The Shifting Personal Care Landscape: How Manufacturer Brands Dominate the Digital Market

The personal care market is undergoing a quiet but profound transformation. Against a backdrop of shifting purchasing habits, retail digitalisation and an inflationary economy, factors such as Share of Shelf, price evolution and promotional strategy have become crucial for the competitiveness of brands and distributors.

Although the hygiene and beauty sector grew by 2% in value during 2023—largely driven by a 5% price increase—purchase volume fell by 2.8%, according to the report “The new leaderships of beauty distribution” by Kantar Worldpanel. In this inflationary environment, consumers are buying less and less frequently: in 2024, 32 units were purchased per shopper, compared to 34 in 2021.

While private brands have made notable advances in some categories, achieving significant shares in facial cosmetics (14.1%), makeup (22.4%) and fragrances (6.9%), manufacturer brands continue to lead the personal care segment. Their strength in innovation, perceived quality and digital channel positioning keeps them as leaders in key categories such as shampoos, deodorants or shower gels, where consumers continue to prioritize brand value over price.

Over the past eight months, from September 2024 to April 2025, we have observed strategic movements that are redefining the sector. This article analyses, with data and strategic insight, how the rules of the game are changing in four key categories: shampoos, deodorants, shower gels and wet wipes. If you are looking to understand current trends and anticipate competitor moves, this analysis is for you.

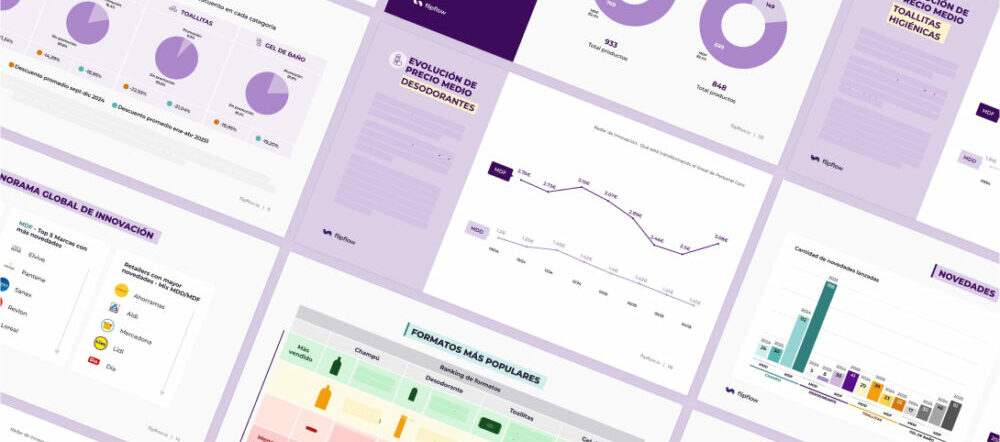

The Absolute Dominance of Manufacturer Brands in Share of Shelf

Manufacturer Brands (MBs) have established almost total control over digital space in Personal Care. As we will see below, in three of the four main categories analysed, their presence far exceeds 75% of Share of Shelf.

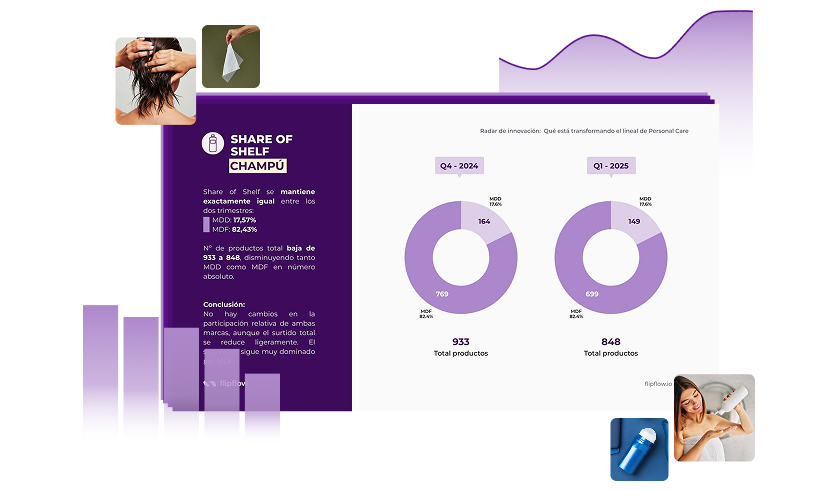

Before analysing each category exhaustively, we want to explain what Share of Shelf is and why it is vital for business growth. Share of Shelf is the percentage of space and visibility achieved by a brand, both on physical shelves and, increasingly importantly, on digital shelves (e-commerce, apps, marketplaces). In a context of reduced assortment and increased competition, measuring this indicator reveals who dominates consumer minds and purchasing decisions.

- In the shampoo category, MBs occupy 82.4% of the digital space. This figure has remained consistent between the fourth quarter of 2024 and the first quarter of 2025. Private Brands (PBs) account for a modest 17.6% of the digital territory.

- Deodorants present the most extreme picture. Here, Manufacturer Brands have increased their dominance from 83.7% to 86.7%. In parallel, private brands have lost significant ground, falling from 16.3% to 13.3%. This loss represents a decrease of almost three percentage points in just three months.

- The shower gel category shows the only instance where PBs manage to gain space, albeit marginally. Their presence on digital shelves grew from 22.9% to 24.1%, while Manufacturer Brands yielded slightly, going from 77.1% to 75.9%.

- Wet wipes constitute the most balanced category in the sector. Even so, Manufacturer Brands maintain an advantage, with 58.2% versus 41.8% for PBs. However, Private Brands also lost ground here, falling from 44.5% previously.

Assortment Contraction: Fewer Products, Greater Concentration

The market is experiencing significant product rationalization. In all the categories analysed, the total number of SKUs has decreased between the two periods compared.

- In shampoo, the assortment was reduced from 933 products to 848, a decrease of 9.1%. This contraction affected both Manufacturer Brands and Private Brands. MBs went from 769 SKUs to 699, while PBs fell from 164 to 149 products.

- In deodorants, the contraction was 15.8%, falling from 196 to 165 total products. This reduction particularly impacted Private Brands, which saw their SKUs fall drastically from 32 to 22 products.

- Shower gel also experienced a considerable reduction, going from 442 to 370 products available. Manufacturer Brands reduced their catalogue from 341 to 281 SKUs, while Private Brands went from 101 to 89 products.

- Wet wipes suffered the largest assortment contraction, 17.4%, falling from 281 to 232 total products. Both types of brands contributed proportionally to this reduction.

The Price War: Stability versus Volatility

Price isn’t just a number: it’s perceived value, it’s comparative against competitors and it’s a vital lever for attracting or retaining consumers.

In this report, prices reveal completely different strategies between Manufacturer Brands and Private Brands. PBs maintain stable and competitive prices, while Manufacturer Brands show greater volatility and systematically higher prices.

- In shampoo, the most popular format (250ml bottle) shows pronounced differences. Private Brands maintained stable prices around €1.70-€1.80, even with a slight downward trend of 7.53% during the period analyzed. Manufacturer Brands, on the other hand, fluctuated between €4.19 and €5.03, maintaining prices that double or almost triple those of the competition.

- 50ml roll-on deodorants, the most popular in the category, show a similar pattern. PBs remained stable between €1.20 and €1.45, with controlled and consistent increases. Manufacturer Brands fluctuated between €2.46 and €3.15, showing noticeable volatility and ending the period with a significant upturn of €0.58 in April.

- In shower gel, Private Brands significantly lowered their prices during 2025, reinforcing their competitive appeal. Their prices fell from €1.87 to €1.53 in the 250-500ml bottle format. Manufacturer Brands maintained prices that more than double those of the retailer brands, fluctuating between €3.37 and €4.08.

- Wet wipes show the most interesting behaviour in terms of average price evolution. PBs increased prices until February 2025, probably due to cost or demand increases, before adjusting downwards. MBs showed strong price increases at the end of 2024 which were maintained during the first months of 2025, ending with a 25% price drop, aligning with the first months analyzed.

More Aggressive Promotions: The Battle for the Consumer

The market has significantly intensified its promotional strategies during 2025. Average discounts have increased in practically all categories, signalling fiercer competition to capture consumer attention.

The aim is to incentivize immediate consumption or rapid shelf rotation. Promotions help to cushion the potential loss of traffic after base price increases. They also serve as a defense against competition, which can lower margins in seconds.

- In shampoo, average discounts grew from 20.95% to 21.24%. Although the increase seems modest, it represents a deepening of promotions in an already highly competitive category. However, they maintain the highest percentage of products on promotion at 24.1%, indicating a broad but less aggressive promotional strategy.

- Deodorants experienced the largest increase in promotional depth. Average discounts jumped from 14.39% to 18.95%, an increase of over four percentage points. In this case, 16.4% of products were put on sale with some kind of promotion.

- Shower gel maintained stable discounts of around 19%, with 18.9% of products on promotion. This category shows the most balanced promotional strategy in the sector.

- Wet wipes slightly reduced the depth of their discounts, from 22.93% to 21.04%. However, only 6.5% of products participate in promotions, suggesting highly selective but very aggressive offers.

The Most Effective Types of Promotion

Direct price discounts have become the dominant promotional strategy across all categories. In shampoo, it accounts for 54.55% of promotional appearances, while in shower gel it reaches 55.67%.

“Buy one get one free” offers maintain significant relevance, especially in shampoo (23.04%), deodorants (23.2%) and shower gel (22.9%). This strategy is less effective for wet wipes, where it only accounts for 7.41% of promotions.

“Second item half price” is the third most popular strategy, particularly strong in deodorants (25.08%) and shampoo (17.86%). This method maintains the perception of value while incentivizing multiple purchases.

More sophisticated strategies such as “now cheaper” have varying penetration, standing out in shower gel (35.19%) but being less relevant in other categories. Fixed discounts in euros and coupons represent more specialized tactics with selective application.

Conclusions of the Market Analysis on the Personal Care Aisle

The Personal Care market is experiencing clear consolidation towards Manufacturer Brands. Their dominance of Share of Shelf is intensifying in most categories, leveraging their capacity for innovation and brand recognition.

The assortment contraction indicates a maturation of the digital market. Brands are optimizing their portfolios, eliminating underperforming SKUs and focusing on more successful products. This rationalization particularly benefits brands with greater negotiating power.

Pricing strategies reveal two clearly differentiated approaches. Retailer brands compete aggressively on price, maintaining stability and seeking the best value for money. Manufacturer brands justify premium prices through innovation, marketing and the perception of superior quality.

The increase in promotional aggressiveness reflects the intensification of competition. Brands are using deeper discounts to boost sales and counteract potential base price increases. This trend suggests a mature market where price differentiation becomes crucial.

The predominance of direct discounts as a promotional strategy indicates that consumers value simplicity and transparency in offers. Complex promotions lose effectiveness against clear and straightforward discounts that facilitate purchasing decisions.

This overview lays the groundwork for understanding how the Personal Care aisle is evolving. What should retailers and brands do now? Monitor price volatility, adapt their assortment strategy and focus on effective and relevant promotions to capture demand and differentiate their offering on the shelf.

Want to know more? Download the full report by clicking on this link.

And if you found this analysis useful, don’t miss our next article, where we will explain how new products, sustainability and the most powerful trends are reconfiguring the entire Personal Care sector.