located in impulse zones like checkouts or entrance aisle ends.

The simplification of promotions

The result of these restrictions is a simplification of promotional mechanics. Now, 51% of offers are direct discounts on the unit price. Furthermore, offers linked to supermarket loyalty cards (such as Sainsbury’s “Nectar Prices” or Tesco’s “Clubcard Price”) have gained enormous prominence.

For chocolate companies from other countries, this is an important warning. Promotions based purely on volume are losing effectiveness and legality in certain markets, forcing brands to focus their efforts on genuine loyalty and direct discounts that do not incentivise overconsumption.

Conclusion: a Demanding Environment where Price and Visibility Must Be Managed in an Integrated Way

The behaviour of the chocolate pouches segment in the UK during Q4 2025 leaves several key takeaways for commercial, marketing, and revenue management teams. Firstly, the average price recorded a significant rise (+17%) until November and stabilised in December: the seasonal peak still exists, but it does not replace the need to work on perceived value consistently throughout the year.

At the same time, shelf visibility is heavily concentrated. Brands like Maltesers and Cadbury monopolise more than half of the available space, while Private Labels already account for over a fifth of the assortment. In this context, gaining presence or growing depends not so much on expanding references as on making very precise assortment decisions for each retailer.

In parallel, paid Share of Voice remains low, so a large part of the exposure continues to be organic. Low competitive pressure in Retail Media opens a clear opportunity for brands that want to invest incrementally. This investment allows for capturing additional visibility in the digital channel. The effect is especially relevant in an environment where the physical store is losing hotspots due to HFSS restrictions.

For companies operating in markets like Mexico, Chile, or Spain that are analysing the evolution of the assorted bags segment, the UK also functions as an excellent laboratory: it combines demanding consumers, digitally advanced retailers, and regulation that is accelerating deep changes in promotions and exposure.