From Shelf to Click: Key Aspects of Offline-Online Correspondence in Fast-Moving Consumer Goods

The rapid evolution of retail in FMCG

The Fast-Moving Consumer Goods (FMCG) sector is undergoing an unprecedented transformation. Digitalisation, changes in consumer habits and the emergence of new purchasing channels have forced brands and retailers to rethink their strategies. For decades, the physical point of sale has been the key setting for influencing purchasing decisions. However, today, the “shelf” extends beyond supermarket shelves, reaching the digital realm: from marketplaces to mobile apps and online stores run by distributors themselves.

The NIQ “Consumer Trends 2024” report reveals that, during 2024, Spanish household spending on groceries reached €122 billion, representing a 4.6% increase on the previous year. One of the major players of the year was online sales, which experienced notable growth, far exceeding that of the physical channel. E-commerce consolidated itself as the fastest-growing channel, increasing spending growth by 18% to reach €6.215 billion. With this data, the share of e-commerce in FMCG is now at 6.8%.

In this new scenario, two crucial questions arise: How do the offline and online worlds relate in FMCG, particularly in terms of product visibility (the shelf) and conversion (sales)? Is it possible to maintain consistency between both environments to maximize impact on the consumer?

Exploring this correspondence becomes vital for brands seeking to gain share in an increasingly competitive and fragmented market. In this article, we will examine both environments and their integration to answer all the important questions.

The Physical Shelf: The Traditional Battleground

The physical shelf has historically been the main battleground for FMCG. In the supermarket, every centimetre of shelf space counts. Large supermarkets (Mercadona, Carrefour, Dia, etc.) dedicate linear shelf metres to each product category. Brands compete fiercely for visibility: placement in main aisles, end-cap displays, eye-level shelves, prominent displays or promotional areas. Product placement, space allocated and promotions at the point of sale are key elements for capturing shopper attention.

Furthermore, the in-store shopping experience has unique components. The impulse to buy something that was not on the list, the casual discovery of a new product, the possibility of physically touching and seeing the items, and the immediacy of taking the purchase home with you on the spot. This sensory and direct environment remains very powerful, especially in categories where the appearance, aroma or texture of the product have significant weight in the purchase decision. Being able to touch, smell and compare products on-site is especially important with fresh food: according to a Mercasa report, in 2024 almost half of those who bought online (49%) avoided purchasing fresh produce online.

The encouragement of impulse purchases and the sensory environment created by the physical shelf are key assets, difficult to fully replicate online.

The Digital Shelf: The New Frontier

With the rise of e-commerce, a new version of the shelf has emerged: the Digital Shelf. In Spain, the main players are retailer websites (e.g., Carrefour.es or Mercadona’s website), marketplaces (Amazon, Aliexpress, etc.) and delivery apps (Glovo, Uber Eats, Just Eat for supermarket products). Although the logic is different, the objective remains the same: achieving visibility and conversion.

In the digital environment, competing for space means optimising your position in each platform’s search results, known as internal SEO. It also involves creating comprehensive and attractive product listings, with high-quality images, detailed descriptions, videos and customer reviews. Furthermore, activating digital advertising within the site is key to standing out from the competition.

The shopping experience on the digital shelf is very different.

The user can search for products from anywhere, compare prices, read reviews and select brands with a few clicks, 24 hours a day. Convenience is the big advantage: the desired item can be ordered without having to travel, even outside of business hours, and delivered to your door. There is also a much wider assortment: a digital hypermarket can offer thousands of SKUs (including little-known own-brand listings or international formats) that wouldn’t physically fit in a single store (the so-called “endless aisle”). Furthermore, online channels collect user browsing and purchasing data. This allows for personalized offers or product recommendations based on their history, something unthinkable in a traditional shop. In short, the digital shelf expands search options and facilitates planned or impulse purchases from a mobile or computer.

But it also presents new challenges for brands: How do you ensure your product appears in the top positions? How do you influence an environment where the shopper doesn’t wander between shelves but filters, searches and scans quickly?

The Correspondence Between the Physical and Digital Shelf

In this context, the need for coherence and alignment between both worlds arises. Is the same assortment available both in-store and online? Are the brand image and messaging consistent across both channels? The omnichannel experience demands coordinated management of the physical and digital shelf so that the consumer receives an integrated proposition, regardless of the touchpoint.

This is where the concept of phygital comes in, fusing physical and digital. Examples of this are QR codes on packaging or digital labels on shelves, which lead to expanded information, customer reviews or recipes. Retailers have also launched apps that allow products to be scanned in-store to add them to an online basket, receive personalized recommendations or activate vouchers in real time.

Well-executed correspondence between the two environments enhances the customer experience and reinforces brand presence. It also allows for synergies to be leveraged: for example, a launch can be simultaneously promoted on the physical and digital shelf, with creative and promotions adapted to each environment but aligned in substance and form. In short, the synchronization of prices, promotions and availability is fundamental for a seamless transition between the physical and digital shelf.

The Relationship Between Offline and Online Sales

Is there a direct correlation between a product’s visibility or presence in both environments and its sales level? The answer is complex. While greater visibility usually has a positive influence, consumer behaviour is increasingly fragmented and multidimensional.

Many factors condition the choice of purchasing channel: price, urgency, product category, convenience, in-store availability or delivery charges. Some consumers prefer to do their weekly shop online for convenience but resort to the physical store to replenish fresh produce or take advantage of a promotion seen in a leaflet.

Furthermore, phenomena such as ROPO (Research Online, Purchase Offline) or showrooming (viewing in-store, buying online) reflect a hybrid behavioural pattern. The consumer no longer sees channels; they see brands and retailers. The important thing is that the product is available and that the experience is seamless, frictionless, regardless of where the purchase is finalized.

However, measuring the cross-channel impact is complex.

How many in-store sales are due to digital campaigns? How much online traffic does a good in-store location generate? An in-store promotion can trigger traffic to the brand’s website, and vice versa. The digital channel also functions as a discovery tool. Many users find new products or collections online, which then motivates them to look for them in the physical store. However, overall, the online channel in FMCG is still smaller than the physical channel. For example, in 2023, 6.2% of grocery spending was online, so most routine purchases are still made in-store. Factors influencing channel choice include immediacy (milk or fresh vegetables are usually bought from a nearby shop), convenience (large or heavy items are preferred online), and offers (an exclusive online discount can tip the balance). The truth is that both channels mutually influence each other, and omnichannel—integrating digital and physical experiences—is the dominant trend.

Strategic Implications for Brands and Retailers

In this new scenario, brands and retailers must abandon siloed approaches. Online and offline channels can no longer be managed separately; an integrated strategy is required that considers both environments in a coordinated way.

Management of the Digital Shelf must receive the same attention as the physical shelf. This involves looking after digital content, optimising for SEO on e-commerce platforms, activating positive reviews and monitoring how products appear in each channel. It is also key to analyse consumer behavioural data in both environments to understand what drives conversion and which touchpoints are most influential. Retailers, for their part, must offer a seamless omnichannel experience, allowing consumers to move freely between physical and digital stores, and leveraging technological capabilities to personalize, recommend and build loyalty.

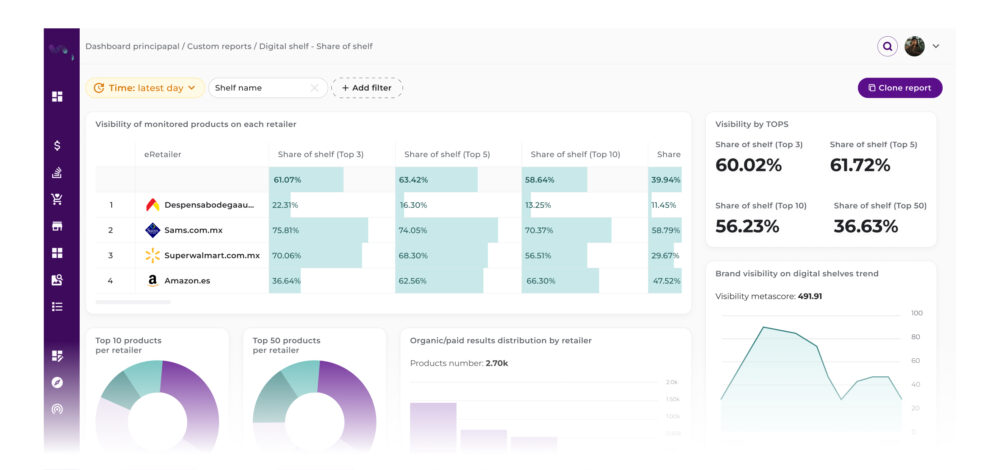

Many companies use specific analysis tools to see how their products appear in different online stores and marketplaces. Using these analyses, they can adjust prices or digital advertising. Businesses must also leverage the data generated by each channel. Physical sales data (for example, consumption trends by geographic area or seasonality) is complemented by online browsing data (most searched terms, conversion rate, abandoned baskets). Using this data, they can personalize promotions or improve assortments. For example, if website analysis reveals that a product range is receiving a lot of traffic but few sales, the brand can launch an online voucher campaign or an in-store trial to boost that SKU. In short, managing both environments in an integrated way improves commercial efficiency. Brand omnipresence is facilitated and a consistent consumer experience is offered regardless of where their purchase journey begins or ends.

Digital Tools for Analysing the Shelf: From Online Data to Physical Reality

Brands and retailers no longer have to rely on general estimates about what is happening at the point of sale. Today, there are technological tools that allow the digital shelf to be observed with a surprising level of detail, even capable of reflecting what is happening on the physical shelf.

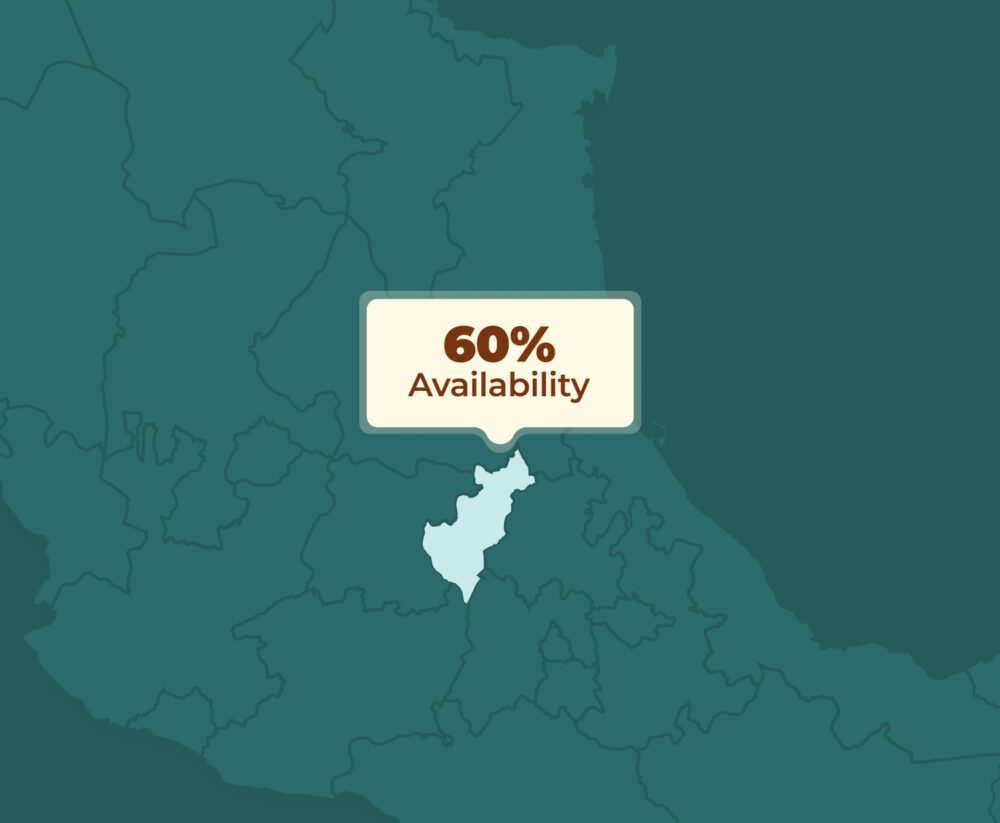

Flipflow is one of these solutions for analysing the FMCG digital market. Thanks to our ability to daily monitor the presence of products in e-commerce, such as large retailer websites or marketplaces, we can provide key metrics on availability, visibility, prices, promotions and content. What’s most interesting is that this digital analysis doesn’t stop at the online environment: the information collected can be extrapolated to the physical channel with an accuracy of up to 95% in terms of availability per store.

This high degree of correlation transforms the digital shelf into a kind of mirror of the physical one. For example, if a product disappears from several of a retailer’s online stores, there is a high probability that the same thing is happening in its network of physical stores. This allows for more agile and informed decisions to be made, from replenishment to the activation of local campaigns.

In addition, using tools such as flipflow provides a constant and automated view of the market, something that the physical channel doesn’t always allow due to fragmentation or lack of real-time data. In an omnichannel environment, where consumers switch between channels indiscriminately, having this cross-channel view becomes indispensable.

The Future of FMCG is Omnichannel and Connected

In conclusion, the physical shelf and the digital shelf are now two sides of the same coin in FMCG retail.

The physical store remains key. It offers a direct experience, immediacy and is a very powerful channel for impulse purchases. The online world, for its part, expands brand reach. It provides more variety, more information and more options for the consumer. Understanding how both environments relate is fundamental. Only in this way can brands ensure that a product is visible and appealing on both the physical and digital shelf. This allows for optimization of investment in point-of-sale actions (such as location or in-store promotions) and in digital marketing (such as SEO, advertising or reviews).

Furthermore, managing both channels in an integrated way using digital tools such as flipflow allows for a consistent brand image to be maintained at all touchpoints. And this, ultimately, translates into a better consumer experience and a positive impact on sales.

In a market such as the Spanish one, which still has a strong offline component, phygital synchronization and a robust omnichannel strategy make all the difference competitively. In short, FMCG in Spain demands a holistic approach: one that recognizes the particularity of each shelf but directs them towards a common objective of customer service and sustainable growth.