Data, Desire and Differentiation: A Deep Dive into the Pricing and Assortment Strategies of Europe’s Luxury Icons

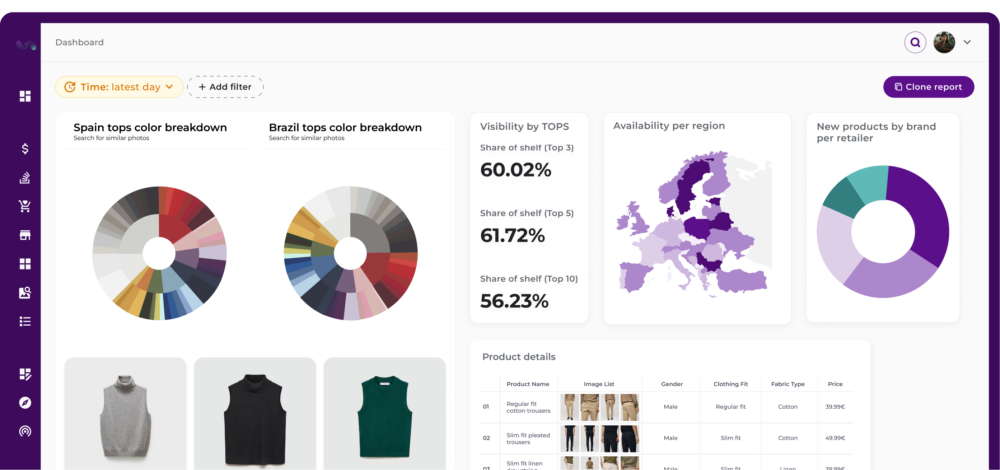

The European luxury fashion sector in 2025 stands at a crossroads between timeless heritage and data-driven precision. In this first article from Flipflow’s Luxury Benchmark series, we analyze pricing structures, assortment distribution, and how these two dimensions reveal each brand’s strategic DNA.

Powered by Flipflow’s market intelligence, our Q2 2025 benchmark (April–June; France, Italy, and the UK) analyzes 5 European luxury houses: Armani, Dolce & Gabbana, Etro, Missoni, and Versace. Our findings show how pricing signals define positioning, how catalogue breadth drives visibility, and how the full strategy becomes clear when both elements are evaluated together.

The European Luxury Context

The European luxury fashion sector in 2025 continues to be a powerhouse backed by resilience and strategic transformation. This market is projected to reach $124.3 billion in 2025, growing at an annual rate of 2.57% from 2025 to 2030 according to Statista. Despite recent macroeconomic tensions, luxury retail sales in Europe increased by 4% in 2024, though this growth represented a normalization compared to the post-pandemic surges of 7% in 2023 and an extraordinary 23% in 2022. These figures illustrate a market that is stabilizing after pandemic-driven spikes but remains fundamentally strong.

Millennials and Gen Z have emerged as increasingly influential demographics in luxury consumption. While exact growth shares vary by study, these younger generations are widely recognized as critical to future market expansion. They emphasize sustainability, digital engagement, and authentic brand experiences, shaping how luxury maisons evolve their strategies. According to Bain’s 2025 analysis, Millennials and Gen Z together will represent the majority of luxury spending growth in the coming years, even if short-term shifts in behavior occur. This generational influence requires brands to balance timeless heritage with innovation in product, pricing, and channel approaches.

Brands are increasingly focused on optimizing assortment breadth, refining price ladders, and creating new entry points for younger, aspirational consumers. Flipflow’s Q2 2025 benchmark highlights two dominant strategic archetypes emerging in this environment: expansive “destination houses” like Dolce & Gabbana and Versace that compete on scale and category leadership, and “focused specialists” like Armani, Etro, and Missoni that excel by curating selective, high-value assortments rather than saturating the market.

This evolving context drives the urgent need for data-driven insights to inform assortment and pricing strategies, a need Flipflow meets with precision analytics.

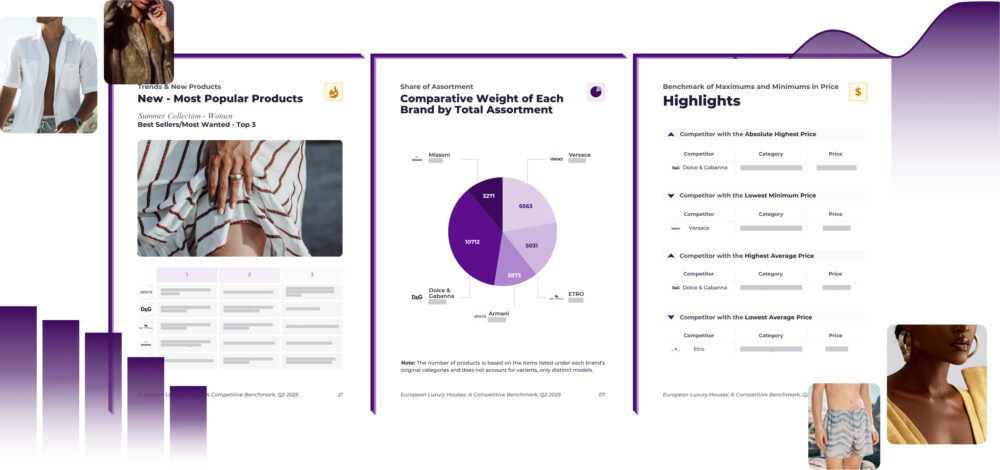

Price benchmarks: ladders, ceilings, and gateways

Price ladders do heavy lifting in luxury. They welcome new clients with brand-true entry items, guide them into core categories, and reserve the top rung for halo pieces that concentrate desirability. In Q2, the clearest signal comes from Dolce & Gabbana. Jewelry for women reaches a remarkable €395,000 at the top and averages €10,741.40, while Handbags for women peak at €24,500 with a €3,231.97 average. Those figures indicate a house that uses scarce, high-ticket items to anchor a premium narrative. The effect of such ceilings extends beyond the categories themselves: they lift perceived value across the catalog and create reference points for price integrity.

Versace leans into prestige within apparel. Dresses for women reach €12,000 and Coats & jackets approach €9,500. These are categories with high visual impact and strong editorial potential, which helps explain why the brand invests in serious peaks here. The strategy aligns with Versace’s strength in statement fashion and supports its accessories ecosystem by keeping attention on standout silhouettes.

Armani takes a different path, building a wide ladder that stretches from approachable on-ramps to elevated caps. The men’s side supplies accessible entry through Beachwear at €190 and T‑shirts and polos at €270, while the women’s offer pushes up to €59,000 in Jewelry and €25,000 in Dresses. This architecture supports long-term client progression: discover the brand in casual or seasonal items, trade up to core tailoring or prêt-à-porter, and eventually consider rare pieces.

Meanwhile, Etro and Missoni maintained more moderate price spans, aligning with accessible luxury — the space between aspirational design and timeless craftsmanship.

Share of assortment: who dominates the shelves

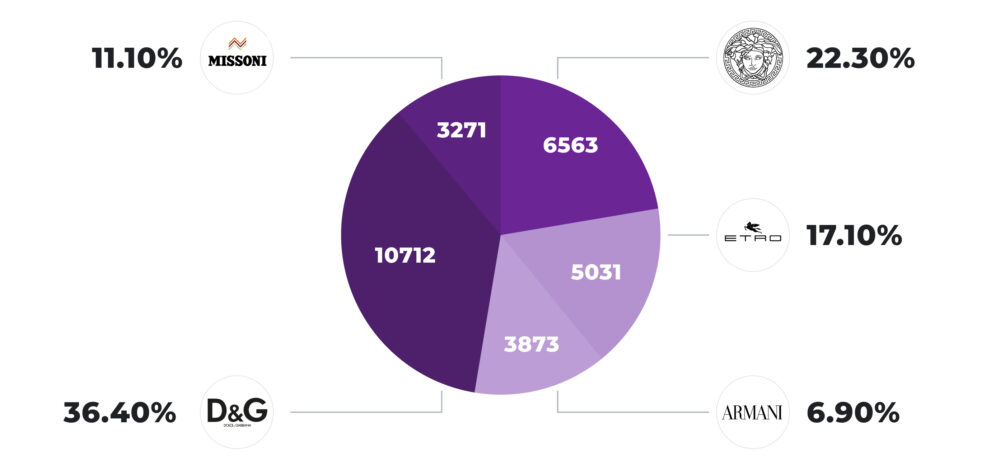

If price sets the tone, assortment determines how often a brand appears in front of shoppers. Across thousands of SKUs tracked by Flipflow’s SaaS, Dolce & Gabbana commands 36.4% of total assortment share, or 10,712 unique models. Versace follows at 22.3% (6,563 SKUs). Together, they control nearly 60% of the total assortment space monitored among the benchmarked brands.

Scale translates into visibility. With larger catalogs, D&G and Versace appear repeatedly in search and navigation. They can present full looks, build adjacent recommendations, and cross-sell across categories. That scale also supports stronger bargaining power with partners and more robust icon programs because replenishment data compounds faster across many placements.

Armani stands apart with a selective approach — strong presence in “New for Him” and “New for Her” collections, but fewer listings in categories like dresses (35 SKUs) or skirts (12 SKUs). This focus translates into scarcity-driven desirability and operational agility, reinforcing the brand’s image of quality through curation rather than volume.

Etro exhibits balance, maintaining comprehensive assortments across apparel for both men and women, supported by sustained innovation in new arrivals. Missoni shows the narrowest scope, with notable emphasis on women’s beachwear (1,000 SKUs) but visible gaps in categories such as jewelry or belts. This skew highlights Missoni’s precision strategy — doubling down on lifestyle and knitwear identity rather than spreading thin across the luxury matrix.

When price meets assortment: defining strategic models

Overlaying price architecture on assortment share reveals 4 archetypes:

1. Dolce & Gabbana and Versace form the high-assortment, high-price duo. They aim for leadership by being everywhere the shopper looks and by maintaining strong ceilings that protect brand equity. Success here requires tight forecasting and disciplined editing once sell-through data arrives, because the risk of inventory complexity grows with range size.

2. Armani represents a selective model with consistent luxury pricing. The brand chooses its arenas and invests in storytelling and product quality rather than blanket coverage. With fewer SKUs, every drop must work hard: imagery, copy, and PDP detail need to pull their weight, and replenishment on proven winners should be fast to maintain momentum.

3. Etro occupies a moderate-assortment, moderate‑high price space. The offer feels steady, considered, and frequently refreshed. Its challenge is to avoid being squeezed by volume-led leaders on visibility and by ultra‑luxury on aspiration. The answer lies in fabric stories, menswear credibility, and accurate allocation so size and color depth sit where sell-through is strongest.

4. Missoni follows a focused model with moderate prices and deliberate category gaps. The brand wins when its distinctive patterns, textures, and fits play to loyal clients who collect updates season after season. The beachwear surge in Q2 shows how a specialist can use seasonal capsules to generate reach without rebuilding the entire assortment.

Revenue drivers: luxury’s economic backbone

From a commercial perspective, accessories remain the undisputed engines of profitability. Bags, shoulder bags, and jewelry consistently occupy the upper end of price brackets across all five houses, confirming their role as identity markers and entry gateways. Dolce & Gabbana’s jewelry, priced above any peer benchmark, positions these pieces as collectible assets and brand symbols.

Conversely, footwear and small leather goods serve as accessible entry points — vital for recruiting younger and aspirational clientele. Categories like sneakers, sandals, and pumps maintain luxury credentials within more contained price ranges, acting as stepping stones into the world of high fashion.

Apparel categories such as dresses, coats, and blazers preserve their prestige function, anchoring perception of status. They are less about utility and more about expression—often commanding high average prices that directly correlate to brand desirability. In this mix, assortment depth equates to competitive power.

The brands with broader inventories gain visibility, shelf priority, and algorithmic advantages in both digital and retail touchpoints.

Strategic insights: what data reveals about positioning

The Flipflow dataset portrays a market divided between expansionists and specialists. For Dolce & Gabbana and Versace, breadth secures dominance but also necessitates continuous storytelling and newness to prevent dilution. Their extensive assortment structures enable cross-selling but require uncompromising price discipline to maintain exclusivity.

For Armani, the opposite is true: less becomes more. Focused launches and limited assortments favor sharper brand coherence and efficient capital allocation. Etro’s equilibrium signals consistency, while Missoni’s narrow focus underscores identity preservation through craftsmanship, color, and textile artistry.

Across all players, strategic finesse lies in mastering the link between price elasticity and assortment visibility. Too many products risk eroding perception; too few may limit reach. The balance between desirability and accessibility defines the luxury continuum today, and Flipflow’s data shows how precision can elevate positioning beyond aesthetics into measurable performance.

Conclusion: compete with clarity, pace with newness

Q2 2025 confirms that European luxury rewards coherent pricing and deliberate assortments. D&G and Versace show how scale and premium ceilings build dominance across the digital shelf. Armani proves that a precise edit with consistent luxury pricing can direct attention and safeguard equity. Etro demonstrates the strength of refined everyday luxury, while Missoni illustrates the power of a specialist stance anchored in signature design.

The path forward is straightforward to state and demanding to execute. Protect the price ladder from entry to halo. Invest depth only where category leadership is credible and sustained. Maintain a cadence of meaningful newness that aligns product, content, and distribution. Brands that operate with this level of clarity compete not just on individual products but on a value architecture that customers understand and trust.

For buyers, planners, and marketers, the full report—European Luxury Houses: A Competitive Benchmark, Q2 2025—provides category‑level detail, best sellers, and deeper gender and season cuts.

Download it to explore the data behind these findings and guide your next buy, pricing review, or drop calendar. In 2025, clarity — not quantity — defines the new luxury advantage.