Who Dominates the Shelf: Share of Shelf and Price Evolution in the Mexican Juice Market

The juice market in Mexico represents an industry valued at over 2,815 million dollars in 2024, with annual growth projections of 4.5% to reach 4,200 million dollars by 2034. These figures reflect a consolidated industry that generates significant employment and economic activity throughout the value chain, from fruit production to final retail.

Although the economic activity figures are solid, the juice market in Mexico is going through a period of adjustment. Consumers are looking for a balance between health, convenience and price, and this combination is reshaping the shelf. In homes, family-sized packs for stocking the pantry coexist with ready-to-drink options that fit in with the daily routine. Meanwhile, there is growing interest in products with less sugar and clear labelling. Competition in supermarkets, warehouse clubs and e-commerce maintains constant pressure on prices and brand visibility. In this context, knowing who is gaining shelf space and how prices are moving by format is crucial for sustaining growth.

Against this backdrop, at flipflow we have analysed the market. We used data collected between January and April 2025 from the digital channels of Bodega Aurrera, Sam’s, Walmart, Soriana, Chedraui and H‑E‑B. In this first instalment, we focus on two key questions: who is winning the shelf and how are prices evolving by category and format. The categories studied are 100% Juice, Juice Drink and Green Juice. This allows us to capture the dynamics of the mass-market segments and the functional niche that currently embodies the perception of “healthy”.

Share of Shelf Overview

Share of Shelf reflects what percentage of the visible assortment in an online shop belongs to each brand. It is a direct indicator of presence and negotiating power, and a good barometer of competitive rivalry. A higher percentage means more opportunities for searches and purchases, as well as better conditions to drive turnover.

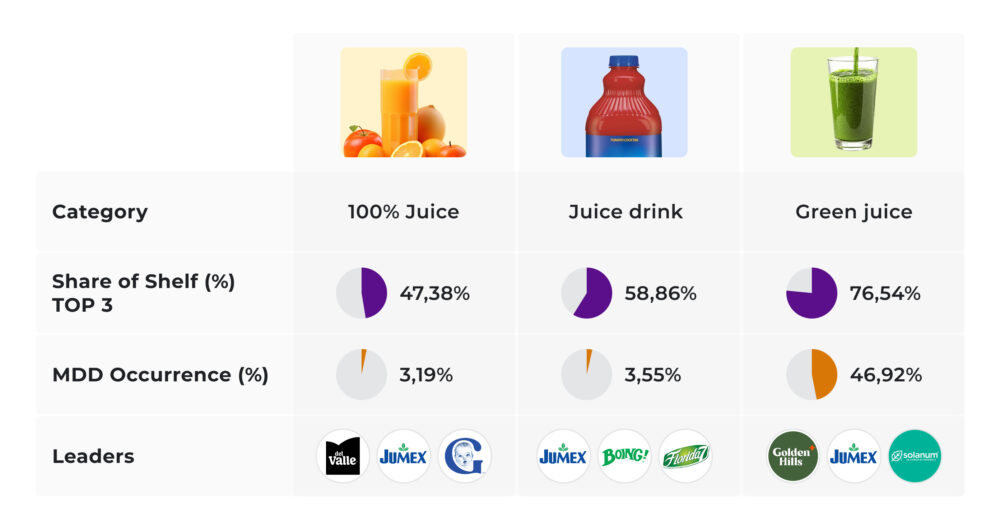

The analysis of brand share in the Mexican juice market reveals an ecosystem divided into three distinct speeds.

100% Juice: the main stage for competition

Within the juice universe, 100% Juice appears as the broadest and most fragmented category. There are 439 active SKUs and, although there are clear leaders, the “long tail” of specialised and imported brands adds variety and increases rivalry. The Top 5 accounts for 65.4% of the Share of Shelf, with Del Valle in the lead (22.1%), followed by Jumex (14.35%) and Gerber (10.93%). Boing, Campo Vivo, Old Orchard, Frutos de Vida, Martinelli’s and Pomita complete a group of players that, together, sustain turnover on the shelf. The weight of Own Brand (private label) is limited: it reaches 3.19% of the shelf, a sign that the “100% fruit” promise and trust in established brands act as barriers to entry for the retailers’ own labels.

For portfolio management, this snapshot suggests that the battle to gain centimetres on the shelf is more about the breadth of the assortment than a single bestselling SKU. A variety of flavours, mixed packs and a range of sizes that cater to different consumption occasions are more effective levers than an approach limited to negotiating facings per SKU. For retailers, developing an Own Brand for 100% Juice will require differentiated propositions in origin, freshness or convenience that can genuinely displace the preference for traditional brands.

Juice Drink: a category concentrated among a few champions

The picture changes when analysing Juice Drinks. Here, the number of products is smaller (141 SKUs) and the concentration is higher. The Top 5 holds 78.8% of the Share of Shelf. Three brands take up a large part of the space: Jumex with 26.95%, Boing with 16.31% and Florida 7 with 15.60%. Ciel and Vigor complement the offering, while Own Brand is once again negligible at 3.55%.

This structure makes it clear that traditional leaders set the pace for the category. For new brands, entry requires very clear differentiation in price per litre, flavour or benefits, as well as an assortment strategy that covers both family sizes and individual portions.

Green Juice: retailer dominance and a premium logic

In Green Juice, the shelf space shrinks and power is reconfigured. Only 81 SKUs are identified and concentration is high: the Top 3 accounts for 76.5% of the Share of Shelf. In this segment, Own Brand is decisive, making up 46.92% of the space. Golden Hills leads with 39.51% and, together with H‑E‑B and Member’s Mark, shapes a “retailer-led” category.

Among the national brands, Jumex stands out with 30.86%. This combination creates fertile ground for tactical innovation by retailers, who can set reference prices and build category loyalty through their Own Brands, while manufacturers must compete with carefully crafted premium propositions in terms of ingredients and health messages.

Prices: how value per litre is shifting

The analysis of price evolution by format reveals different behaviours across categories:

- 100% Juice: The 1-litre format shows a downward trend during the observed period, falling from $58.58 in January to $54.58 in April, with a low of $52.51 in March. This trajectory indicates greater pressure from promotions or a recalibration of the price architecture to sustain volume. In contrast, the large 1.89-litre format remains practically stable; the net variation compared to January is -0.2%. The result is a clear advantage for family-sized packs: the saving per litre for the larger size is around 42% compared to the 1-litre pack, giving the shopper a clear incentive to stock up the home with larger-sized formats.

- Juice Drink: This category shows the opposite behaviour. The 1-litre size recorded a sustained 12.9% fall in its average price, while the 1.89-litre size rose by 7.4% between January and April. The consequence is that the per-litre incentive erodes significantly: the per-litre difference between the 1 L and 1.89 L sizes falls from approximately 21.5% in January to a mere 3.1% in April. When the benefit of the larger format almost disappears, demand tends to shift towards the 1-litre size, which can compromise family-size volume and profitability. Reviewing the price ladder and, if necessary, relying on combos or multipacks to re-establish the advantage of the 1.89 L size becomes a priority.

- Green Juice: In this category, the trend is towards price increases. The price of the 1-litre size increased by 18.4%, from $99.89 to $118.25, and the small 700 ml format rose by 28.6%, from $58.32 to $75.00. This consolidates a significant price premium compared to the other categories: one litre of Green Juice costs, on average, around 2.7 times more than a litre of 100% Juice and nearly 4.5 times more than a litre of Juice Drink. The larger increase for the 700 ml size highlights a willingness to pay for convenience and immediate consumption, which reinforces the segment’s premium positioning.

What the same SKUs reveal in different chains

To understand the dispersion by channel, prices of representative products were compared.

- For Del Valle Reserva 100% Orange Juice 946 ml, the difference between the maximum and minimum price reaches $7.09, equivalent to a 25.9% variation between chains. Bodega Aurrera offers the lowest price ($27.35) and Soriana the highest ($34.44). The simple average is $30.52.

- In the case of Jumex Peach Juice Drink 1.89 L, the gap is even greater: $17.58 between chains, representing a 49.4% difference. Bodega Aurrera has the lowest price ($35.62) and Chedraui the highest ($53.20). The simple average is $43.69.

- For Clamato The Original Juice 1.89 L, the difference is $10.04 (17.6%, the smallest difference among the three products compared), with a low at Bodega Aurrera ($56.96) and a high at Soriana ($67.00), and an average of $58.83.

This pattern leads to two conclusions. Firstly, dispersion by retailer is high, even when geographical dispersion is low. Each chain’s policy, costs and promotional intensity explain why the same SKU can show such marked differences. Secondly, it is essential for brands to adjust suggested prices by channel and negotiate appropriate exposure; the national list price does not guarantee consistency in the perception of value if it is not accompanied by a retailer-specific strategy.

Prices by city: stability with specific premiums

The geographical comparison using Del Valle Reserva 100% Orange Juice 946 ml in 40 cities confirms that the national average price is around $32.3 per unit, equivalent to about $34.2 per litre.

Most locations are concentrated in a narrow band between $31.7 and $32.9. The gap between the cheapest and the most expensive city is contained. Veracruz marks the lowest price at $31.13 and Mexico City the highest at $34.05; the total difference is $2.92, around 9%.

The capitals with the greatest economic activity, such as CDMX, and cities like Santiago de Querétaro, San Luis Potosí and Boca del Río, tend to be above the average. In the tourist destinations of the southeast and the coast—Cancún, Playa del Carmen and Mérida—slight premiums appear, consistent with seasonality and logistics. In contrast, the Monterrey corridor and its metropolitan area, along with Saltillo, Aguascalientes and León, remains in the most competitive range, typically between $31.7 and $31.9.

Volatility within each city is low. In most cases, the maximum price is the same as the minimum, or differs very little. The exception is the capital, where a range of around $1.00 (3%) is observed, a sign of a greater mix of formats and promotional activity.

Practical implications of the analysis

For manufacturers, gaining Share of Shelf in Mexico involves designing a portfolio with more touchpoints by flavour, size and pack, and managing the price-per-litre difference with surgical precision. For 100% Juice, it is advisable to use the 1-litre size as an entry point or anchor for new flavours, while protecting the margins of the 1.89 L size. In Juice Drinks, it is urgent to recover the incentive for the large size through RRP adjustments, bundles or promotions that are clearly defined in the calendar, so as not to dismantle the price ladder. In Green Juice, the challenge is to justify the premium: ingredients, freshness, low sugar and functional benefits must be made explicit in the product description and image to sustain conversion.

For retailers, the pricing strategy per chain makes the difference. The evidence of gaps of up to 49.4% for the same SKU calls for a review of the consistency between the store’s positioning, promotional aggressiveness and Own Brand development. In Green Juice, the leadership of own brands opens the door to format innovations and value messages that build category loyalty. At a geographical level, price stability allows for planning specific adjustments only in locations where traffic and seasonality justify a premium, as is the case in large cities and tourist areas.

From data to advantage: towards leadership in juices

The juice market in Mexico combines mass-market appeal with expanding niches. 100% Juice is broad and competes for space based on variety, with a solid incentive towards family-sized formats. Juice Drink is heavily concentrated and is experiencing a redefinition of its price architecture, which currently favours the 1-litre size. Green Juice operates with a premium logic and retailer leadership, with significant price increases that consumers accept when they perceive convenience and clear benefits.

To grow, brands and chains must align on three fronts: sustained visibility on the shelf, prices per format that reflect real value for the shopper, and an assortment that connects with consumption occasions. Whoever achieves this coordination will turn the shelf into a competitive advantage measurable in traffic, turnover and margin.