Omnichannel Retail in Europe: Towards a Connected and Personalised Experience in 2025

Introduction: European Retail at a Crossroads

E-commerce in the five main European markets – Germany, France, Spain, Italy and the United Kingdom – will reach €565 billion in 2029. This figure from Forrester marks a turning point for European retail. However, behind this growth lies a transformation that is completely redefining the sector.

Growth is no longer a battle between digital and physical channels. The modern consumer does not perceive different sales channels. For them, there is only one brand with multiple touchpoints. This mindset is forcing companies to rethink their business strategies.

To understand the true scope of this transformation, two of the world’s most prestigious consultancies have published complementary analyses that offer a complete overview of the European omnichannel landscape.

Forrester clearly establishes the ‘what’ and the ‘why’ of this transformation. It defines the market size and its exponential growth. Furthermore, it explains that the growth of physical stores depends directly on companies’ omnichannel capabilities. This completely redefines the traditional role of the physical store in the retail ecosystem.

For its part, Deloitte delves into the ‘how’ and the ‘what for’ of this evolution. It confirms that omnichannel has become an absolute strategic priority. More importantly, it puts a direct monetary value on this strategy: omnichannel customers spend 50% more than traditional customers.

According to these consulting giants, success in 2025 will depend on mastering an integrated omnichannel strategy. Below, we will explore their diagnosis in more depth and the consequences of not mastering this strategy.

Forrester’s Diagnosis: Omnichannel as a Driver of Growth

Forrester identifies a key pattern: the growth of physical stores no longer depends solely on direct sales. It is driven by omnichannel functions that transform the store into a strategic logistics hub.

The store’s role as a logistics hub is mainly manifested in two key functions. The first is the in-store collection service, known as “click and collect”. Customers buy online and collect their products from the physical store. This method combines the convenience of digital purchasing with the immediacy of physical collection.

The second function is to serve as a returns centre. Customers can return products purchased online directly to the physical store. This eliminates the logistical complications of postal returns and significantly improves the customer experience.

These functions have transformed customer footfall in physical stores. Many visitors do not arrive with the intention of buying at that moment. They come to collect online orders or return products. However, once in the store, they frequently make additional impulse purchases.

Forrester highlights that this channel integration requires significant technological investment. Companies need systems that allow for real-time inventory visibility. They also require platforms that efficiently manage online orders for in-store collection.

Its direct recommendation is clear and unequivocal: “Invest in advanced digital platforms” to unify the customer experience. This investment is the strategic key to “dictating market dominance” in the near future.

The Deloitte Opportunity: The Real Value of the Omnichannel Customer

Deloitte has precisely quantified the economic value of an omnichannel strategy. Its research reveals a fundamental piece of data that completely changes the investment equation for these strategies: omnichannel shoppers spend 1.5 times more than traditional single-channel customers.

This finding transforms omnichannel from an operational improvement into a direct revenue growth opportunity. It is not simply about improving the customer experience. It is about significantly increasing the value of each customer to the company.

The financial ‘why’ becomes evident. A company that converts traditional customers into omnichannel ones can expect a 50% increase in average spend per customer. This improvement justifies significant technological investments.

Omnichannel customers spend more for multiple reasons. They:

- Have more touchpoints with the brand, increasing their exposure to products.

- Develop greater trust due to the seamless experience between channels.

- Tend to be more loyal, as convenience creates natural barriers to switching.

Deloitte also identifies that digitalisation and omnichannel have become the main strategic priorities for retailers in 2025. This is a structural transformation of the sector that requires immediate adaptation.

Deloitte’s research provides the clear economic justification for these investments. The return on investment in omnichannel is not just theoretical. It is measurable and significant through the direct increase in customer value.

4 Key Trends for 2025 According to Deloitte and Forrester

1. The rise of personalised marketing and generative artificial intelligence

Personalisation has become the main driver of revenue growth for retail companies. The data is compelling: 80% of consumers prefer brands that personalise their communication and shopping experience.

This consumer preference is not accidental. Personalisation creates a stronger emotional connection between the brand and the customer. When a customer feels that a brand understands their specific needs, their loyalty and purchase frequency increase.

Generative artificial intelligence is revolutionising personalisation capabilities. It allows for the automated creation of personalised content at scale. Companies can generate product recommendations, marketing content and customer service responses tailored to each individual customer.

The application of artificial intelligence in omnichannel commerce covers multiple areas:

- Automation: Allows for more efficient management of inventories, order processing and delivery coordination.

- Recommendations: Analyses customer behaviour across all channels to suggest relevant products.

- Customer service: It is possible to provide immediate and accurate responses 24 hours a day.

Leading companies are integrating these technologies holistically. They do not use them as isolated tools, but as components of a coherent omnichannel strategy. This amplifies the impact of each individual technology.

2. Total integration: from multichannel to unified commerce

The sector is evolving from multichannel towards truly integrated platforms. In unified commerce, sales, order fulfilment and customer service interact in real-time without barriers between channels.

This evolution represents a significant qualitative leap. Traditional multichannel offered multiple purchasing options but with separate systems. Unified commerce eliminates these separations and creates a seamless and coherent experience.

In this model, physical locations take on a strategic role as hybrid logistics hubs that integrate sales, storage, collection, returns and product trials. This convergence improves operational efficiency and the customer experience by combining digital convenience with physical immediacy: it allows customers to collect online orders in-store, return products without complications, and access advice or immediate alternatives from staff. Furthermore, the ability to try products in-store complements the digital purchasing process.

3. Consumer behaviours and shopping habits in Europe

European consumer buying patterns have undergone a radical transformation. 75% of consumers use three or more channels to interact with a brand during their purchasing process, according to a study by Minsait. This statistic reflects a new reality of consumer behaviour.

The modern purchasing process is inherently complex and multichannel. A typical customer might discover a product on social media, research it online, compare prices on different websites, read reviews, visit a physical store to try it on, and finally buy it via a mobile app.

The same Minsait study mentioned earlier shows that online shopping directly influences over 70% of physical sales. This means that most in-store purchases are influenced by some form of prior digital research or interaction. This digital influence on physical sales redefines the importance of an online presence. A company can lose sales in its physical store if its digital presence is poor.

The use of data allows for the creation of hyper-personalised and relevant experiences. Companies can combine online and offline behavioural data to better understand each customer’s preferences. This deep understanding allows for more precise and effective offers.

4. Economic and strategic outlook

The stable growth of European retail is mainly supported by omnichannel and the context of economic recovery after the pandemic. This new scenario has strengthened consumer confidence and their willingness to spend. However, it has also raised expectations for the shopping experience. Consumers expect more value and better service for their money.

Well-known brands like Decathlon and Zalando are leading the expansion of physical stores to complement their online platforms. This strategy may seem contradictory in the digital age, but it responds to consumer demand for hybrid experiences.

Decathlon uses its physical stores as experience centres where customers can try sports products before buying. They also function as logistics hubs for online orders and returns. This integration optimises both the customer experience and operational efficiency.

Zalando has adopted a similar approach in the fashion sector. Its physical stores in Germany allow customers to try on clothes and shoes before buying. They also serve as collection points for online orders, reducing delivery costs and improving customer convenience.

These strategies show that digitalisation does not mean abandoning physical spaces, but rather reinventing them as integrated components of a broader omnichannel experience.

Strategic Recommendations for Retailers

Companies looking to lead in 2025 must adopt an approach focused on three fundamental pillars, according to the studies from Forrester and Deloitte:

First pillar: Investment in advanced digital platforms

This investment cannot be superficial or cosmetic. It requires robust systems that allow for real integration between all sales and customer service channels. The platforms must be scalable and flexible to adapt to future needs. Effective integration requires all company systems to ‘speak the same language’. Inventory, sales, customer and marketing data must flow freely between platforms. This integration eliminates organisational silos and improves operational efficiency.

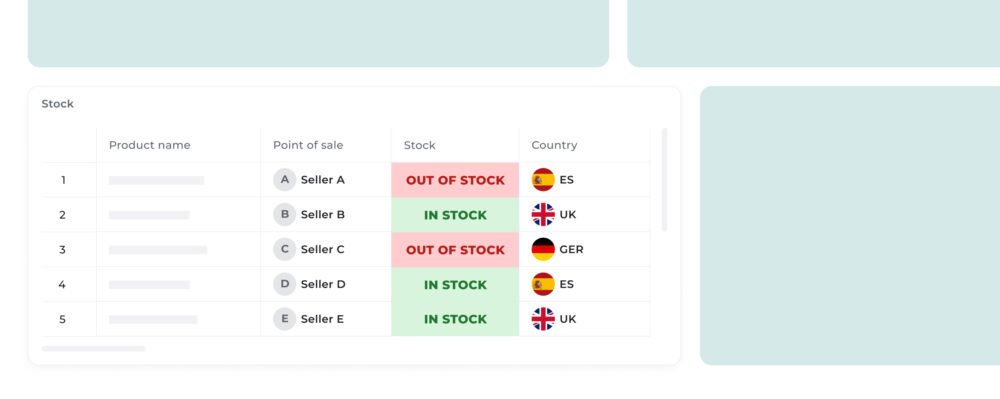

Second pillar: Channel alignment and real-time inventory visibility

Customers expect accurate information on product availability regardless of the channel they use. A lack of inventory visibility leads to frustration and lost sales. Real-time visibility allows for the optimisation of inventory distribution between channels. Products can be moved dynamically between physical stores and online warehouses according to demand, which improves efficiency and reduces storage costs. Channel integration must also include coherent pricing, promotion and service policies. Customers should not face different conditions depending on the channel they choose.

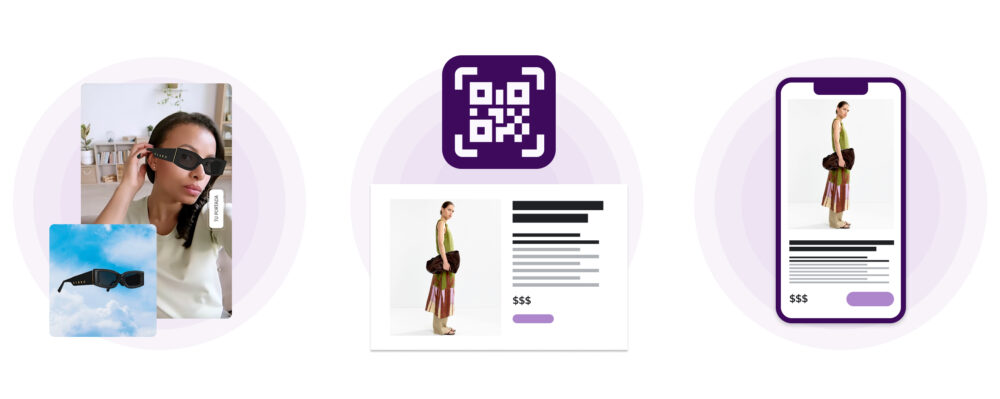

Third pillar: Integration of shoppable content and hybrid physical experiences

Shoppable content allows customers to buy products directly from social media posts, promotional videos or online ads without needing to leave the platform they are browsing. This integration eliminates multiple steps in the purchasing process and significantly reduces friction. Hybrid physical experiences transform traditional stores by incorporating digital elements such as virtual changing rooms, product information via QR codes, or mobile apps that enrich the visit without replacing the tactile experience that consumers value.

Conclusion: Preparing Today for the Retail of Tomorrow

The future of European retail is neither physical nor digital: it is hybrid, integrated and centred on the expectations of the new consumer. A consumer who moves seamlessly between channels, who demands frictionless convenience and who rewards brands that offer them personalised, consistent and memorable experiences. This reality is already a present that is separating the prepared players from those still operating under past models.

The time for experimenting is over. The figures are clear: omnichannel customers spend more, are more loyal and generate more long-term value. Physical stores are not disappearing; they are evolving into more complex and strategic roles within a connected ecosystem. Technology is no longer an accessory; it is the core of any sustainable value proposition. And total integration between channels, data and operations has become the foundation on which differentiating experiences are built.

Forrester and Deloitte agree on an unquestionable truth: retail leadership in 2025 will depend on the decisions made today. Companies that postpone investment in advanced digital platforms, real-time inventory visibility or hybrid experiences will be out of the game sooner than they think. The transformation is not just necessary; it is urgent. And its return, as the data shows, is tangible, measurable and strategic.

The market will not wait. Every day that passes without action is a day that another competitor gains an advantage. Your competition is already on the move. Are you ready to lead the transformation?