Promotional Trends, Formats and Brand Analysis in the Mexican Meat Market

In Mexico, the meat market is showing constant and sustained growth, reflecting changes in both the national economy and the population’s consumption habits. According to recent data from the Mexican Meat Council, during 2024, meat consumption in the country increased by 4.4% annually, reaching approximately 10.7 million tonnes consumed. This growth is partly explained by improved household incomes, government support and greater economic stability, which are driving demand for high-quality animal proteins. Per capita consumption reached 82.7 kilograms at the close of 2024, consolidating Mexico’s position among the world’s leading meat consumers.

Furthermore, the trend towards ready-to-eat meat products and diversification in formats is driving new dynamics in the sector. The industry is responding to the preferences of an urbanised population that seeks convenience without sacrificing quality, with growth in the cold cuts and processed meats segment, which now accounts for 16% of the total volume purchased by Mexican households. On the production side, investment in processing plants and technologies is strengthening supply capacity for both the domestic market and exports, showing a positive but complex outlook in the face of challenges such as price volatility and variations in input costs.

This context of expansion and evolution lays the groundwork for promotions, formats and brand positioning on the shelf to become fundamental factors for competing effectively in the Mexican market. Analysing these variables in the main meat categories provides companies with precise indicators for designing successful commercial and product strategies in 2025 and beyond.

Main categories and promotional dynamics in the Mexican meat market

Across several articles, we are reviewing a report focusing on 3 high-turnover segments in the Mexican meat market in 2025: Turkey Ham, Cured Ham and Turkey Breast.

In the first article, we discussed shelf visibility (Share of Shelf) and price evolution between January and April 2025. In this second publication, we will delve into the landscape of promotions and their mechanics. We will also talk about the product formats that capture customer preference, and the key insights from the sector’s various leading and emerging brands.

Promotional landscape: where price comes into play

Penetration and depth by category

The promotional landscape for the Turkey Breast, Turkey Ham and Cured Ham categories shows different dynamics in terms of the penetration and depth of discounts.

Turkey Breast stands out as the most aggressive category, with 56.9% of products on promotion and average discounts of -15.68%. This reflects a sustained strategy that combines the perceived value of health and protein quality with price incentives. Turkey Ham follows closely with a 53% presence on promotion and an average discount of -13.66%, in a highly competitive context where promotional pricing becomes a key differentiating element. Meanwhile, Cured Ham shows less activity, with 34.2% of products on promotion and an average discount of -12.36%, although the proportion confirms that even in this segment, the consumer expects price incentives.

Most commonly used mechanics

Regarding promotional mechanics, direct discounts dominate in all three categories, albeit with varying intensity.

Cured Ham accounts for almost two-thirds of these activities, followed by “15% extra savings” and “limited stock”. In Turkey Ham, in addition to discounts and extra savings, bonuses and gifts with purchase also feature with some relevance. This reflects a greater variety in promotional activation. Turkey Breast shows the highest degree of sophistication: alongside direct discounts, mechanics such as “limited stock”, “online price” and bonuses are gaining traction, demonstrating a tactical use of stock and the incorporation of omnichannel strategies. Meanwhile, “15% extra savings” remains a cross-cutting resource in both Turkey and Cured Ham, allowing discounts to be staggered without reaching extreme depths.

Who applies the deepest discounts?

Finally, an analysis by retail chain reveals clear differences in the depth of the discounts applied.

Bodega Aurrera leads with average price reductions of -21.54%, establishing itself as the most aggressive and attractive channel for high-impact price tactics. Soriana (-20.98%) and Walmart (-20.05%) complete the top three, with levels capable of influencing the elasticity of demand across all categories.

In contrast, chains like La Comer (-15.04%) and Sam’s (-14.71%) opt for more moderate promotions, which creates space for communicating attributes and the value of the format to carry more weight. H-E-B (-18.99%), for its part, combines competitive discounts with the backing of a strong own-brand in Turkey Breast, focusing more on quality-value strategies than on a constant price war.

Overview of formats: how the product is sold

The dominant format on the shelf

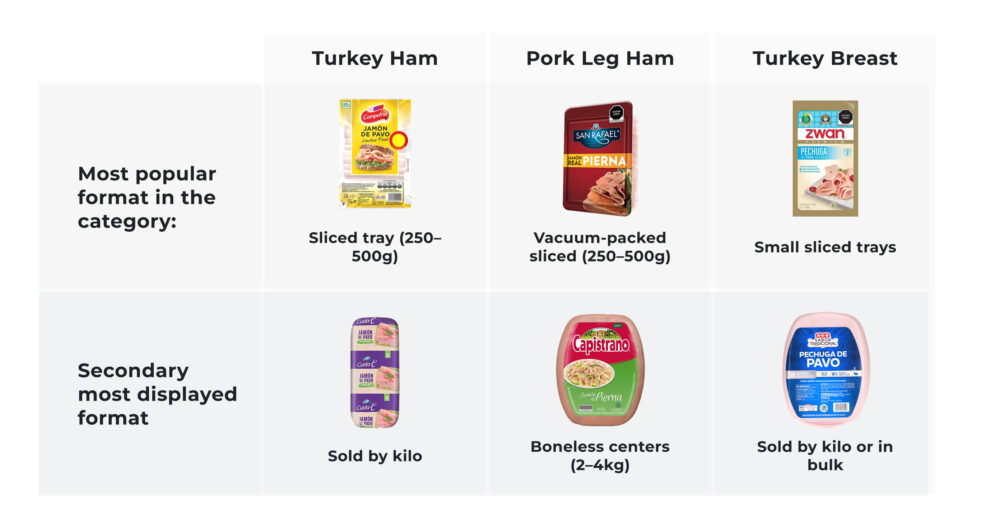

The analysis of the most relevant formats at the point of sale shows a common pattern across the three categories.

In Turkey Ham, pre-packaged slices in 250g to 500g trays are the most popular, while being sold by the kilo remains a secondary option for shoppers looking for a better price per volume. In Cured Ham, vacuum-packed slices in the same weight range also predominate, followed by 2kg to 4kg boneless joints, which cater to large family consumption or light foodservice needs. The star format in Turkey Breast is small trays of pre-packaged slices, although alternatives sold loose or by the kilo serve as a complement.

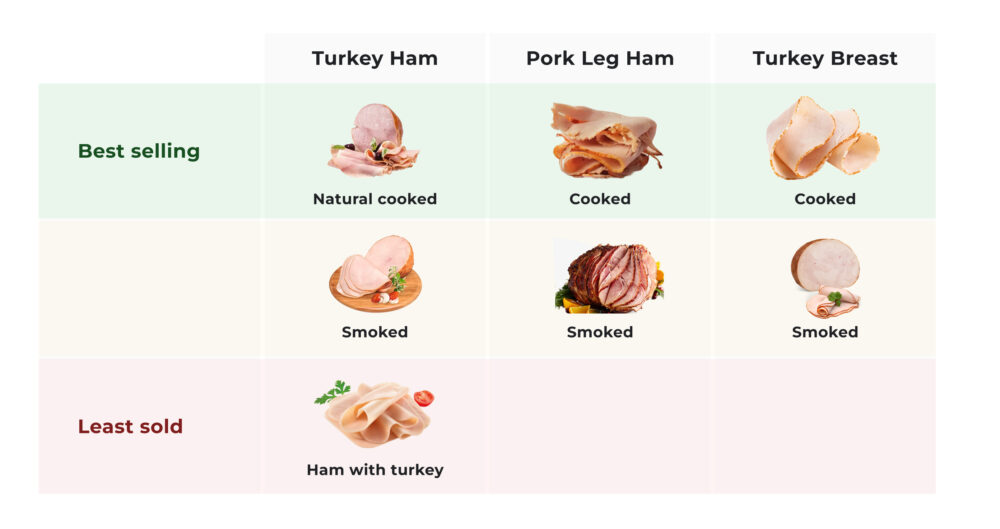

The fastest-moving characteristics

Consumer preferences are concentrated on specific attributes depending on the category. In Turkey Ham, “plain cooked” is the characteristic with the highest presence and turnover, followed by “smoked”, while “with turkey” varieties—blends with a lower proportion of turkey—show the lowest demand.

In both Cured Ham and Turkey Breast, the “cooked” attribute leads, with “smoked” as the second option. This reflects a market inclination towards simple and familiar options, with a growing interest in natural versions.

Brand analysis: strengths and opportunities

Brands with broad coverage

The group of brands with broad coverage is led by FUD, Zwan and San Rafael, all of which have a strong national presence and a diverse portfolio.

- FUD stands out as the leader in Turkey Ham, as well as being in the top 2 for Cured Ham and top 4 for Turkey Breast, with a solid positioning thanks to its health-oriented innovation. Its best lever is to combine price and variety campaigns, both in supermarkets and warehouse clubs.

- Zwan, for its part, excels in Turkey Breast and Turkey Ham, supported by its Selecta line which gives it a premium image, with a balanced positioning across the three categories. Its optimal strategy combines discounts and “limited stock” mechanics, emphasising the quality of its pre-packaged slices.

- San Rafael maintains a traditional and consistent profile in Cured Ham and Turkey Ham, with good national penetration and formats adapted for family consumption and wholesale; the recommendation is to strengthen its large joints for shared consumption, supported by selective promotions.

Specialists and premium offerings

In the premium segment, brands differentiate themselves through their focus on quality and gourmet attributes.

- Bernina is very strong in Turkey Breast and relies on its positioning in select stores, with the opportunity to take advantage of this category’s high promotional level to combine storytelling gourmet with tactical price reductions.

- Bafar offers a premium proposition in Turkey Ham and Cured Ham, although it has a low presence in Turkey Breast; its challenge is to expand this range with health attributes without abandoning its high-quality perception.

- Marietta, with its artisanal processes and emphasis on smoked products, stands out in Turkey Ham and also participates in the other categories. Its strategy involves capitalising on the appeal of the gourmet segment through small packs and activations that reinforce its value.

Retailer’s own brands (private labels)

Private label brands reflect the channel’s influence on promotional and price dynamics.

- H-E-B combines a quality-value positioning with a broad and competitive range. This is especially seen in Turkey Breast, where it enters the top 5 for Share of Shelf. Its strategy should be to maintain medium-to-aggressive prices while differentiating on health attributes.

- Walmart’s Great Value caters to mass consumption with standard quality and modest coverage in all categories, but with great potential to drive traffic by leveraging direct promotions and family packs.

- Bodega Aurrera offers very economical formats with a limited presence, especially in Turkey Ham, but its clear tactic is to sustain deep discounts that allow it to maximise visibility and consistency with its aggressive discount positioning.

Emerging, regional and competitive brands

Emerging and regional brands form a varied group seeking to differentiate themselves through attributes, price or proximity. Kir, with a soya-free portfolio focused on sliced products and small joints, ranks in the top 5 for Turkey Ham, where it can boost its presence with messages about clean ingredients and “limited stock” promotions. Capistrano, with a regional profile and recognised for its artisanal Cured Ham, maintains its strength in hams, although with less visibility in major chains; its opportunities are concentrated in seasonal periods and key regions.

Chimex focuses on Turkey Ham with competitive prices and can grow by strengthening its visibility in 250g–500g trays. Alpino maintains a presence in Turkey with an average consumption profile and potential for expansion into other categories. Lala, with its health focus, is gaining ground in Turkey Breast and should leverage its nutritional benefits in both physical and online environments. Finally, Sabori maintains a solid product range in Turkey Ham with a focus on family consumption, with room to promote “combos” and lunch packs to boost turnover.

Conclusion: a market that rewards precision

The meat market in Mexico shows a fine balance between price, promotion and format. Three conclusions guide commercial execution:

- Price continues to set the pace. With 48% of products on promotion and chains like Bodega Aurrera, Soriana and Walmart applying the deepest discounts, brands must plan promotional calendars by category and by retailer, avoiding a permanent price war and prioritising mechanics with clear objectives.

- The format shapes the perception of value. In Turkey Ham and Cured Ham, selling by the kilo is an ally for improving the cost per kilo; in Turkey Breast, small trays combined with promotions outperform the large format. Size architecture, accompanied by clear communication of attributes (“cooked”, “plain cooked”, “smoked”), is decisive.

- The role of each brand is well-defined. FUD and Zwan maintain broad coverage; San Rafael sustains a national presence; Bernina, Bafar and Marietta capitalise on the premium segment; private labels are gaining ground, with H‑E‑B very strong in turkey breast. For each profile, the winning mix changes: from direct discounts and “15% extra savings” to more tactical mechanics like “limited stock” or bonuses.

Those who align their product range, mechanics and communication by channel will be better positioned to compete on the shelf for the remainder of 2025. If you are looking for the full details by category, retailer and brand, download the complete report and delve into the data that supports these trends.