Innovation and Sustainability: The Trends Redefining Personal Care

The personal care industry is experiencing a quiet but profound revolution. Beyond sales figures and market share, the real transformations are happening in innovation labs and in the minds of more conscious consumers.

Analysis of new product launched between 2024 and 2025 reveals fascinating patterns that go far beyond simple cosmetic improvements. We are witnessing a fundamental shift towards sustainability, practical functionality and personalization of the consumer experience.

This second part of our analysis of the Personal Care market delves into the heart of sector innovation. We explore what products are reaching the market, who is developing them and where the industry is heading in the coming years.

The innovative leadership of Manufacturer Brands

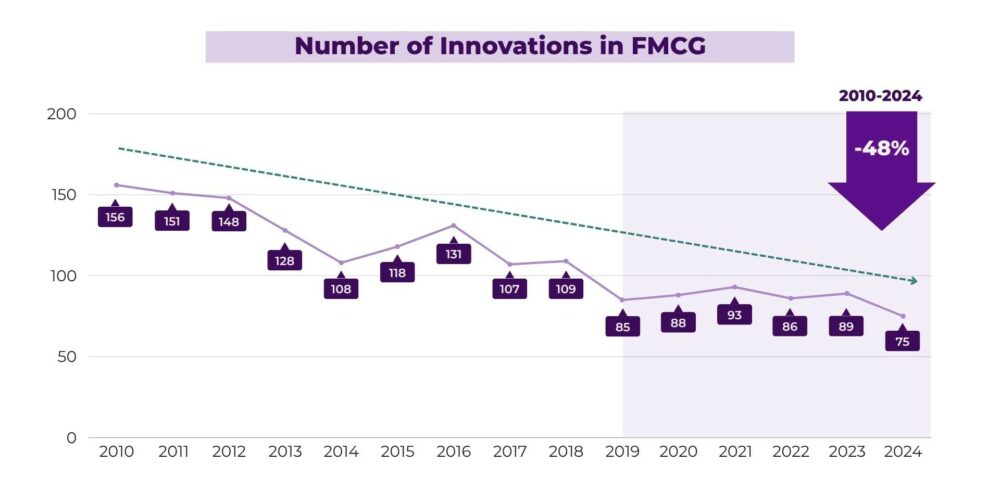

The FMCG sector in Spain is going through a critical moment, with innovation at its lowest levels ever. Even so, Manufacturer Brands (MBs) maintain their role as the main driver of new launches.

According to the Kantar Innovation Radar 2024, Manufacturer Brands consolidate their role as the main drivers of innovation in FMCG, being responsible for 96% of new product launches in 2024. Despite the total number of innovations having fallen by 50% since 2010, MBs clearly continue to lead the way in innovation as a growth driver.

Source: Qcom.es – June 2025

Manufacturer Brand innovation in Personal Care

In the market we are analysing in this article, the data reveals an overwhelming superiority in the launch of new products, consolidating their position not only as market leaders but also as pioneers in technological development.

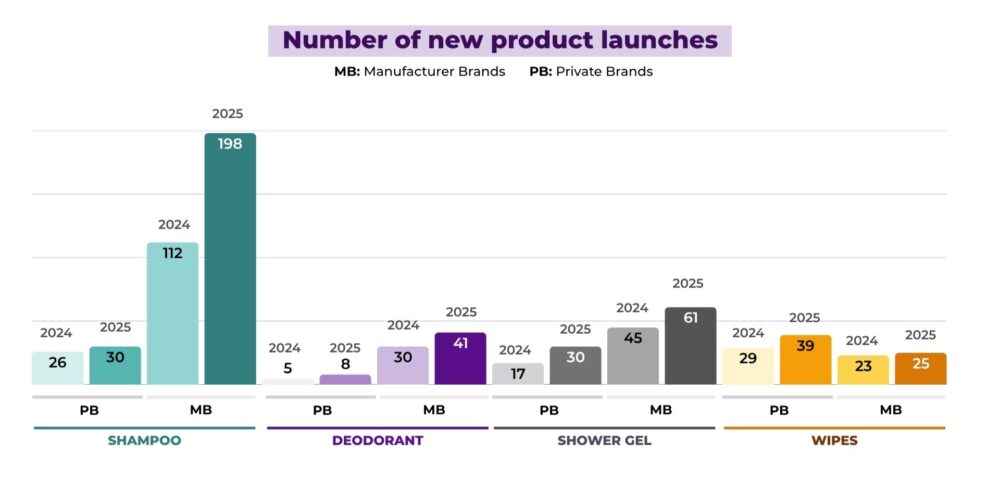

During the period analysed by flipflow, between September 2024 and April 2025, MBs were responsible for over 70% of all new product launches. This supremacy is particularly evident when we examine the absolute numbers of launches per sector:

- In shampoo, Manufacturer Brands launched 112 new products in 2024, a figure that increased to 198 in 2025. Private Brands (PBs), on the other hand, contributed just 26 launches in 2024, increasing slightly to 30 in 2025. This almost seven-to-one difference clearly illustrates where the sector’s innovative capacity is concentrated.

- Deodorants show a similar pattern although with lower volumes. Manufacturer Brands introduced 30 new products in 2024 and 41 in 2025, while Private Brands were limited to 5 and 8 launches respectively.

- In shower gel, the gap is also maintained with 45 launches from Manufacturer Brands in 2024 and 61 in 2025, compared to 17 and 30 from Private Brands.

- Wet wipes show more balanced figures and are the only category where the trend is broken, as Private Brands launched more new products than MBs. PBs launched 29 products in 2024 and 39 in 2025, compared to 23 and 25 from Manufacturer Brands.

The driving forces of innovation

The innovation landscape is dominated by well-defined players combining technical capability, research resources and in-depth knowledge of the consumer.

Among Manufacturer Brands, five names stand out as the true architects of the future of Personal Care:

- Elvive and Pantene lead this select group, both representing innovation in hair care. Each presents different but complementary approaches: Pantene focuses on specific solutions for different hair types, while Elvive integrates premium ingredients with accessible technologies.

- Sanex positions itself as a specialist in body care, developing formulas that balance dermatological efficacy with sensory experience. Its knowledge of products for sensitive skin allows it to innovate in specific market segments.

- Revlon brings its expertise in beauty and personal care, combining tradition with modernity to create products that respond to both functional and aspirational needs.

- L’Oréal leverages its vast experience in cosmetic research, its ability to translate global trends into commercially viable products and its focus on active ingredients and scientifically-backed formulas to maintain a constant flow of significant innovations.

On the Private Brands side, the landscape is dominated by brands with greater internal development capacity. Bodyplus (Ahorramas) leads this segment, representing a specialized approach concentrated on specific categories where it can provide differential value. Imaqe (Dia) uses its operational flexibility to respond quickly to emerging trends.

Deliplus (Mercadona) leverages its vertically integrated model and intimate knowledge of the Spanish consumer to develop products that compete directly with premium brands. Auchan’s private label brands (Cosmia and Alcampo) complete the group of private label innovators.

Retail and innovation: Channels as catalysts

Retail is playing a fundamental role as a catalyst and filter for innovation. Different chains are adopting distinctive strategies that reflect both their brand positioning and their understanding of the needs of their target consumers.

- Ahorramas emerges as a leader in launching new products, focusing on convenience and practicality. Its knowledge of the urban consumer allows it to detect needs that other chains might overlook.

- Aldi positions itself as the second player, negotiating exclusive launches with Manufacturer Brands while developing its own innovative line. Its strategy combines the best of both worlds: name-brand new products and competitive own-brand alternatives.

- Mercadona leverages its premium Private Brand model to introduce innovations at an accelerated pace. Its ability to develop products specifically for the Spanish market allows it to experiment with formulations and formats that might not work in broader markets.

- Dia and Lidl, on the other hand, are focusing on innovations that offer value at competitive prices, using their turnover model to experiment with niche products that complement their main offering.

The format revolution: Sustainability as a driver

The real transformation in Personal Care isn’t just in the formulas. It’s in the design of sustainable formats that respond to a growing demand to reduce environmental impact without sacrificing efficacy or user experience.

Refill packaging is consolidating as an elegant solution to waste, especially in shampoos, where it allows for a premium dispenser to be retained and only the contents replaced, reducing plastic use by up to 70%. Solid formats, such as shampoos, deodorants and gels, go a step further by completely eliminating plastic packaging, concentrating the formula into compact, durable and easier-to-transport formats.

Innovation also extends to wet wipes, with biodegradable and compostable versions appearing. Even reusable wet wipes are emerging, rethinking the consumption model towards a circular solution.

In parallel, formulations are evolving thanks to a combination of science and nature. Brands are reducing synthetic ingredients and improving the biodegradability of shampoos and body wash without compromising results. In deodorants, the elimination of parabens and aluminum has given way to cleaner formulas with ingredients such as essential oils and plant extracts. Reusable wet wipes, made from materials such as bamboo or organic cotton, complete this revolution by offering functionality and sustainability in a single gesture.

Formats balancing convenience and sustainability

The personal care market is achieving an increasingly sophisticated balance between practicality and environmental responsibility. The most popular formats are adapting so that consumers aren’t forced to choose between one or the other.

- In shampoo, 250-400ml containers remain the most common due to their convenience. Innovations are pointing towards formats of up to 1 litre, which reduce environmental impact per use and offer better value for money.

- In deodorants, the 50-75ml roll-on continues to dominate due to its precision and portability, while brands are renewing their formulas with more natural ingredients.

- Shower gels, traditionally in 250-500ml containers, are also adopting larger-capacity formats. These require improvements to the dispenser to maintain the user experience.

- In wet wipes, innovation is in segmentation: large formats remain key for the home, but smaller packs, designed for on-the-go use, are growing.

Conclusions: The future of Personal Care is now

Analysis of innovations and trends in Personal Care reveals a sector undergoing transformation, where sustainability and functionality converge to create entirely new consumer experiences.

The innovative hegemony of Manufacturer Brands is not accidental but the result of systematic investment in research, development and understanding of the consumer. Their ability to launch up to seven times more new products than PBs reflects superior resources and a deeper understanding of where the market is headed.

In a sector traditionally dominated by recurring formats and routines, innovation has become the main vector of differentiation and growth. The brands leading this transformation are not only developing new products but are also reconfiguring entire categories through more sustainable, functional offerings adapted to consumers’ new priorities. Sustainability is no longer an accessory argument but an essential attribute reflected in every decision on packaging, formulation or positioning. In turn, the growing personalization of experience—driven by consumer knowledge and technological development—is taking personal care into an increasingly sophisticated arena where value is measured in multiple dimensions: health, convenience, environmental impact and emotional affinity.

Looking to the future, manufacturers and distributors who manage to integrate these levers into a consistent and agile strategy will be the ones who capitalize on the new growth cycle of Personal Care. In this new scenario, where the boundary between manufacturers and distributors blurs and traditional formats are rewritten, the ability to experiment purposefully and scale quickly will be the true indicator of leadership in the category. The revolution is already underway, and those who embrace it with vision and commitment will be in a position to define the standard for the next decade.