The Future of European Grocery Retail: Insights from McKinsey’s 2025 Report

Introduction

European grocery retail is on the brink of change. In McKinsey’s “The State of Grocery Retail Europe 2025” report, the authors—Daniel Läubli and colleagues from McKinsey & Company, in partnership with EuroCommerce—examine recent market dynamics, reveal learnings from growth champions, and set a forward-looking agenda for the sector.

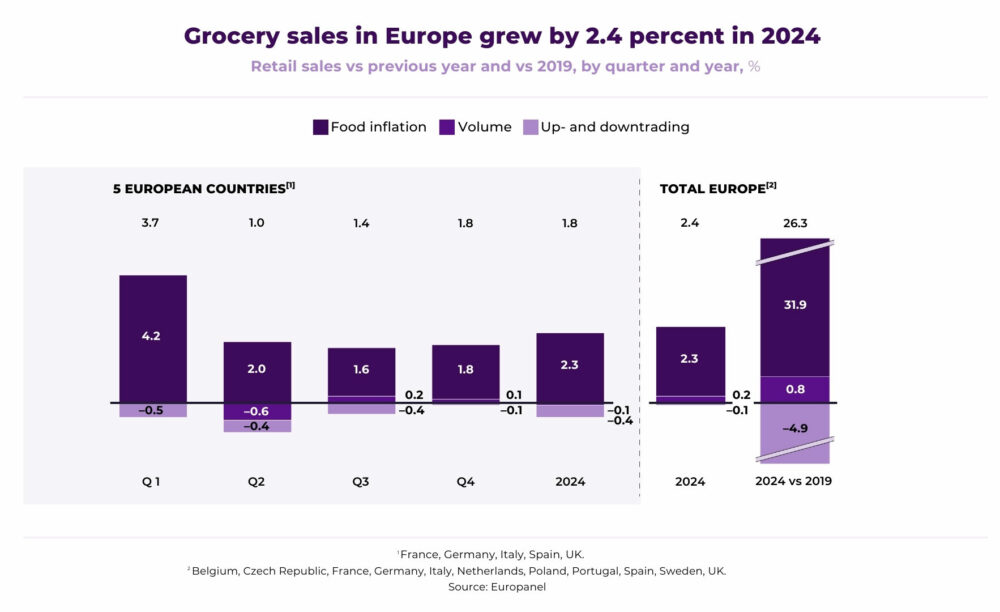

The report offers a comprehensive overview of the current state and future outlook of grocery retail in Europe. After several years of volatility, 2024 marked a period of stabilization, with modest growth driven primarily by food price inflation and slight increases in volume. However, inflation-adjusted revenues still remain below pre-pandemic levels. Throughout the analysis, McKinsey highlights the common traits of the most successful grocers—those gaining market share and outperforming competitors—including a strong focus on private labels, high product quality, and a pleasant in-store experience.

Looking ahead to 2025, there is cautious optimism among industry leaders, but the environment is expected to remain challenging. With low volume growth and continued margin pressure, long-term success will depend on grocers’ ability to differentiate, improve operational efficiency, and embrace innovation through data, AI, and emerging technologies.

In the following sections, we dive deep into the key trends shaping the industry, the strategic implications for grocers, specific market KPIs for Spain, and our concluding thoughts.

Key Trends Explained

McKinsey identifies nine trends that will define European grocery retail in 2025 and beyond. These trends touch on everything from volume growth and private labels to the transformative power of technology and sustainability. Here are the major trends:

1. Low Volume Growth

Volume growth is forecast to remain modest—about 0.2 percent annually across Europe until 2030. This slow growth persists despite the rising prices and ongoing cost pressures. In some regions—Central and Eastern Europe—the trend may even be negative. Despite these challenges, overall stability offers grocers a chance to fine-tune their strategies.

Categories that are expected to grow the most include fresh foods, healthy foods, and functional foods, such as power bars, protein-rich options, and sports drinks. Convenience and food-to-go categories are expected to be major growth pockets, too. Among channels, online is expected to see the highest growth (2.0 percentage points above average), followed by discounters (0.8 percentage points above average), according to the Kantar European Outlook 2025.

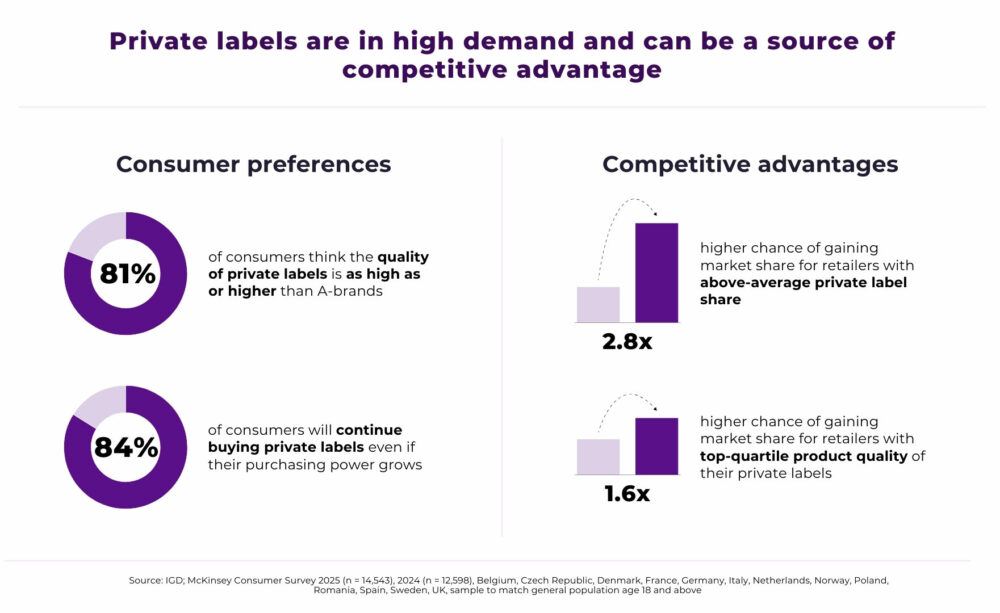

2. From Private Labels to Private Brands

Private labels have become a competitive asset. The report shows that grocers with a high share of revenue from private labels are 2.8 times more likely to be growth champions.

Marit van Egmond, CEO of Albert Heijn, is clear about why private labels are crucial to her company’s success:

“Our own brands are vital to our success, as they are of major importance for organic growth and customer loyalty. We have over 11,000 products from our own brands in our assortment year-round, and they account for roughly 55 percent of our revenue. They are a central enabler of our commitment to customer satisfaction, sustainability, and healthy eating.”

Beyond conventional private labels, many retailers are now developing category-specific private brands. Grocers have established their own product development, concept, design, and packaging departments to differentiate their offer. They often use category-specific brands designed to evoke specific emotions and appeal to different customer groups. Overall, these brands mimic the quality and appeal of A-brands while providing differentiation and improved margins.

3. Growing Appetite for Healthy Food

Consumer tastes are shifting. There is a clear trend toward healthier, fresher, and functional foods. This shift is most pronounced among younger consumers, especially Gen Z. For example, the net intent among Gen Z to focus on healthy nutrition has seen a significant upswing. Grocers can capture additional revenue by offering premium healthy options—even if it means a slight price premium.

Preferences around healthy eating differ by generation, reflecting how each age group defines health. Baby boomers tend to prioritize low-salt and minimally processed foods to support heart health and delay age-related issues. Meanwhile, Gen Z and millennials are more drawn to high-protein, low-calorie options. Despite this growing demand, many shoppers feel underserved—only 35 percent believe their primary grocery store offers a suitable range of products that support a healthy diet. The report also notes that while quality gains momentum, sustainability concerns are slightly declining among some consumer groups.

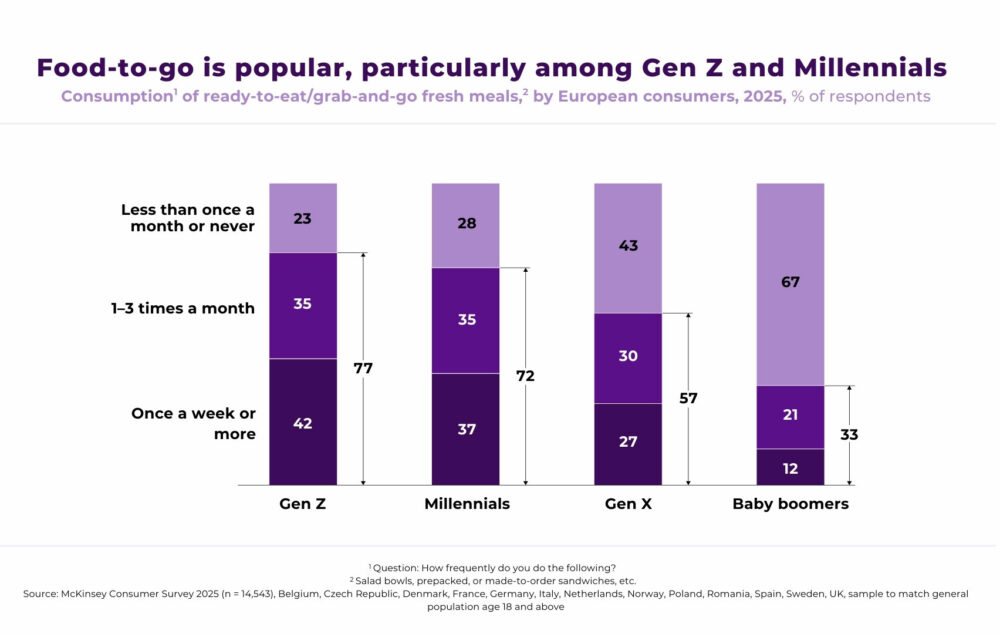

4. Ready to (h)eat: Catering to the No-Cooking Generation

Convenience is king. A growing share of consumers, particularly among Gen Z and millennials, are turning to ready-to-eat and food-to-go options. In fact, 77 percent of Gen Z shoppers purchase food-to-go monthly—a rate more than double that of older consumers.

Ready-to-eat meals are very popular, with 54 percent of consumers purchasing items such as sandwiches, salads, drinks, and snacks at least once a month. The share of consumers who purchase less than once a month prepackaged, partially cooked, or frozen meals has decreased from 41 percent in 2023 to 36 percent in 2024, signaling a growing acceptance of these convenient options.

This change in behavior is fueling new growth opportunities in the convenience and foodservice segments. Grocers are rethinking their store formats to better serve the no-cooking generation.

5. Unlocking a New Level of Customer Engagement Through Personalization

Personalization isn’t just a buzzword—it’s a necessity. According to the study, 56 percent of consumers say they will become repeat buyers after a personalized experience.

Gen AI might fill in the gap and unlock a new level of customer engagement and personalization. Major European grocers have started implementing gen AI-based chatbots for customer service. A few pioneers are offering highly personalized shopping experiences with recipes and product recommendations. Others are piloting chatbot based online shops that allow shoppers to fill their virtual baskets via a dialogue with the chatbot.

The push for a hyper-personalized experience spans across all channels, ensuring that every customer interaction is both efficient and memorable.

6. Sustainability: Scope 3 – The Challenge Ahead

Even as grocers make strides in reducing direct (Scope 1 and 2) emissions, Scope 3—indirect emissions along the value chain—remains a tough nut to crack. The investments needed for decarbonization can be substantial, and the cost impact will vary widely. Grocers must build concrete, tailored abatement plans and forge collaborations with suppliers to mitigate these costs.

While consumer intent to buy environmentally friendly products has dipped slightly, younger shoppers still favor sustainable products, pushing grocers to balance cost and environmental commitments.

7. European Consolidation

Size matters in grocery retail. The report shows that larger grocers, which are typically 35 to 50 percent larger than their peers, manage to maintain higher profitability through scale advantages. Multinational grocers are increasingly joining forces via mergers and acquisitions (M&A) to gain cross-country synergies.

With M&A activity up more than 30 percent since 2019, the trend toward consolidation is likely to continue as grocers seek to overcome margin pressures.

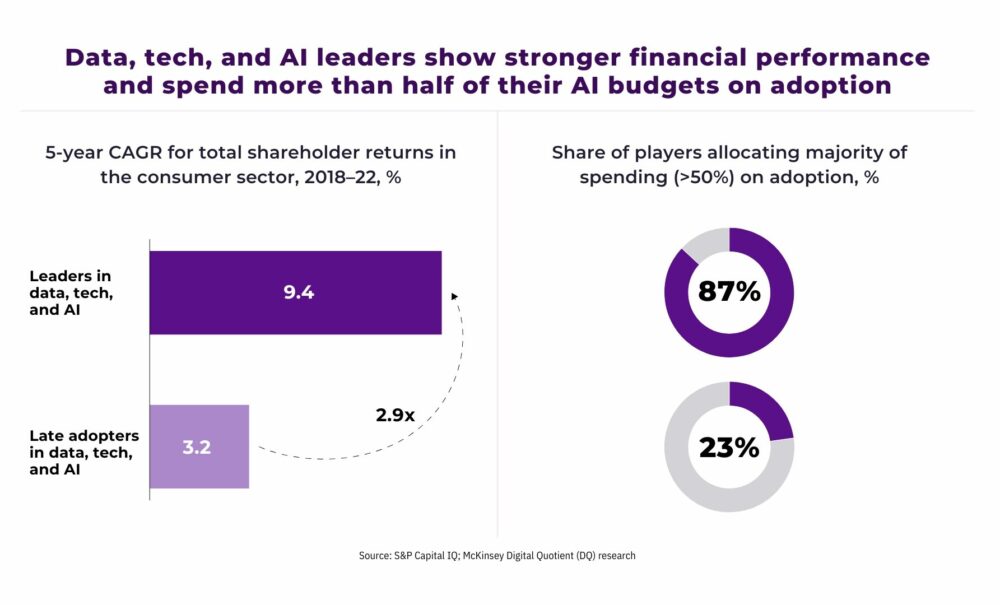

8. The Race to Get Tech Right

Data, artificial intelligence (AI), and technology are now at the top of the CEO agenda. Grocers who invest in digital capabilities reap rewards—experiencing up to 2.9 times the total return to shareholders as their late-adopting peers.

Driving value from AI requires significant investment in adoption. Research shows that 87 percent of companies leading in data, AI, and technology allocate more than half of their AI budgets specifically to adoption efforts—compared to just 23 percent among lower-performing peers in terms of total shareholder return (TSR). These high performers tend to focus the entire organization on the most valuable use cases, create tailored roadmaps by business domain, and ensure they have the right foundations in place—ranging from data and technology to operating models, talent, and risk management.

Investments in IT modernization, analytics, and even early-stage generative AI are seen as essential for optimizing everything from pricing to supply chain management. In a market where margins are under constant pressure, the technological edge is a must-have differentiator.

9. Retail Media Growth and Professionalization

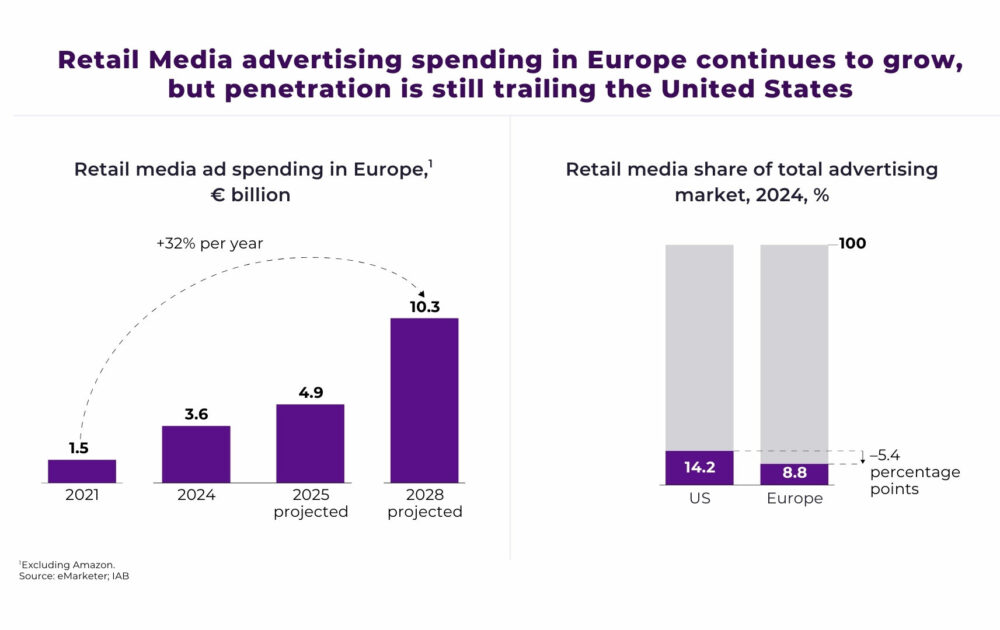

Retail media is emerging as the fastest-growing non-traditional profit center for grocers. IAB Europe expects retail media spending to reach €31 billion by 2028, up from €14 billion in 2024—a CAGR of about 20 percent. This means that retail media spending could reach €41 billion by 2030.

In response to these insights, grocers have started to simplify and refine their advertising strategies. Still, the fragmented nature of the market makes it challenging for advertisers to connect with consumers across multiple retailers. Up to now, most retailers have expanded their advertising primarily through their own channels—like in-store displays and ads on their websites. To unlock further growth, they could broaden their reach by leveraging external platforms and sharing their targeting capabilities more widely. This includes options like third-party websites, social media, shoppable video content, and connected TV ads.

By leveraging digital platforms and personalized promotion strategies, retailers can drive incremental revenue while deepening customer engagement .

Implications for Grocers

Each of these trends represents both a challenge and an opportunity. Grocers that can navigate these trends will be better positioned to capture market share in an increasingly competitive landscape.

For grocery retailers, the report lays out four strategic priorities to navigate the challenges of today’s market:

- Double Down on Pockets of Growth

In a low-growth environment, differentiation is the key. Grocers should concentrate on high-potential categories such as ready-to-eat meals, healthy and functional foods, and premium private labels. Investing in these areas can help grocers stand out, capture niche markets, and drive incremental sales. - Increase Execution Efficiency

Cost pressures remain a top concern. To improve margins, grocers need to streamline their operations. This includes consolidating sourcing—especially for private label products—optimizing supply chain processes, and leveraging economies of scale through partnerships and buying alliances. Efficiency gains can free up resources that can be reinvested in innovation. - Win the Favor of the Consumer of the Future

The rise of Gen Z and millennial shoppers demands a fresh approach. Their expectations differ from those of previous generations. They look for a seamless, personalized shopping experience, value convenience, and demand healthy product choices without an overly high price premium. Grocers must therefore reimagine their loyalty programs and digital engagement strategies. - Take Advantage of Data, AI, and Technology

Investment in technology is not optional—it is essential for survival. Grocers need to move beyond ad hoc digital initiatives toward a strategy that integrates data and AI across the entire value chain. This means not only modernizing IT systems but also ensuring that these technologies can scale. The future belongs to those who measure and track the impact of their tech investments, thereby turning them into tangible financial benefits.

Food and Grocery Market KPIs in 2024: The Case of Spain

A central component of the report is the analysis of key performance indicators (KPIs) for the food and grocery market in 2024. Although the report aggregates data across Europe, it also provides insights at the country level. We’re going to focus on Spain, one of the key markets within Southern Europe.

Grocery Retail Value Growth

Spain’s grocery sector has seen modest growth, with a percentage of +1.8%. The European average is at +2.4% This is indicative of a mature market where traditional revenue streams continue to expand slowly despite rising inflation. Spanish consumers are demanding stable quality and affordable options.

Modern Grocery Retail Growth

The modern grocery segment in Spain – which covers hypermarkets, supermarkets, online channels, and discounters – is performing in line with broader Southern European trends. Retailers here are increasingly leveraging private labels and digital channels to capture market share.

Food Market Segment Growth and Deflated Value Growth

Even though the overall market growth remains modest, the inflation-adjusted (or deflated) growth figures highlight the resilience in consumer demand. This suggests that despite pressure on margins, Spanish grocers have maintained competitive pricing and diversified product ranges that keep consumers coming back.

Other key grocery indicators

Similar to other European markets, Spain shows an increasing preference for private labels. Spanish consumers are gradually trading up for more premium private label products. This trend is helping retailers differentiate themselves from manufacturers’ A-brands while still providing value for money.

Another important fact that should be highlighted is the huge opportunity for Spanish supermarkets in online sales. With only 2.7%, they are at the bottom of Europe, only ahead Poland, in terms of market share.

In summary, the Spanish grocery market in 2024 is characterized by modest volume increases and steady adaptation to modern retail formats. Grocers in Spain are balancing price sensitivity with the need to innovate in product offerings and distribution channels. These KPI trends help to explain why strategic initiatives focusing on online sales and private label development are even more essential in a market like Spain.

Conclusion

McKinsey’s “The State of Grocery Retail Europe 2025” report paints a detailed picture of a sector at a crossroads. In 2024, European grocers experienced stabilization after years of unprecedented shifts. While volume growth was modest and inflation-adjusted sales lag behind 2019 levels, there are several bright spots for the future.

Key trends—from the rise of private labels and healthy, ready-to-eat options to the critical role of data, AI, and technology—offer a roadmap for transformation. Grocers must adapt by doubling down on pockets of growth, improving operational efficiency, winning over the new generation of consumers, and embracing a digital-first mindset. These steps are critical in addressing the twin pressures of low volume growth and persistent cost challenges.

In Spain, as in many Southern European markets, modest growth is tempered by competitive dynamics. Shoppers continue to seek quality and affordability, which calls for agile responses from retailers. The country’s KPIs reflect a balanced approach in which traditional revenue growth is complemented by innovation in private labels and digital channels.

As grocery retail moves into 2025 and beyond, the stakes are high. Retailers who listen to their customers, invest wisely in technology, and continuously innovate will not only survive but thrive. McKinsey’s report offers both the data and the strategic perspective needed for leaders in the sector to make informed decisions.

In summary, the journey ahead for European grocery retail is one of transformation through innovation and efficiency. With a cautious yet optimistic outlook from industry leaders and clearly defined strategies for addressing key trends, grocers can confidently move toward a more resilient and dynamic future .

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

For more insights, read McKinsey’s original “The State of Grocery Retail Europe 2025” report and stay tuned to this blog for further analysis and commentary.