The Programmatic Retail Media Revolution: What to Expect in the Second Half of 2025 and Looking Ahead to 2026

Introduction: The New Cornerstone of Digital Marketing

What began as an extension of advertising spaces in e-commerce has now transformed into a complex and rapidly growing ecosystem, in which retailers are becoming genuine advertising media. Retail Media has emerged as a new strategic cornerstone, allowing advertisers to reach consumers right at the moment of the purchase decision, within the retailers‘ own environments.

But the real revolution lies not just in its existence, but in the adoption of a fundamental layer that maximises its potential: programmatic technology. This synergy between the vast knowledge of consumer purchasing behaviour and the efficiency of programmatic technology is creating an unprecedented advertising ecosystem.

In this article, we will break down what exactly Programmatic Retail Media is and why it has become an unstoppable force. But, beyond the definition, we will look to the future: What can we expect from this trend in the second half of 2025 and, crucially, looking ahead to 2026?

What is Programmatic Retail Media? Breaking Down the Concept

Programmatic Retail Media combines advertising on e-commerce platforms with automated purchasing technology. It is a system where brands can automatically buy advertising space on retailer platforms, using first-party data and real-time optimisation algorithms.

Unlike traditional retail advertising, which requires manual negotiations and static planning, the programmatic model allows for instant adjustments based on performance, available inventory and user behaviour. This flexibility maximises both efficiency and results.

The “Programmatic” component: Intelligent automation

Automation is at the heart of Programmatic Retail Media. The systems use machine learning to analyse millions of data points in milliseconds. They evaluate factors such as purchase history, browsing behaviour, temporal context and product availability.

Real-time bidding allows brands to compete automatically for specific advertising spaces. When a user visits a product page, the system triggers an instant auction. The algorithms evaluate the probability of conversion and adjust the bids automatically.

A retailer’s first-party data feeds these systems with privileged information. They know exactly which products each user bought, when they bought them and how often. This information surpasses any third-party cookie in accuracy. Programmatic advertising also helps Retail Media Networks to scale effectively. It allows brands to show their ads to the most relevant audiences and retailers to sell advertising inventory to the highest bidder, through automated programmes, in a matter of milliseconds.

Source: Retail 2025: 10 Trends Shaping the Retail Media Market – Coresight Research, January 2025

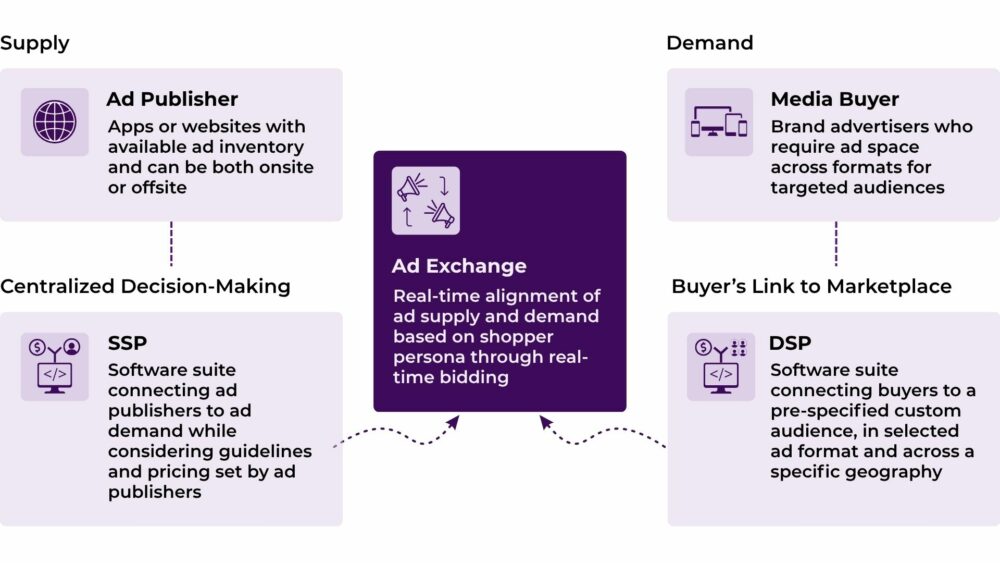

In the image above, we can see the process: A programmatic demand-side platform (DSP) helps advertisers to facilitate the purchase of ads using predefined conditions on audiences, formats, etc., while the supply-side platform (SSP) helps retailers to facilitate the sale of advertising inventory to the most relevant buyers.

Key advantages of the system

For retailers, Programmatic Retail Media represents a significant new source of revenue. They can monetise their web traffic and first-party data without compromising the user experience. This monetisation is particularly valuable. Retailers have purchasing behaviour information (patterns, preferences, or repurchase cycles) that brands desperately need.

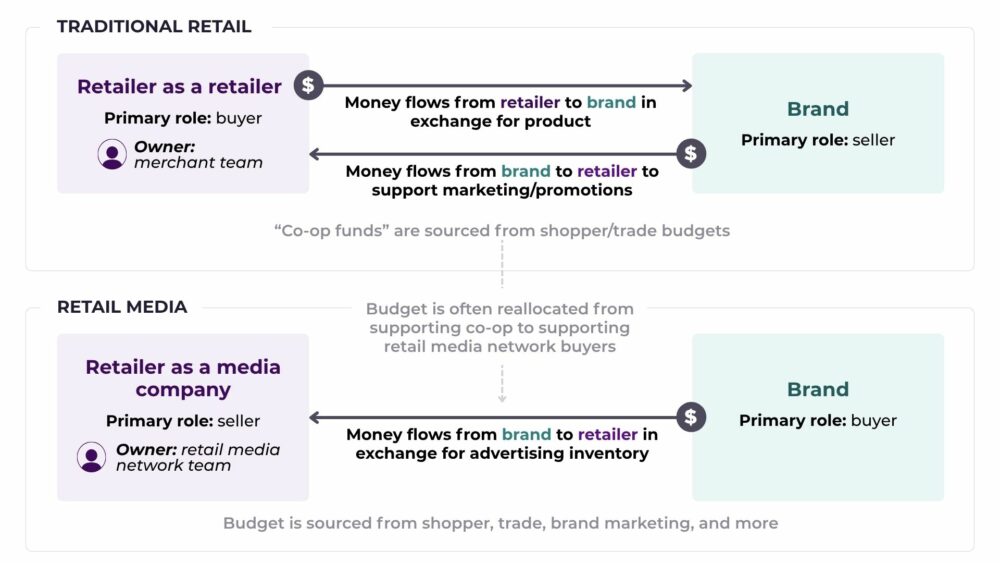

Furthermore, in addition to being a significant revenue channel, Retail Media is also profoundly changing the relationship between retailers and brands. More than just selling advertising space or exploiting data, retailers are now taking on an active role as strategic partners in campaign planning and execution.

This shift fosters closer collaboration, where both parties share insights, co-design strategies and align commercial objectives. As highlighted by eMarketer, Retail Media thus becomes a key meeting point for generating joint value, fostering more lasting, results-oriented relationships with a long-term vision.

Source: Retail Media Forecast Update H1 2025 – emarketer, May 2025

For advertising brands, access to high-intent audiences is the biggest benefit. Users on retail platforms are ready to buy. Their searches and browsing indicate explicit commercial intent, not just passive interest.

Actual purchase data allows for optimisation based on concrete results. Brands can see exactly which ads generate sales, not just clicks. This direct attribution significantly improves the ROI of advertising campaigns.

Challenges of the ecosystem

Technical complexity is the first hurdle. Integrating programmatic advertising systems with e-commerce platforms requires a sophisticated infrastructure. Retailers must invest in technology and in specialised talent that can manage it and train the rest of the team.

The fragmentation of the ecosystem complicates campaign management. Each retailer develops its own platform with different interfaces, metrics and processes. Brands must adapt to multiple systems without standardisation, which can be complex and inefficient.

Data privacy is also a cause for concern. Users are becoming more aware of how their personal information is used. Although data is a competitive advantage for this ecosystem, managing it involves complying with privacy regulations such as GDPR or CCPA, and balancing personalisation with respect for privacy.

The Rise of Programmatic Retail Media: Why Now?

The phasing out of third-party cookies is accelerating the adoption of Programmatic Retail Media. Google has already begun its gradual withdrawal, while Safari and Firefox block them by default. Consequently, this change is forcing brands to look for alternatives based on first-party data.

In this new landscape, retailers’ own data is becoming a key asset. Meanwhile, other channels are losing their segmentation capabilities, but retailers retain direct access to detailed information about their users. The value of retailer data is unparalleled. They know each customer’s purchase history: what they buy, when they buy it and how much they spend. This transactional information is unique and difficult for other platforms to replicate.

Added to this is behavioural data. Retailers observe how users browse, which products they view and what barriers prevent a purchase. Thanks to this combination, this complete view allows for much more precise segmentation.

New incentives for retailers and brands, with technology as an ally

On the other hand, retailers are feeling growing pressure to diversify their revenue streams. Traditional retail margins are becoming increasingly tight. Advertising, in contrast, offers higher margins without requiring investment in physical stock. For this reason, retailers have started to see their digital platforms as advertising assets. The traffic they generate has its own commercial value, beyond direct sales. As a result, this change is transforming their business model.

From the brands’ side, there is also strong demand for more efficient advertising channels. Budgets are under scrutiny, and a clear and measurable ROI is required. Programmatic Retail Media offers precisely this transparency. In addition, brands are looking for alternatives to dominant platforms like Google or Facebook, where costs are constantly rising and competition is fierce. Retail Media, on the other hand, allows them to reach valuable audiences in a less saturated environment.

Finally, technology is also a contributing factor. Cloud infrastructure makes it possible to process millions of bids in real time. Likewise, machine learning algorithms optimise campaigns with ever-increasing precision. Lastly, advertising management platforms are evolving rapidly. Tools such as retail-specific DSPs and SSPs facilitate the execution and management of complex campaigns, integrating all these advances into a single ecosystem.

Towards the Second Half of 2025: Key Trends and Predictions

The second half of 2025 will see an exponential acceleration of Programmatic Retail Media. Medium-sized and small retailers will enter the market en masse. Democratised technological solutions will allow smaller retailers to launch their own advertising networks and join the expansion.

Below, we will look at some of the trends that will mark the remainder of 2025.

1. Consolidation and standardisation

The industry will evolve towards greater standardisation of processes and metrics. Industry associations will develop common standards for measurement and reporting. This standardisation will facilitate the management of multi-retailer campaigns.

Unified management platforms will gain traction. Brands are demanding tools that allow them to manage campaigns across multiple retailers from a single interface. These platforms will significantly reduce operational complexity.

Interoperability will accelerate the adoption of Programmatic Retail Media by advertising brands, who will be able to integrate their campaigns with multiple retailers more easily, without the need for complex technical developments for each platform.

2. Sophistication of first-party data

Retailers will significantly increase their investment in data and analytics capabilities. They will develop more advanced platforms to centralise customer information, integrating data from different touchpoints. This unified view will allow for much more precise segmentation.

Artificial intelligence will play a key role in this process. Thanks to machine learning, it will be possible to detect behavioural patterns that go unnoticed by human analysis. This will allow for more refined personalisation and much more relevant ads.

3. Expansion of Off-Site Retail Media

Off-site Retail Media will grow very quickly. Retailers will extend their advertising reach beyond their own platforms, using their own data to target ads on the open web.

Alliances between retailers and digital media will multiply. News, entertainment and social media sites will incorporate retail data to improve segmentation. This collaboration will be beneficial for both parties.

Off-site advertising formats will become more sophisticated. Adverts will include real-time stock information, dynamic pricing and personalised calls to action.

4. Integration with other channels

The convergence of Programmatic Retail Media with other advertising channels will generate highly valuable synergies for brands, especially in three main areas:

- Content marketing will become much more personalised thanks to purchase data. This way, users will receive articles, guides and videos adapted to their interests and behaviours, making advertising useful and relevant throughout the entire customer journey.

- Social Commerce will be strengthened by combining actual purchase information with behavioural data from social media. This will make it possible to create more precise audiences and campaigns with higher conversion rates, as well as offering influencers specific data on their followers’ purchasing habits.

- Digital out-of-home (DOOH) advertising will adapt using aggregated local data. Adverts on city screens or in shopping centres will be personalised according to specific purchasing patterns in each area, increasing the effectiveness of the campaigns.

5. AI-driven automation and optimisation

Advertising automation systems will evolve towards greater intelligence and autonomy. Thanks to advances in artificial intelligence, these systems will be able to automatically manage bidding, segmentation and ad creative, adapting them in real time to maximise their impact. This will allow marketing professionals to dedicate more time to designing global strategies and let the tools handle the execution and precise adjustment of tactics.

In addition, AI-based recommendations will become a standard feature on platforms. The systems will continuously analyse campaign performance, identifying patterns and suggesting changes to optimise results. This process will accelerate the learning cycle, allowing for quick and efficient adjustments that will significantly improve the return on advertising investment.

Looking Ahead to 2026: The Future of the Ecosystem

While the second half of 2025 prepares us for a more mature adoption of Programmatic Retail Media, 2026 is shaping up to be a period of consolidation and strategic expansion. We will see this trend become established and completely redefine the relationship between brands, retailers and consumers.

The future of Retail Media will not follow a straight or predictable path. We are entering a stage of simultaneous growth on several fronts: the emergence of new formats such as CTV or shoppable content; the strengthening of alliances between retailers and technology companies; and the growing demand for results measurement and return on investment. This diversity and complexity is forcing industry players to create more agile and connected strategies that can adapt to fragmented audiences and increasingly hybrid customer journeys. Understanding this non-linear nature is fundamental to developing innovative and sustainable solutions in the medium term.

Retail Media Networks as growth engines

One of the pillars of this evolution will be the emergence of Retail Media Networks as growth engines. More and more retailers of all sizes, from supermarkets to specialist shops, will launch and optimise their own advertising networks. These networks will become hubs for monetisation and data, offering brands direct access to high-intent audiences with unprecedented granularity. Competition between these networks will drive innovation and specialisation, benefiting the entire ecosystem.

Advanced measurement and attribution

Hand in hand with the expansion of RMNs, advanced measurement and attribution will be crucial. The sector will move beyond basic metrics to embrace much more precise models that allow for an understanding of the full ROI of Retail Media. This will include not only the impact on online sales, but also the ability to measure the influence on the physical shop. We will see solutions that connect data from online advertising exposure with purchases made at physical points of sale, closing the attribution loop and demonstrating the total value of the campaigns. The ability to link the digital with the physical will be a key differentiator for 2026.

Online-Offline Convergence

Finally, Online-Offline (O2O) convergence will be solidified thanks to Retail Media. It will no longer be about two separate channels, but a single, seamless customer journey. Retail Media will not only influence online purchasing decisions, but will also become a powerful tool for driving traffic and sales in physical shops. Think of segmented ads that direct consumers to the nearest branch with personalised offers, or promotions that are activated when a customer enters a shop and has previously interacted with one of the retailer’s online ads. This O2O integration will transform the shopping experience and open up new avenues for retail marketing.

Source: Retail Media Forecast Update H1 2025 – emarketer, May 2025

Conclusion: Preparing for the Great Wave of Programmatic Retail Media

Programmatic Retail Media represents the most significant transformation in digital marketing since the rise of social media. Its impact transcends the simple addition of a new advertising channel. It fundamentally redefines how brands connect with consumers.

The future of marketing will be programmatic, it will be based on first-party data, and it will be retail-centric. Organisations that understand and embrace this reality will thrive in the new era of digital marketing. Those that resist change will face gradual obsolescence.

The Programmatic Retail Media revolution is just beginning and the next 18 months will be decisive for establishing competitive positions. The time to act is now.