The future of retail: online retail to reach 11.2% of sales in Spain in 2025

Introduction: a Look at the Future of Retail in Spain

The retail landscape in Spain is constantly evolving, and the COVID-19 pandemic accelerated a digital transformation that was already underway. A key figure that will shape the direction of the sector in the coming years is the forecast that online retail will account for 11.2% of total retail sales by 2025. This forecast, taken from the latest “e-retail Index Spain” report by the consultancy Savills, invites us to reflect on the future of retail and the strategies that companies must adopt to remain competitive in an increasingly digitalised market.

While this figure represents significant growth, it is interesting to note that Spain will remain some way behind the European average, estimated at 14.6% for the same year. This suggests that, despite the boom in e-commerce, the Spanish consumer still values the in-store shopping experience, which opens up a range of opportunities for companies that know how to integrate both worlds: the online and the offline.

In this article, we will analyse in depth what this 11.2% means for the retail sector, how we got here, and what trends will shape the future of retail in Spain.

Sustained Growth in E-commerce Following the Pandemic

The 2020 lockdown was a turning point for e-commerce in Spain. The share of online sales jumped by 2.7 points. Since then, growth has stabilised at a steady rate of 0.5 percentage points per year. This indicates a maturing market and a consolidation of the shopping habits acquired during the pandemic.

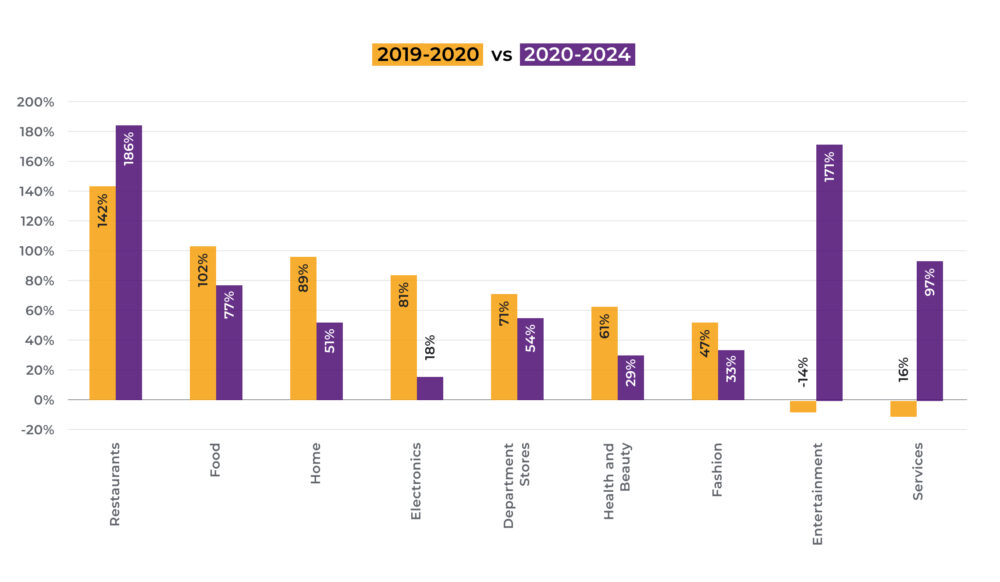

How has each category evolved since the surge in 2020?

Source: The state of e-commerce in Spain – Savills, October 2025

As Alicia Corrales, Director of Retail Research & Consultancy at Savills Spain, neatly summarises:

This new phase, although more moderate than the initial boom, demonstrates the resilience of the physical shop. It also reveals the consumer’s preference for a mixed model. In 2024, 72.2% of retail purchases were made on the high street. Meanwhile, 17.4% took place in shopping centres and retail parks. These figures confirm that the bricks-and-mortar retail apocalypse, so often heralded, has not arrived. Instead, we are witnessing an integration of channels that is redefining the shopping experience.

The Resilience of the Physical Shop and the Rise of Omnichannel

Far from disappearing, the physical shop is reinventing itself to offer added value that the online channel cannot replicate. The key to success in the new retail paradigm lies in omnichannel, that is, in the ability to offer a seamless and consistent shopping experience across all sales channels.

A clear example of this trend is the growing number of digital pure players that are opening physical shops. In the last five years, 46 such openings have been recorded on high streets or in shopping centres in Spain. For example, the brand Sepiia, which was founded in 2016 as a completely online brand, has managed to make sales in its physical shops account for almost 15% of its total turnover in 2024. These brands, born in the digital environment, have understood the importance of having a physical space to connect with their customers, build trust and offer memorable experiences.

Shopping centres and retail parks have also demonstrated their ability to adapt. After a fall in 2020, they have partially recovered their market share, holding steady at 17.4%. This has been thanks to strategies to renew their offerings, the integration of leisure and dining, and advances in digitalisation and customer experience.

Trends that will Shape the Future of Retail

The Savills report also points to a series of trends that will define the future of retail in Spain. Efficiency, flexibility and the emergence of new ways to shop will be key to success.

- Last-mile optimisation: Logistics has become a crucial factor for customer satisfaction. Companies are investing in optimising the last mile to offer faster, more flexible and more sustainable deliveries.

- Personalised offerings: Thanks to data analysis, companies can get to know their customers better and offer them personalised products and services, thereby increasing conversion and loyalty.

- Click & Collect: This purchasing method, which allows customers to collect an online order in-store, is a clear example of the convergence between the physical and digital worlds. The rise of click & collect in Spain shows that consumers are looking for convenience and flexibility.

- New sales channels: The digital channel is fragmenting and specialising. Vertical marketplaces, Direct To Consumer (D2C) brands, and live shopping and social commerce strategies are emerging, opening up new opportunities to reach consumers.

Conclusion: a Hybrid Market Led by Innovative Companies

The forecast that online retail will account for 11.2% of retail sales in Spain by 2025 should not be interpreted as the end of traditional retail. Rather, it should be seen as the consolidation of a hybrid model in which the online and offline channels complement and reinforce each other.

In fact, Spanish businesses demonstrate a remarkable ability to adapt in this regard. A revealing figure from the Savills report is that Spanish companies are above (20%) the European average (19%) in online sales. This leading position shows that e-commerce is already a strategic pillar and that the Spanish market is dynamic and competitive.

The future of retail inevitably involves omnichannel strategies, personalisation and the creation of unforgettable shopping experiences. Those companies that know how to adapt to this new scenario, by investing in technology, logistics and, above all, in a deep understanding of their customers, will be the ones to lead the market. In short, the path towards that 11.2% is not just a statistic. It’s a roadmap full of opportunities for Spanish companies to continue to innovate and demonstrate their competitiveness in a global market.