The Rise of the Grey Market in E-commerce: Economic Risks, Technological Challenges and the Need to Regain Control in 2025

A few months ago, someone bought a latest-generation smartphone on a very well-known platform. The product arrived in its original box, with all the accessories and at an irresistible price. But when they tried to activate the warranty, the technical support service informed them that the serial number corresponded to another region: their purchase was not covered. The experience, which had started with enthusiasm, ended in mistrust.

This type of situation happens every day in e-commerce, and it has a name: the grey market. This is the sale of authentic products — manufactured by the brand itself — through unauthorised channels. The grey market operates in an ambiguous area: the products are genuine, but their circulation is beyond the manufacturer’s control, breaching pricing, territory and service agreements.

According to recent estimates, the grey market is now worth more than 20,000 million euros a year globally, and in some sectors — such as consumer electronics and luxury goods — it accounts for between 5% and 10% of total online sales. These figures not only reflect the scale of the phenomenon but also its growing normalisation on digital channels.

The rise of e-commerce has been the perfect catalyst for this expansion. In 2025, hyper-connectivity, global marketplaces and logistical ease have shaped an environment where the lines between official and unauthorised channels are blurred. For brands, the challenge is to regain control: to protect their margins, their reputation and consumer trust in the face of a parallel market that is growing silently but at great speed.

What the Grey Market Is and How it Differs from Counterfeiting

The grey market (also called the parallel market) refers to the sale of authentic branded products that are circulated through channels not authorised by the manufacturer or brand owner. In other words, the product is not counterfeit, but the distribution channel is outside the company’s approved system.

It is important to distinguish this phenomenon from counterfeiting. With counterfeiting (or the “black market”), the products are imitations that usually violate intellectual property, quality and warranty rights. They can even often put the consumer at risk. In contrast, in the grey market, the product is genuine, but its circulation does not respect the brand’s criteria for price, territory, warranty, service or positioning.

Where do these products come from? The sources are varied:

- Production surpluses: Manufacturers that produce more units than ordered and sell the excess to unauthorised distributors.

- Parallel imports: Products legally purchased in a country where they are cheaper and resold in another with higher prices, taking advantage of market differences.

- Channel diversion: Authorised distributors who sell part of their inventory to unauthorised intermediaries to liquidate stock or increase profits.

- Products intended for specific markets: Items manufactured for specific regions that end up being sold in other markets, often without local warranties or necessary technical adaptations.

This hybrid nature of the grey market makes it difficult to control. Brands face a dilemma: the products are authentic, but their unauthorised sale has serious consequences that affect both the company and the end consumers.

Why Now? The 2025 Context and Figures

The grey market has existed for decades, but it is experiencing exponential growth driven by several converging factors:

- Globalisation of e-commerce: Platforms like Amazon, eBay, AliExpress and new players like Temu have eliminated geographical barriers. A seller in China can market products in Europe or America within hours, facilitating the proliferation of unauthorised channels.

- Economic pressure on consumers: Inflation and economic uncertainty have increased price sensitivity. Consumers actively seek cheaper alternatives, and the grey market offers authentic products at significantly lower prices.

- Sophistication of unauthorised sellers: Grey market operators have professionalised their operations. They use advanced digital marketing techniques, listing optimisation and efficient logistics to compete directly with official channels.

- Difficulty in detection: E-commerce platforms manage millions of sellers and products. Identifying which sellers are authorised and which are operating on the grey market is a monumental challenge. Luckily, the existence of tools like flipflow means that brands are beginning to get a better view of the scope of the problem. Discover in this success story how the Havaianas brand managed to reduce its unauthorised sales by 50% thanks to our solution for controlling distributors and sellers.

The figures are revealing. According to a study by the consultancy Oliver Wyman, in 2021, 13% of global consumer sales came from products sold in markets other than those intended by the manufacturer. Furthermore, these sales were made at prices between 20% and 30% lower than the net purchase price for retailers in those markets.

In short, in 2025, the technological, logistical and channel context has changed enough for the grey market to cease being a minority phenomenon and become a structural threat to many brands.

The Triple Threat: Economic, Technological and Reputational Risks

The impact of the grey market goes beyond a simple loss of sales. Brands face a multidimensional threat that affects their finances, operations and public perception.

Economic Risks

From an economic point of view, the grey market directly affects margins, the ecosystem of authorised distributors, and the forecasting of legitimate sales.

Some of the main consequences are:

- Price erosion: when products appear on the unauthorised channel at lower prices, authorised distributors may be forced to lower their prices to compete, reducing their margins and even disincentivising the commercialisation of the product.

- Channel conflict: authorised distributors may feel aggrieved to see a third party not subject to the brand’s standards selling more cheaply, and may stop collaborating or put less effort into the brand, which affects coverage, service and image.

- Reduced control over stock and demand: products that are diverted from the official channel can cause the brand to lose visibility of the end consumer, which makes it difficult to plan inventory, promotions and product development.

- Devaluation of brand value: When consumers get used to seeing a brand’s products at much lower prices on the grey market, they begin to think that the official price is artificially inflated. This perception damages the image of quality and exclusivity that many brands have built up over years. A revealing example was reported by the Financial Times: a luxury watch, with an official price of £42,600 at an authorised distributor, was offered on the grey market for just £27,227. Although the product was identical, the price difference was enough to call its perceived value into question and cast doubt on the essence of “luxury” that the brand wanted to convey.

Technological and Product Risks

Grey market products, although authentic in origin, present significant technical risks that many consumers are unaware of.

- Regional incompatibility: Many electronic products are manufactured with different specifications depending on the target market. A mobile phone intended for the Asian market may lack the 5G frequency bands used in Europe, limiting its functionality. Differences in voltages, connectors and safety certifications are also common.

- Absence of valid warranties: Grey market products rarely include warranties recognised by the manufacturer in the market where they are sold. If the product fails, consumers discover that they cannot access the official technical support service, leading to frustration and complaints.

- Software and updates: Some grey market devices may have modified software versions or lack access to official updates. This particularly affects connected products that rely on cloud-based applications and services.

- Traceability and safety: The chain of custody in the grey market is opaque. Products may have been stored in inadequate conditions, handled incorrectly or even modified during their journey through unauthorised channels. In sectors such as cosmetics or food supplements, these conditions put consumer safety at risk.

- Compromised Digital Shelf visibility and accuracy: when products are distributed outside the official channel, the brand loses control over how they are listed, with what images, what messages or at what prices. This directly affects its presence on marketplaces, content management, message consistency and search optimisation. With flipflow, none of this will go unnoticed. Request a demo and discover everything you can control using our platform.

Reputational and Brand Risks (the intangible damage)

Beyond the numbers, the impact on the brand and customer perception is perhaps the most subtle and, at the same time, the most lasting.

- Deterioration of the customer experience: Consumers who buy grey market products expect the same quality and service they would get from official channels. When they face compatibility problems, a lack of warranties or poor after-sales service, they blame the brand, not the unauthorised seller.

- Market confusion: The proliferation of unauthorised sellers creates uncertainty. Consumers cannot easily distinguish between official and parallel channels, which complicates purchasing decisions and reduces trust in the brand.

- Association with questionable practices: Although the products are authentic, a massive presence on the grey market can associate the brand with non-transparent business practices, affecting its image of integrity.

- Impact on premium positioning: Brands that base their strategy on exclusivity and superior quality suffer particularly. Widespread availability at reduced prices erodes the perception of premium value, making it difficult to justify higher prices in official channels.

Strategies and Tools for Brand Protection

Given the scale of the risks described, brands must act deliberately to regain or strengthen control. Below, we set out a roadmap with key strategies:

1. Channel audit and full visibility

- Map all distributors, resellers, sub-resellers and product flows that can generate diversions.

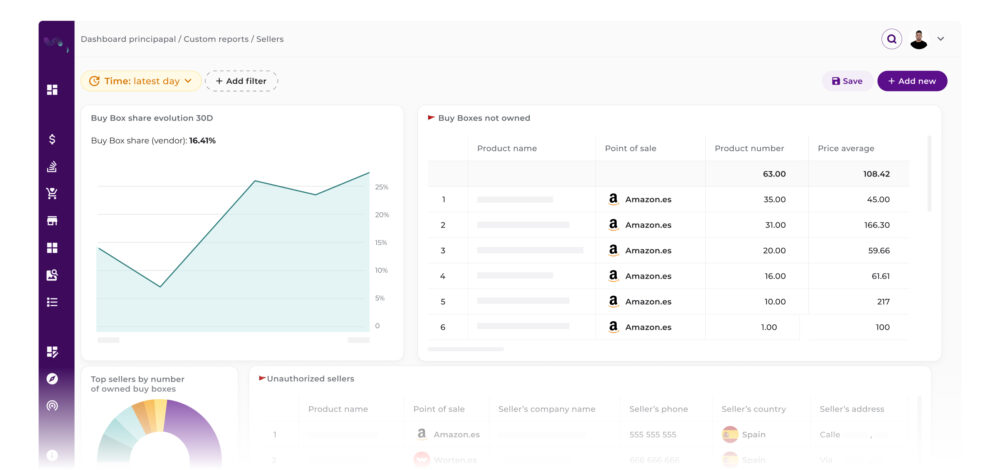

- Implement monitoring tools like flipflow, which analyse in real time online product listings, prices, seller location, language, and ratings.

- Make test purchases and trace the origin of products that appear on suspicious channels (for example, with a different country edition or different packaging) to detect leakage points in the chain.

2. Control of pricing, territory and warranty

- Establish a Minimum Advertised Price (or MAP) policy and ensure that all authorised distributors respect it.

- Identify price deviations that are clearly below the standard (a typical sign of the grey market).

- Ensure that the product warranty and after-sales service are conditional on the official channel and communicate this clearly to the consumer.

- Review distributor contracts to include non-resale clauses for unauthorised territories, or at least track cross-border sales.

3. Strengthen traceability and the product

- Introduce traceability elements (unique codes, QR, RFID) that allow the product’s region of origin and distribution channel to be identified, and thus detect parallel imports.

- For products with territorial dependence (e.g., electronics with an adapter, software with a regional licence), design market-specific versions or, when this is not feasible, adjust the protection strategy.

4. Collaboration with marketplaces and legal compliance

- Use the “brand registry” tools offered by some marketplaces (e.g., Amazon or Walmart) to report unauthorised sellers.

- Collaborate with marketplaces to establish authorised channel policies and demand information about sellers who list your products without authorisation.

5. Consumer communication and education

- Inform the end customer about the difference between authorised and unauthorised channels: warranties, returns, service, product versions.

- Incentivise your authorised distributors to communicate the value of the correct channel: service, support, authenticity, trust.

- Create a visible list of authorised sellers on your website and warn about the risks of buying outside the official channel.

6. Permanent monitoring and adjustment of digital strategy

- Establish dashboards for Digital Shelf Analytics that show where your product is listed, at what price, who is selling it, what the seller’s reputation is, returns, negative ratings, etc.

- Adjust your e-commerce and distribution strategy, taking into account the risk of channel leakage.

- Implement sanctions or suspend relationships with distributors who generate major leaks.

Taken together, these actions will allow the brand to regain control, minimise leaks, protect prices and preserve the customer experience, which is key to defending brand value in the medium and long term.

From Lack of Control to Strategy: the Path to Curbing the Grey Market

The grey market has established itself as a silent crack in e-commerce. It occupies a middle ground between the logic of fraud and the formal market, eroding brands’ control from within. Its expansion in 2025 is not only explained by technology, but by a deeper imbalance: the tension between the immediacy that consumers seek and the consistency that brands need.

Faced with this scenario, the challenge is to rebuild the channel map: to understand where value is leaking, how the warranty is diluted and at what point the brand experience is lost. And the answer lies in the ability to connect data, decisions and relationships within a single framework of trust.

Regaining control means acting with precision, not urgency. It means using analytics to detect leaks, adjust agreements with distributors, review the pricing strategy and communicate to consumers what it really means to buy safely.

In a market where products travel faster than reputation, the brands that manage to strike that balance between visibility and consistency will be the ones that retain their value. Not by resisting the grey market, but by understanding that their greatest defence is to get to know their own channel in depth once again.