The Rise of Vertical Retail Media: Why Niche Markets Outperform Traditional Categories in ROAS

For years, the conversation about Retail Media has revolved around the same names: Amazon, Walmart or Mercado Libre. By late 2025, however, growth is shifting elsewhere: Retail Media networks of specialised retailers by category. These networks are offering better efficiency metrics and higher ROAS than many generalists.

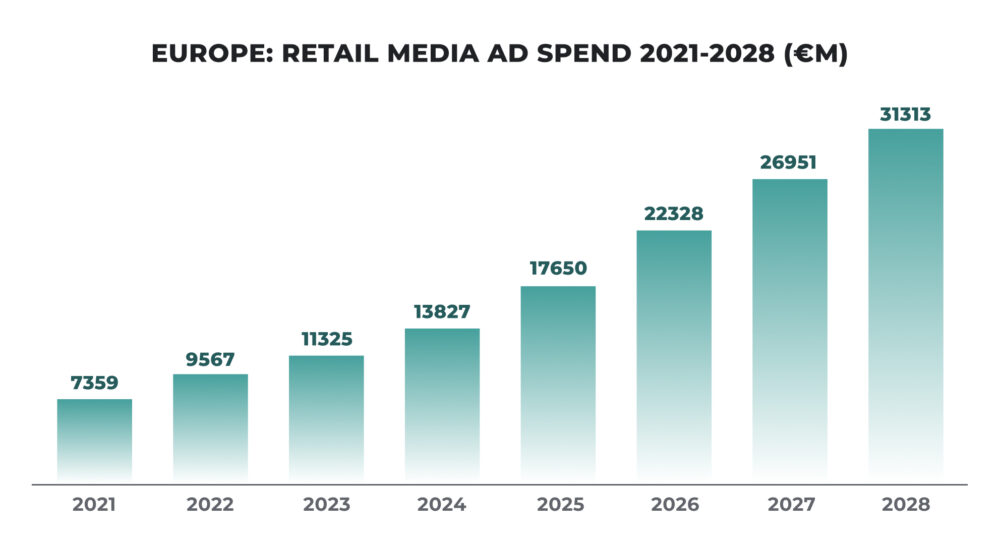

In Europe, it is estimated that the Retail Media market will double in four years. With annual growth four times higher than that of digital advertising as a whole, it will exceed €31 billion by 2028.

Source: European Retail Media set to double in four years – WARC, October 2024

In this context, vertical platforms focused on specific sectors, such as household cleaning, pet products or sporting goods, stand out for their advertising effectiveness. They demonstrate return on investment (ROAS) capabilities that systematically outperform traditional categories. The main reason lies in the precision of their first-party data and the high purchase intent of their audiences.

In this article, we will explore how niche markets are redefining expectations in Retail Media and which categories are leading this revolution. Furthermore, we will analyse the concrete strategies that brands can implement to maximise their performance in these specialised environments.

The Current Landscape: Retail Media Beyond the Giants

Retail Media will cease to be an “emerging channel” to consolidate itself as the third great advertising pillar alongside search and social, with a projected global volume close to $180 billion in 2025. In Europe, recent reports from IAB Europe show strong optimism: the majority of advertisers and agencies state they are increasing investment and particularly value access to first-hand retailer data and proximity to the point of sale.

Although large marketplaces continue to concentrate a good part of the advertising budget, the ecosystem is expanding rapidly. More and more medium-sized and specialised retailers are launching their own Retail Media networks to monetise their audiences and consumer knowledge. This phenomenon is especially visible in categories where the purchase decision is more complex, more recurrent or strongly linked to trust.

This expansion has a clear effect: advertising inventory is fragmenting, but far from being a problem, it opens up new opportunities for brands. Less saturated environments are emerging, with high-intent audiences and, above all, a much greater capacity to measure the real impact on incremental sales, and not just on clicks or impressions.

Compared to generalist platforms, where a dog food brand competes for attention with electronics, fashion or entertainment, vertical retailers offer a context completely aligned with user intent. When a consumer browses a shop specialised in pet products, each advertising impact occurs within an environment where the predisposition to buy is already activated. This multiplies relevance, efficiency and, ultimately, return on investment.

Niche Categories Leading the Revolution

Household Cleaning

Home and DIY retailers have become key players in Retail Media because they concentrate high-value purchases and long decision processes, which require more impact than the typical last-minute banner. Networks such as The Home Depot’s (Orange Apron Media) combine millions of e-commerce visits with in-store purchase data and advanced geographic and contextual segmentation solutions.

Furthermore, their measurement approach no longer focuses only on ROAS. They use frameworks such as ROMO (Return on Marketing Objective), which contemplate brand objectives, average order value, cross‑sell or recurrence. For cleaning and home maintenance categories, this allows campaigns to be linked to behaviours such as scheduled replenishment, renovation projects or seasonal changes. In this way, every euro invested is more likely to generate real value.

Moreover, these platforms capture valuable data on very specific preferences. For example, consumers concerned about eco-friendly products, those who prioritise efficacy over price or buyers sensitive to fragrances. This granular segmentation allows for extraordinarily relevant advertising campaigns.

Pet Products

Pet care is considered a recession-resistant market with strong migration to the online channel, where some estimates place it close to 40% of sales, with prospects of exceeding 50% in the medium term. Digital marketing benchmark studies show that this category records above-average click-through rates and lower acquisition costs than many other consumer verticals.

Retailers and specialised platforms, such as Chewy or large grocery chains with a strong pet care assortment, use subscription and loyalty programmes to enrich their first-party data and segment by pet type, size, sensitivity, average order value or purchase frequency. This context favours highly profitable Retail Media: clear audiences, recurrent buying cycles and scope to test creatives oriented towards “new‑to‑brand” and increasing basket value with treats, toys or accessories.

Luxury Beauty and Health

The premium beauty and skincare segment has seen a proliferation of specialised platforms offering sophisticated advertising experiences. Retailers such as Sephora, Ulta Beauty and others have developed robust advertising capabilities.

The beauty category benefits especially from enriched advertising formats: application tutorials, user-generated content, detailed reviews and personalised recommendations based on skin type, specific concerns and ingredient preferences. Recent reports point out that niche and independent brands are growing faster than large consolidated groups, which reinforces the role of specialised Retail Media as a lever for visibility and discovery.

In parallel, health and wellness categories (supplements, advanced personal care, health devices) leverage user sensitivity to expert recommendation and social proof. Retail Media networks in online pharmacies and parapharmacies allow combining transactional information with contextual signals, such as seasonal changes or wellness-linked campaigns. Thus, they can launch highly relevant messages via native formats, educational content and personalised recommendations.

Sports and Fitness

Sport and fitness constitute another fertile field for vertical Retail Media. Sports retailers , from large chains to cycling or running specialists, know not only what is bought, but how often, in which discipline and at what level. This depth allows for segmentation by practice profile (beginner vs. advanced), average order value or interest in premium brands.

In this context, campaigns can focus both on direct conversion of high-value equipment (bicycles, technical gear) and on cross-selling accessories, apparel, sports nutrition or services (workshop, repairs, experiences). The possibilities multiply when the retailer combines its e-commerce data with loyalty programmes, training apps or in-store experiences.

Why Do Niche Markets Achieve Better ROAS?

There are several reasons why these verticalised markets achieve a better return on advertising investment. Below, we review them:

Ultra-specific first-party data

The first decisive factor is the quality of first-party data. Consultancies like BCG point out that the advanced use of this data can generate revenue increases of between 3% and 5% and similar improvements in margin, especially when integrated into Retail Media strategies. Specialised retailers have a detailed view of purchasing behaviour in their category that generalists cannot match.

Knowing the type of pet, the level of sports practice or the skincare routine allows for the creation of audiences and messages that fit precisely. This level of granularity increases the probability of clicks and conversion, and reduces impression wastage, which directly improves ROAS.

High-intent audiences

Purchase intent represents perhaps the most determining factor in advertising effectiveness. When a user browses a platform specialised in baby products, their categorical intent is already declared. Each visit represents an extremely high-value advertising opportunity.

Contrast this with generalist platforms where a user might be exploring electronics, clothing and food products in the same session. The dispersion of intent dilutes advertising effectiveness. In vertical environments, thematic concentration ensures that each advertising contact occurs at a mentally receptive moment.

Vertical benchmark studies show that, in categories such as pets or beauty, click-through and conversion ratios for well-segmented campaigns can be clearly above generalist e-commerce averages. The result is a superior ROAS without the need to multiply investment.

Unique buying cycles requiring sophisticated measurement

Another decisive factor is the way in which measurement is adapting to the long or recurrent buying cycles specific to each category. Each vertical has very different consumption dynamics, and specialised platforms know them in depth. Whilst cleaning products are repurchased every three to six weeks, sports equipment can have decision cycles that span months or even years, albeit with more frequent complementary purchases over time.

This reality is leading advertisers and Retail Media networks to go beyond traditional ROAS. It is becoming increasingly common to incorporate metrics such as incrementality (iROAS), “new-to-brand” sales, contribution to brand objectives or advanced attribution models. In niche markets, where a single conversion can imply high value or a long-term subscription, this approach is especially relevant. A higher initial advertising cost can be amply compensated in the medium and long term.

Thanks to a much more sophisticated understanding of the customer journey, it is possible to apply optimisations that could not be implemented on generalist platforms. In the latter, homogeneous attribution models are used for categories with radically different purchasing behaviours.

Lower advertising saturation

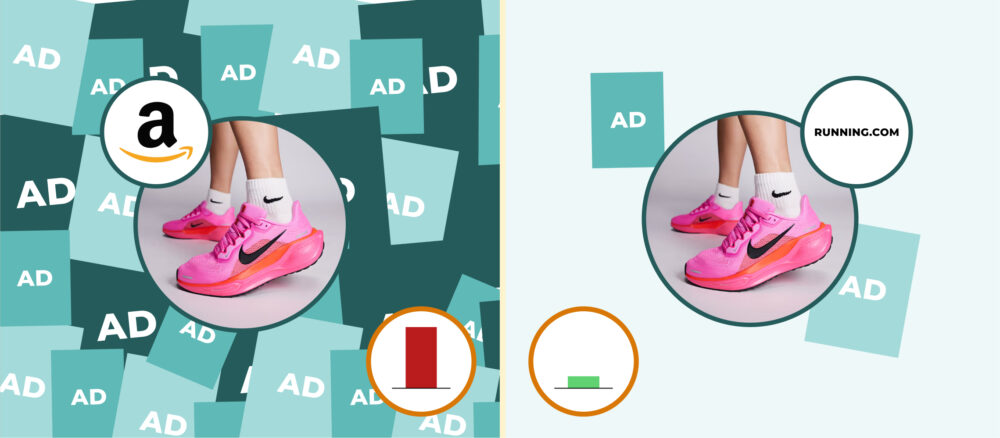

Vertical platforms usually present environments less saturated with advertising than the generalist giants. Whilst on Amazon a product may compete with dozens of ads on the same page, smaller specialised retailers maintain more moderate advertising densities.

This lower saturation benefits both users and advertisers. Consumers experience less advertising fatigue, maintaining receptiveness towards well-targeted messages. Brands, for their part, obtain greater relative visibility for each impression purchased.

Furthermore, competition for advertising inventory is usually less fierce on emerging vertical platforms, resulting in significantly lower costs per click. A brand can obtain premium placements at a fraction of the cost it would pay on massive platforms.

Strategies to Maximise ROAS in Specialised Markets

Selection of specialised RMN

The strategic choice of vertical Retail Media networks constitutes the first critical step. Not all specialised platforms offer the same capabilities or reach the right audiences. For a sports supplement brand, for example, it may make more sense to prioritise a sports retailer with a strong digital presence than a generalist marketplace.

Brands must evaluate various factors, such as audience size and composition, and the quality of data available for segmentation. They must also consider the sophistication of advertising tools, the formats offered and measurement capabilities. It is preferable to concentrate investment on two or three leading vertical platforms than to scatter it across dozens of smaller specialised sites without critical mass. Alignment between the platform’s customer profile and the brand’s target audience is also fundamental.

Leverage emerging formats

The formats working best in niches combine relevance and storytelling capacity: sponsored video, native ads in product carousels, recommendations in internal search results or in‑store activations synchronised with digital campaigns.

In niche categories, showing product usage, the expected result or testimonials from other customers has a direct impact on the purchasing decision. Combining these formats with high-impact placements (category pages, search results, baskets) ahelps to increase incremental sales and ROAS.

The key is to view these specialised formats as strategic investments rather than additional costs. The incremental return amply justifies the extra creative effort.

Personalisation based on behavioural data

The great asset of niche retailers lies in the depth of their user behaviour data: purchase history, frequency, price sensitivity, preference for certain brands or ranges. Activating this data in dynamic campaigns allows the message, recommended product and impact frequency to be adapted to each segment. Personalisation is not limited to the initial advertising message. It extends to the entire post-click experience, including adapted landing pages and purchase journeys optimised for each profile.

Recent cases on Retail Media platforms show significant increases in “new‑to‑brand” and average order value when strategies based on consumption moments (for example, monthly pet food purchase or sports season preparation) are used and creatives are adjusted to those contexts. At this point, brands benefit especially if they can cross-reference information from various networks and understand which segments respond best at each retailer.

Continuous testing and optimisation

Vertical markets, although smaller than massive platforms, still offer sufficient volume for rigorous testing programmes. This includes A/B testing of creatives, experimentation with different audience segments, variation of promotional offers, campaign timing aligned with specific buying cycles, and optimisation of bidding strategies.

The advantage of vertical platforms is that learning cycles are faster. With highly relevant audiences, performance signals emerge more quickly, allowing for agile iterations. A campaign can be significantly optimised in days or weeks, compared to months in less focused environments.

For the advertiser, the challenge is to coordinate this information centrally and convert it into a clear budget distribution strategy by channel and category.

Conclusion: The Future of Retail Media in Niche Markets

Everything points to Retail Media continuing to grow at double-digit rates in the coming years. But what is truly relevant is not just its size, but how its structure is transforming. In Europe, the development of local and regional networks, together with the strength of specialised retailers in categories such as food, beauty, sport or home, is shaping an ecosystem that is much more diverse, fragmented and, at the same time, more sophisticated than that of other markets. In this new scenario, niche markets cease to be a residual space to become one of the most promising terrains of the channel.

Trends consolidating the prominence of niches

The very trends defining Retail Media in 2025 reinforce this competitive advantage of vertical environments. The growth of off-site Retail Media —where retailer data is activated on third-party media such as social networks, online video or display— clearly favours those with well-defined audiences, clear interests and high purchase intent. Added to this is the take-off of in-store media, which allows the loop between digital impact and physical purchase to be closed through screens, dynamic signage and omnichannel experiences. In categories where the product is tested, touched or experienced, this bridge between the digital and physical worlds multiplies the value of the advertising impact.

Furthermore, the consolidation of measurement standards and best practices in incrementality and attribution are reducing entry barriers for many advertisers. As analysis tools mature, it becomes increasingly simple to demonstrate that a campaign at a niche retailer does not just generate visibility or clicks. It also allows real sales, incremental growth and long-term value to be measured.

In this context, niche categories start with structural advantages that are difficult to replicate in generalist environments. Brands that know how to combine these strengths with an orderly strategy of network selection, formats and measurement models will be in a privileged position to protect their margin, gain relevance and grow sustainably in the coming years.