What Makes Chocolate Successful Today? Key Innovation Drivers in Formats, Flavours and Sustainability

TL;DR

For companies in the chocolate sector in Mexico, Chile and Spain, innovation is not an abstract concept, but a direct response to the demands of a fast-changing consumer. After analysing the UK market in our latest category report, it is clear that this country acts as a mirror of what we will soon see on FMCG shelves across the Spanish-speaking world.

The Context of the International Chocolate Market

The chocolate market in the United Kingdom reached $6.85 billion in 2025 and is projected to grow to $10 billion by 2035, with a compound annual growth rate of 3.8%, driven by the demand for premium products and online channels. Within this context, chocolate sharing pouches (pouches) stand out as a key format in confectionery, with a surge in flexible packaging such as resealable bags that respond to the search for convenience, sustainability and the at-home consumption experience.

Although 95% of Britons consume chocolate and 4 out of 5 do so at least once a week, HFSS regulations have reduced visibility at key in-store points and curtailed impulsive consumption, accelerating innovation in reformulation, recyclable materials and value propositions such as complex textures and premium flavours.

In this second article based on data from our SaaS, we delve into how packaging formats and new ingredients are redefining commercial success. While in Mexico chocolate has deep cultural roots linked to tradition, and in Chile per capita consumption is one of the highest in the region, the United Kingdom leads the adoption of premium formatspremium and sustainability solutions that lead the way for any exporter or local manufacturer.

The Hegemony of Formats: From “Sharing” to “Portioning”

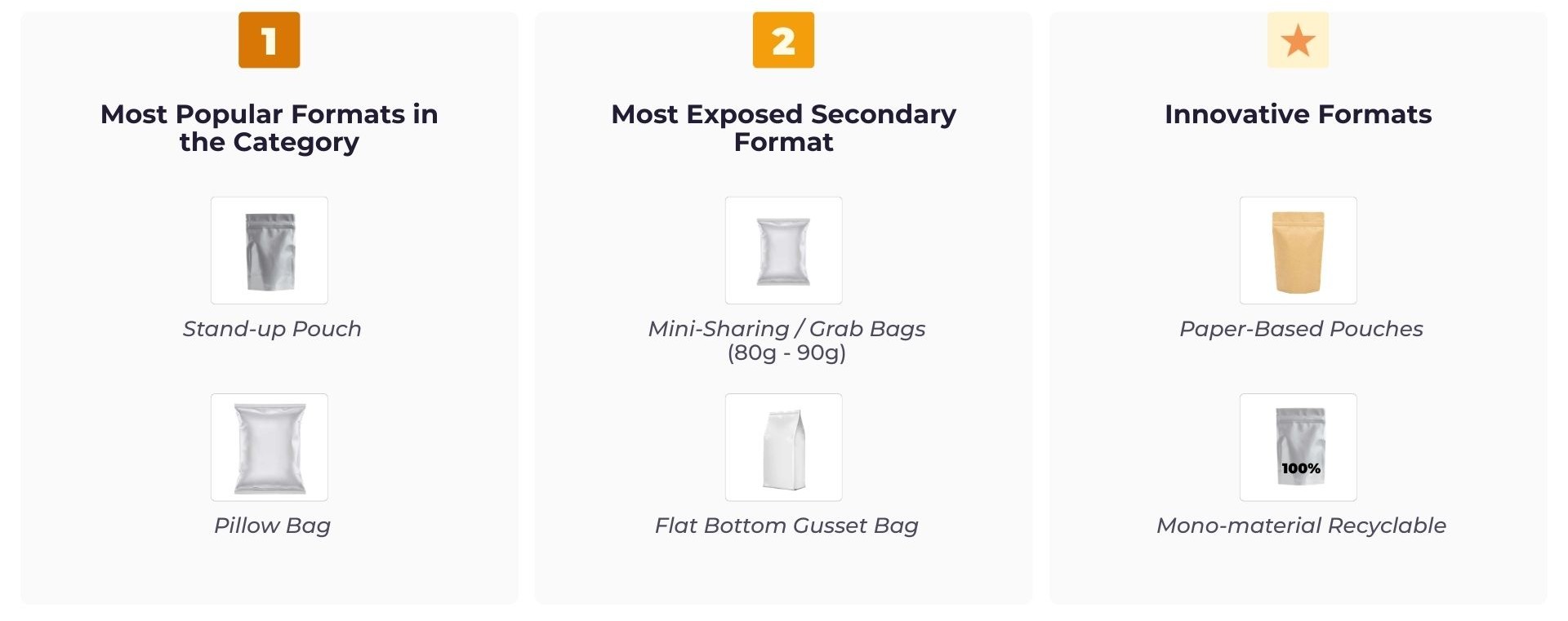

The sharing pouch format dominates the British shelf, but its use has evolved. According to data from our report, the zip-lock Doypack (Stand-up Pouch) is the most popular format in the category. Its ability to stand upright facilitates shelf visibility and improves the user experience at home.

Airtight closure as a purchase requirement

One of the most relevant findings is the change in perception regarding the zip closure. 54% of British consumers consume the contents of a sharing bag alone over several days. This has transformed the airtight or resealable closure. This element was previously perceived as an optional added value, but currently consumers consider it a basic purchase requirement. In practical terms, the closure fulfills three functions that influence repeat purchases:

- Preservation: maintains texture and freshness.

- Convenience: allows opening, serving and storing without complications.

- Consumption control: facilitates portioning without the product deteriorating.

This phenomenon marks a shift away from the traditional concept of “sharing” towards “portioning”. Companies in Spain and Latin America can draw a clear lesson: the consumer seeks to self-manage their indulgence. Making it easier for the product to be opened and closed several times allows the manufacturer to offer larger formats (100g-200g) without the customer feeling they must finish it in one go for fear of it going stale.

Other formats on the shelf

Although the stand-up pouch leads, the report identifies other formats with a relevant presence, which are used to play with price, occasion or differentiation:

- Pillow Bag: Still a cost-effective option for entry-level or private-label products.

- Mini-Sharing / Grab Bags (80g-90g): These function as an intermediate step between the individual bar and the large bag, ideal for on-the-go consumption.

- Flat Bottom Gusset Bag: Commonly used for irregularly shaped chocolates or larger truffles that require a stable base and a more rigid presentation.

For innovation and marketing teams, the lesson is clear: format is no longer chosen solely for efficiency. It is chosen for its ability to sustain a real and repeated consumption experience.

Innovation Insights: Flavours and Textures that Justify the Price

In a market where the average price has risen by 17% in the last quarter of 2025, innovation is the primary tool for maintaining perceived value. Brands that manage to sustain prices between £3 and £5 do so through propositions that offer a complex sensory experience.

The “Fully Loaded” trend

The report highlights the success of “Fully Loaded” propositions. Brands like Marks & Spencer, with their Choc Marks range, are redefining what the consumer expects from a chocolate bite. These propositions combine multiple inclusions and textures in a single piece: pistachio, wafer, toasted corn or sea salt.

This technical complexity allows the price to be perceived as fairer. When the product offers crunch, creaminess and salty nuances simultaneously, it stops competing solely on volume to compete on the intensity of the experience. Mexican companies, with their access to unique local ingredients, have a huge field of exploration here for the export market.

The pistachio phenomenon and the viral effect

Flavour is the engine of the sector, and in 2026 pistachio is positioned as the star ingredient. Driven by the viral effect of “Dubai Chocolate” on social media, pistachio has moved from being a niche flavour to a clear path for launching modern variants. These versions are perceived as accessible luxury and allow traditional brands to refresh their catalogue without leaving the FMCG price range.

On the other hand, “blonde” chocolate (caramelised white chocolate) has ceased to be a limited edition to become a stable flavour on the British shelf. Supermarkets like Waitrose and Sainsbury’s have normalised its presence, opening the door to new permanent combinations that were previously considered too risky.

Regulatory Impact and Healthy Reformulation

The HFSS (high in fat, sugar and salt) legislation in the United Kingdom has forced an acceleration in the reformulation of bagged chocolate. This regulation, which came fully into force in January 2026, restricts the placement of less healthy products at checkouts or supermarket entrances.

The use of functional fibres

To compensate for sugar reduction without sacrificing the creaminess that the consumer demands, brands are turning to technical ingredients. Inulin, a plant-based fibre, is increasingly being used to maintain the structure and sensory profile of chocolate with fewer calories.

In countries like Chile, where the culture of nutritional warning labels is well established, these British technological solutions represent a learning opportunity. The challenge is not simply to remove sugar; it is to reformulate so that the consumer does not notice the difference in the mouth. Innovation in functional ingredients is the key to maintaining competitiveness in markets with strict health legislation.

Sustainability: From Plastic to Paper

Sustainability has moved from being a marketing message to an operational necessity. The flipflow report shows an accelerated transition towards more environmentally responsible packaging.

Recyclable paper bags and mono-materials

Leading brands are migrating their multi-layer plastic formats towards Paper-Based Pouches (recyclable paper bags) or easy-to-recycle mono-materials. Although this change presents technical challenges, especially in maintaining the seal and moisture barrier, manufacturers who have led the way are already winning the preference of younger consumers.

This trend is especially relevant for Spanish companies, which operate under increasingly demanding European circular economy directives. Innovation in materials that maintain zip-lock functionality but are 100% recyclable is one of the fields with the greatest growth potential.

Brand Values and New Consumption Habits

The report reveals that success in the chocolate pouches segment also depends on the emotional and ethical connection with the consumer.

The ethical message as a purchase determinant

Tony’s Chocolonely’s case is paradigmatic. Its communication focused on eradicating slavery in cocoa cultivation demonstrates that company values can be just as determinant as the product format.

Source: Jon Richards – LinkedIn – 2025

This approach connects especially with Gen Z and Millennials, who are willing to pay extra for products with clear fair trade certifications. In Mexico, where the origin of cocoa is a mark of national identity, there is immense potential to communicate these stories of social impact and sustainability.

E-commerce growth and the “Big Night In”

The consumption occasion is also changing. E-commerce growth and quick commerce platforms has shifted the peak demand for chocolate towards the night. The highest number of impulsive purchases via apps is recorded between 20:00 and 22:00.

This habit favours the use of digital Retail Media. With a paid share of 4.6%, still relatively low, brands that invest in advertising specifically targeted at these times will be able to compensate for the loss of physical visibility at checkouts due to HFSS regulations.

The “Big Night In” (movie or games night at home) is the perfect scenario for sharing pouches, and brands that best adapt their communication to this specific moment will lead the category.

Conclusion: Useful Innovation, Clear Formats and Packaging that Solves Everyday Needs

The detailed analysis of the chocolate pouches category in the United Kingdom offers us a clear roadmap for innovation. It is not enough to manufacture quality chocolate; current success depends on a precise combination of a functional format (Doypack with zip closure), a complex sensory experience (trending textures and flavours like pistachio) and a firm commitment to sustainability and health.

For chocolate companies, these data represent an opportunity to stay ahead of the competition. The trends towards portioning, reformulation using functional fibres and the adoption of recyclable materials are already here. The general direction is clear: brands that innovate with utility, choose easy-to-understand formats and design packaging that accompanies the real use of the consumer will win.